Alternative funding platforms such as crowdfunding, peer-to-peer lending, and angel investing offer entrepreneurs flexible financing options with faster approval times compared to traditional bank loans, which often require extensive credit checks and collateral. These platforms leverage digital technology to connect startups with a broader pool of investors, enabling access to diverse capital sources beyond conventional banking institutions. Explore the advantages and challenges of alternative funding versus bank loans to make informed entrepreneurial financing decisions.

Why it is important

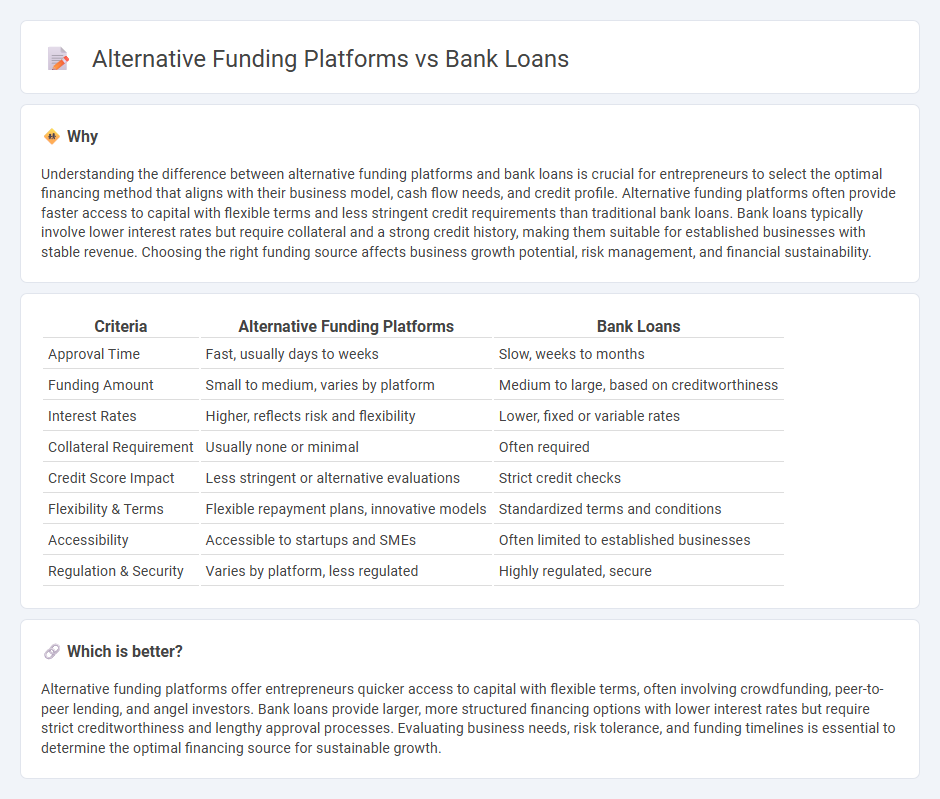

Understanding the difference between alternative funding platforms and bank loans is crucial for entrepreneurs to select the optimal financing method that aligns with their business model, cash flow needs, and credit profile. Alternative funding platforms often provide faster access to capital with flexible terms and less stringent credit requirements than traditional bank loans. Bank loans typically involve lower interest rates but require collateral and a strong credit history, making them suitable for established businesses with stable revenue. Choosing the right funding source affects business growth potential, risk management, and financial sustainability.

Comparison Table

| Criteria | Alternative Funding Platforms | Bank Loans |

|---|---|---|

| Approval Time | Fast, usually days to weeks | Slow, weeks to months |

| Funding Amount | Small to medium, varies by platform | Medium to large, based on creditworthiness |

| Interest Rates | Higher, reflects risk and flexibility | Lower, fixed or variable rates |

| Collateral Requirement | Usually none or minimal | Often required |

| Credit Score Impact | Less stringent or alternative evaluations | Strict credit checks |

| Flexibility & Terms | Flexible repayment plans, innovative models | Standardized terms and conditions |

| Accessibility | Accessible to startups and SMEs | Often limited to established businesses |

| Regulation & Security | Varies by platform, less regulated | Highly regulated, secure |

Which is better?

Alternative funding platforms offer entrepreneurs quicker access to capital with flexible terms, often involving crowdfunding, peer-to-peer lending, and angel investors. Bank loans provide larger, more structured financing options with lower interest rates but require strict creditworthiness and lengthy approval processes. Evaluating business needs, risk tolerance, and funding timelines is essential to determine the optimal financing source for sustainable growth.

Connection

Alternative funding platforms complement traditional bank loans by offering diverse financing options for entrepreneurs who may face strict eligibility criteria or lengthy approval processes with banks. Crowdfunding, peer-to-peer lending, and microfinance platforms provide access to capital through community support and flexible terms, bridging gaps for startups and small businesses. These alternative sources often serve as initial funding steps that can enhance creditworthiness and improve chances of securing bank loans later.

Key Terms

Collateral

Bank loans often require substantial collateral, such as property or valuable assets, to secure the borrowed amount and reduce lender risk. Alternative funding platforms, including peer-to-peer lending and crowdfunding, typically offer less stringent collateral requirements or unsecured financing options, appealing to small businesses and startups. Explore the differences in collateral demands and discover which funding option aligns best with your financial needs.

Crowdfunding

Bank loans typically require extensive credit checks, strict eligibility criteria, and collateral, making access challenging for startups and small businesses. Crowdfunding platforms offer an alternative by allowing entrepreneurs to raise capital directly from a large pool of individual investors without traditional credit constraints. Explore how crowdfunding can unlock innovative funding opportunities tailored to your business needs.

Interest Rates

Bank loans typically offer fixed or variable interest rates that are influenced by credit scores, loan terms, and market conditions, often resulting in higher costs for borrowers with lower creditworthiness. Alternative funding platforms like peer-to-peer lending and crowdfunding frequently provide competitive or flexible interest rates, leveraging technology and diversified investor pools to reduce borrowing expenses. Explore the advantages and interest rate structures of each to determine the best financing solution for your needs.

Source and External Links

Personal loans: See options and apply online - Wells Fargo offers unsecured personal loans ranging from $3,000 to $100,000 with terms from 12 to 84 months, providing fast online application and same-day funding options.

Personal Loans and Lines of Credit - Fifth Third Bank provides unsecured personal loans from $2,000 to $50,000 with fixed rates and terms between 12 and 60 months, including no prepayment fees and flexible payment options.

Personal Loans, Unsecured, Fixed Rate | TD Bank Fit Loan - TD Bank offers unsecured personal loans of $2,000 to $50,000 with fixed interest rates, no fees, terms up to 60 months, and fast funding, useful for debt consolidation or major expenses.

dowidth.com

dowidth.com