Exit as a Service offers entrepreneurs a streamlined, tech-enabled way to sell their businesses, focusing on flexibility and speed compared to traditional private equity buyouts that often involve complex negotiations and longer timelines. This innovative approach leverages digital platforms to maximize value and simplify the exit process for startup founders and small business owners. Discover how Exit as a Service can transform your business exit strategy by exploring its advantages over conventional private equity options.

Why it is important

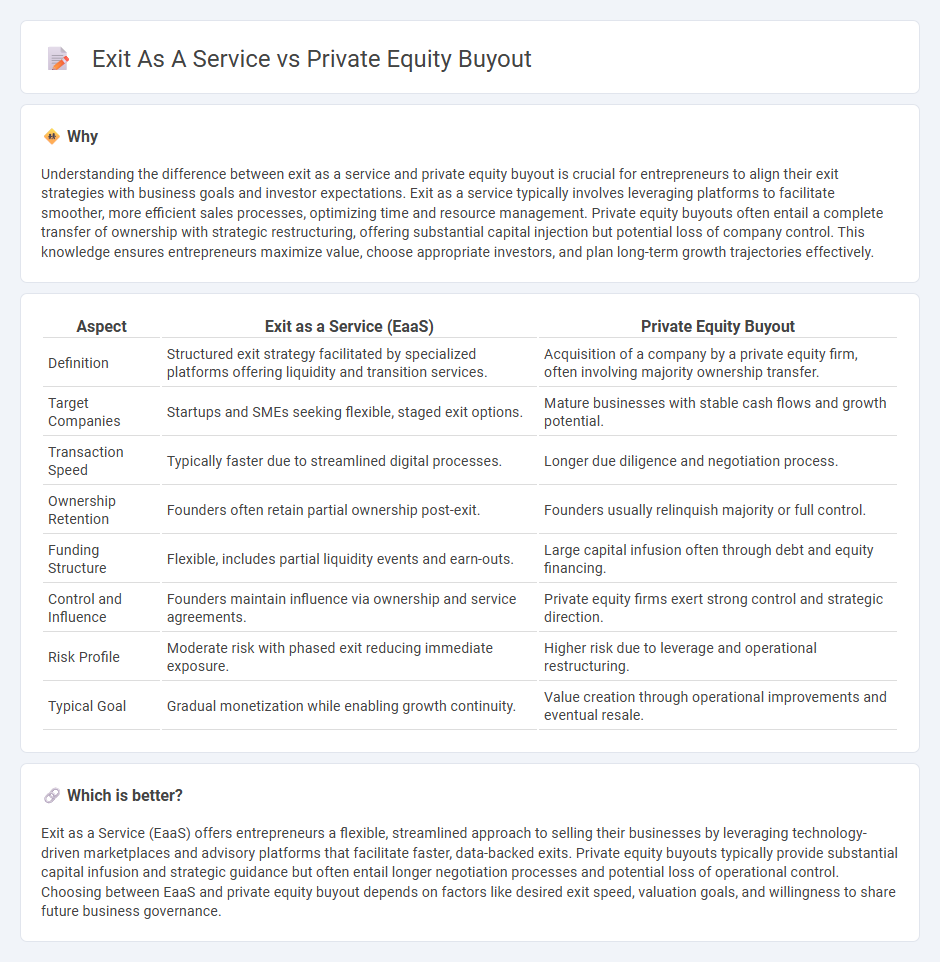

Understanding the difference between exit as a service and private equity buyout is crucial for entrepreneurs to align their exit strategies with business goals and investor expectations. Exit as a service typically involves leveraging platforms to facilitate smoother, more efficient sales processes, optimizing time and resource management. Private equity buyouts often entail a complete transfer of ownership with strategic restructuring, offering substantial capital injection but potential loss of company control. This knowledge ensures entrepreneurs maximize value, choose appropriate investors, and plan long-term growth trajectories effectively.

