Entrepreneurship offers diverse avenues for generating revenue, with passive income streams providing ongoing earnings through investments or digital products, while consulting services leverage expert knowledge to deliver personalized solutions for clients. Passive income requires upfront effort but can scale without continuous active involvement, whereas consulting demands time-intensive client engagement and tailored advice. Explore the advantages and challenges of each to optimize your entrepreneurial strategy.

Why it is important

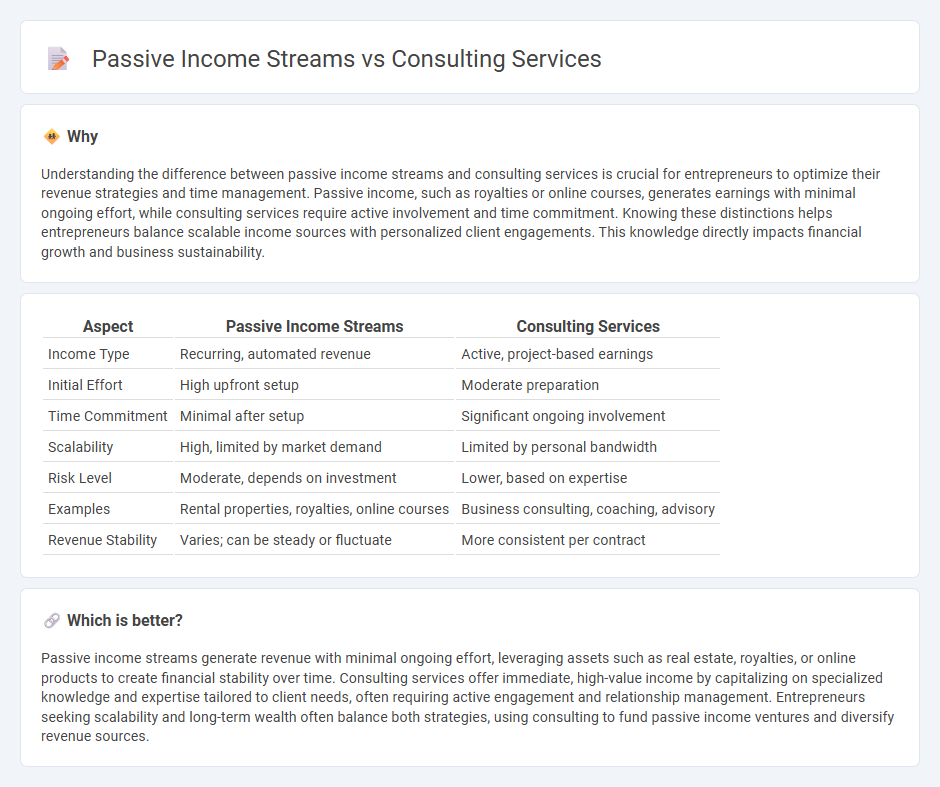

Understanding the difference between passive income streams and consulting services is crucial for entrepreneurs to optimize their revenue strategies and time management. Passive income, such as royalties or online courses, generates earnings with minimal ongoing effort, while consulting services require active involvement and time commitment. Knowing these distinctions helps entrepreneurs balance scalable income sources with personalized client engagements. This knowledge directly impacts financial growth and business sustainability.

Comparison Table

| Aspect | Passive Income Streams | Consulting Services |

|---|---|---|

| Income Type | Recurring, automated revenue | Active, project-based earnings |

| Initial Effort | High upfront setup | Moderate preparation |

| Time Commitment | Minimal after setup | Significant ongoing involvement |

| Scalability | High, limited by market demand | Limited by personal bandwidth |

| Risk Level | Moderate, depends on investment | Lower, based on expertise |

| Examples | Rental properties, royalties, online courses | Business consulting, coaching, advisory |

| Revenue Stability | Varies; can be steady or fluctuate | More consistent per contract |

Which is better?

Passive income streams generate revenue with minimal ongoing effort, leveraging assets such as real estate, royalties, or online products to create financial stability over time. Consulting services offer immediate, high-value income by capitalizing on specialized knowledge and expertise tailored to client needs, often requiring active engagement and relationship management. Entrepreneurs seeking scalability and long-term wealth often balance both strategies, using consulting to fund passive income ventures and diversify revenue sources.

Connection

Passive income streams and consulting services are interconnected through the scalability and expertise-sharing potential of consultants who create digital products, online courses, or subscription-based content. Consultants leverage their specialized knowledge to generate recurring revenue without continuous direct involvement, transforming time-intensive advisory roles into sustainable passive income. This synergy enhances financial freedom and business growth by diversifying income sources beyond traditional client engagements.

Key Terms

Client Acquisition

Consulting services rely heavily on targeted client acquisition strategies such as networking, referrals, and personalized outreach to drive consistent revenue. Passive income streams, like digital products or investments, require upfront efforts in market research and platform optimization to attract and sustain customer interest without direct ongoing client interaction. Explore effective client acquisition methods and optimize your income approach to maximize profitability.

Scalability

Consulting services often face scalability limitations due to time-intensive client interactions and personalized project requirements, restricting exponential growth. Passive income streams, such as digital products or investment portfolios, enable scalable revenue by generating income independently of active time input and reaching diverse markets. Explore effective strategies to amplify scalability in your income model and maximize financial growth.

Automation

Consulting services often demand active involvement and time investment, whereas passive income streams rely heavily on automation to generate revenue with minimal ongoing effort. Automation tools such as AI-driven marketing platforms, automated billing systems, and workflow management software significantly enhance scalability and efficiency in passive income strategies. Explore how integrating advanced automation can transform your income model from active consulting to sustainable passive revenue.

Source and External Links

34 Types of Consulting Services to Offer Clients - Paperbell - Consulting services include management consulting (such as leadership and project management), operations consulting (focusing on process management, outsourcing, procurement, supply chain, and risk), with specialists in areas like ROI, risk compliance, and e-commerce.

Consulting firm - Wikipedia - Consulting firms provide expert professional services across various sectors including management, IT, legal, healthcare, HR, and niche industries, often offering complementary consulting or outsourcing solutions.

Business Consulting List Of Services: 5 Types Of Services To Know - NeONBRAND - Business consulting services aim to boost client profitability through strategic planning, execution guidance, lead acquisition, and operational improvements delivered by experienced consultants offering customized solutions.

dowidth.com

dowidth.com