Micro private equity focuses on acquiring and growing smaller, often overlooked companies with high potential for value creation through strategic guidance and operational improvements. Small business acquisition involves purchasing established businesses with proven cash flow and customer bases, aiming for steady returns and incremental growth. Explore the nuances and opportunities in choosing between micro private equity and small business acquisition.

Why it is important

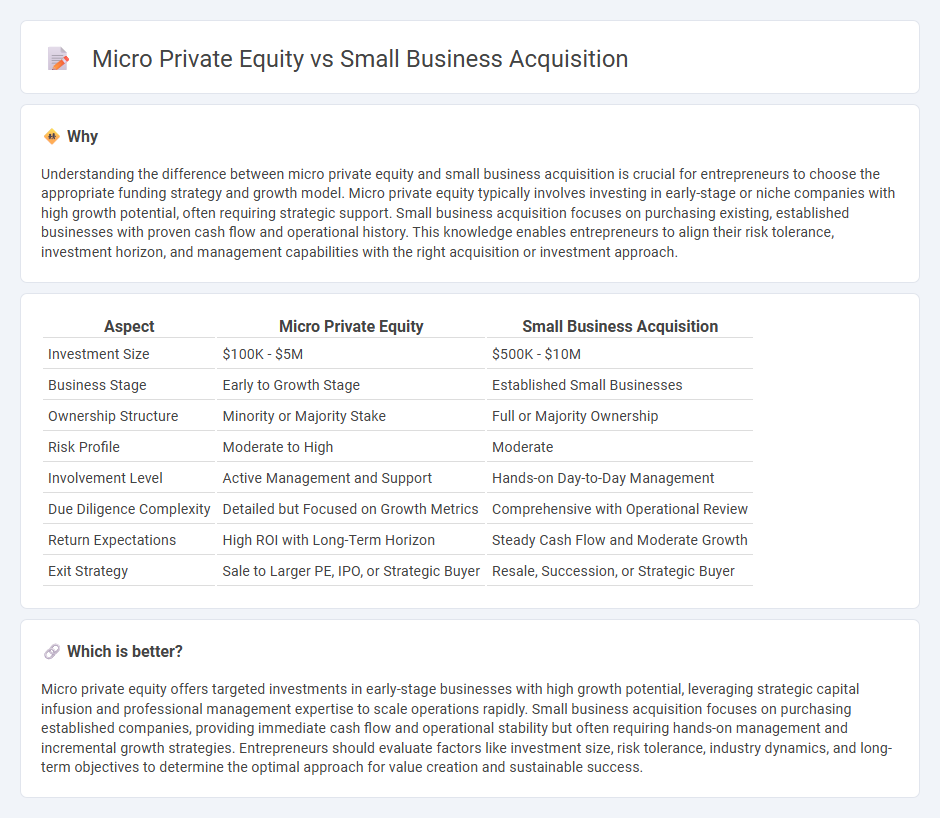

Understanding the difference between micro private equity and small business acquisition is crucial for entrepreneurs to choose the appropriate funding strategy and growth model. Micro private equity typically involves investing in early-stage or niche companies with high growth potential, often requiring strategic support. Small business acquisition focuses on purchasing existing, established businesses with proven cash flow and operational history. This knowledge enables entrepreneurs to align their risk tolerance, investment horizon, and management capabilities with the right acquisition or investment approach.

Comparison Table

| Aspect | Micro Private Equity | Small Business Acquisition |

|---|---|---|

| Investment Size | $100K - $5M | $500K - $10M |

| Business Stage | Early to Growth Stage | Established Small Businesses |

| Ownership Structure | Minority or Majority Stake | Full or Majority Ownership |

| Risk Profile | Moderate to High | Moderate |

| Involvement Level | Active Management and Support | Hands-on Day-to-Day Management |

| Due Diligence Complexity | Detailed but Focused on Growth Metrics | Comprehensive with Operational Review |

| Return Expectations | High ROI with Long-Term Horizon | Steady Cash Flow and Moderate Growth |

| Exit Strategy | Sale to Larger PE, IPO, or Strategic Buyer | Resale, Succession, or Strategic Buyer |

Which is better?

Micro private equity offers targeted investments in early-stage businesses with high growth potential, leveraging strategic capital infusion and professional management expertise to scale operations rapidly. Small business acquisition focuses on purchasing established companies, providing immediate cash flow and operational stability but often requiring hands-on management and incremental growth strategies. Entrepreneurs should evaluate factors like investment size, risk tolerance, industry dynamics, and long-term objectives to determine the optimal approach for value creation and sustainable success.

Connection

Micro private equity focuses on investing in small businesses with high growth potential, making it a key driver in small business acquisition strategies. These investments provide crucial capital and strategic support that enable entrepreneurs to scale operations and increase profitability. The connection between micro private equity and small business acquisition lies in their mutual goal of nurturing emerging enterprises for sustainable long-term value creation.

Key Terms

Deal Sourcing

Small business acquisition relies heavily on leveraging local networks, industry contacts, and direct outreach for deal sourcing, often focusing on owner-operators and niche markets. Micro private equity firms utilize systematic sourcing strategies including proprietary databases, intermediaries, and digital platforms to identify scalable small businesses with strong cash flow and growth potential. Explore detailed strategies and tools to optimize deal sourcing in both models to enhance acquisition success.

Valuation

Small business acquisition valuation typically relies on tangible assets, cash flow analysis, and market comparables, offering a straightforward approach suited for businesses with clear financial records. Micro private equity valuation incorporates growth potential, scalability, and operational improvements, emphasizing future value creation beyond current earnings. Explore detailed valuation methodologies and strategic differences to optimize investment decisions.

Exit Strategy

Small business acquisitions typically emphasize personalized exit strategies, often involving family succession or strategic resale to industry players, ensuring value preservation and legacy continuation. Micro private equity firms prioritize scalable exit strategies such as mergers, acquisitions, or public offerings to maximize investor returns within a defined timeframe. Explore in-depth insights on optimizing exit strategies for scalable growth and investment returns.

Source and External Links

Small Business Acquisition: From Start to Finish | datarooms.org - This resource outlines a detailed 10-step process for acquiring a small business, covering analyzing corporate structures, leadership decisions, due diligence, and valuation to ensure a successful acquisition.

Acquiring a small business is more attainable than you think - Explains various funding methods for small business acquisition including SBA loans and seller financing, which can make purchasing a small business more accessible and manageable.

How to Prepare for an Acquisition as a Small Business | CO - Describes preparation steps for business owners selling a small business and outlines different acquisition types like full acquisitions, partnerships, and joint ventures to help sellers clarify their goals and involvement.

dowidth.com

dowidth.com