Comparison Table

| Aspect | Exit as a Service (EaaS) | Private Equity Buyout |

|---|---|---|

| Definition | Structured exit strategy facilitated by specialized platforms offering liquidity and transition services. | Acquisition of a company by a private equity firm, often involving majority ownership transfer. |

| Target Companies | Startups and SMEs seeking flexible, staged exit options. | Mature businesses with stable cash flows and growth potential. |

| Transaction Speed | Typically faster due to streamlined digital processes. | Longer due diligence and negotiation process. |

| Ownership Retention | Founders often retain partial ownership post-exit. | Founders usually relinquish majority or full control. |

| Funding Structure | Flexible, includes partial liquidity events and earn-outs. | Large capital infusion often through debt and equity financing. |

| Control and Influence | Founders maintain influence via ownership and service agreements. | Private equity firms exert strong control and strategic direction. |

| Risk Profile | Moderate risk with phased exit reducing immediate exposure. | Higher risk due to leverage and operational restructuring. |

| Typical Goal | Gradual monetization while enabling growth continuity. | Value creation through operational improvements and eventual resale. |

Which is better?

Exit as a Service (EaaS) offers entrepreneurs a flexible, streamlined approach to selling their businesses by leveraging technology-driven marketplaces and advisory platforms that facilitate faster, data-backed exits. Private equity buyouts typically provide substantial capital infusion and strategic guidance but often entail longer negotiation processes and potential loss of operational control. Choosing between EaaS and private equity buyout depends on factors like desired exit speed, valuation goals, and willingness to share future business governance.

Connection

Exit as a Service (EaaS) streamlines the process for entrepreneurs to sell their startups by providing structured support and strategic guidance during the transition. Private equity buyouts are a prominent exit strategy within EaaS frameworks, where private equity firms acquire significant ownership stakes to scale and restructure businesses. The synergy between EaaS and private equity buyouts accelerates value realization for founders and investors while ensuring operational continuity.

Key Terms

Valuation

Valuation in private equity buyouts hinges on factors like EBITDA multiples, market conditions, and growth potential, often seeking substantial control premiums. Exit as a service emphasizes flexible valuation strategies tailored to maximize liquidity events without full ownership transfer, leveraging market timing and strategic partnerships. Explore deeper insights into how valuation dynamics shape investment returns and exit success.

Ownership Transfer

Private equity buyouts involve the complete transfer of ownership to a private equity firm, allowing for strategic control and operational improvements aimed at increasing the company's value. Exit as a Service offers business owners a structured platform to gradually transition ownership through tailored exit strategies, balancing continuity and liquidity without abrupt ownership changes. Explore detailed insights on ownership transfer mechanisms and benefits in both models to determine the best fit for your business goals.

Liquidity Event

Private equity buyouts generate liquidity events by transferring ownership through leveraged acquisitions, often resulting in significant capital gains for investors and founders. Exit as a Service offers a streamlined, technology-driven approach to liquidity events, enabling companies to access market opportunities and investor pools without traditional buyout complexities. Explore the differences between these liquidity event strategies to optimize your business exit planning.

Source and External Links

What Lies Beneath a Buyout: The Complex Mechanics of Private Equity Deals - Private equity buyouts involve using new acquisition vehicles (special purpose vehicles) in multi-tiered structures to acquire operating companies, often combining equity and different layers of debt to finance the purchase efficiently and protect the investments.

Leveraged buyout - Wikipedia - A leveraged buyout (LBO), a common type of private equity buyout, is the acquisition of a company primarily with borrowed funds secured against the company's assets and cash flows, enabling private equity firms to gain control with a small equity contribution while aiming to enhance value and eventually exit profitably.

An Introduction to Private Equity Buyout - CAIS - Private equity buyout funds seek majority ownership to improve and grow companies, commonly employing leveraged buyouts (LBOs) or management buyouts (MBOs), with typical fund life cycles of 7-10 years spanning fundraising, investing, and harvesting phases.

dowidth.com

dowidth.com