Exit as a service enables entrepreneurs to streamline the process of selling their stake by leveraging specialized platforms that connect buyers and sellers, offering transparency and efficiency. Secondary sales involve existing shareholders selling their shares directly to new investors, providing liquidity without the need for a full company exit. Explore the key differences and benefits of each approach to optimize your entrepreneurial exit strategy.

Why it is important

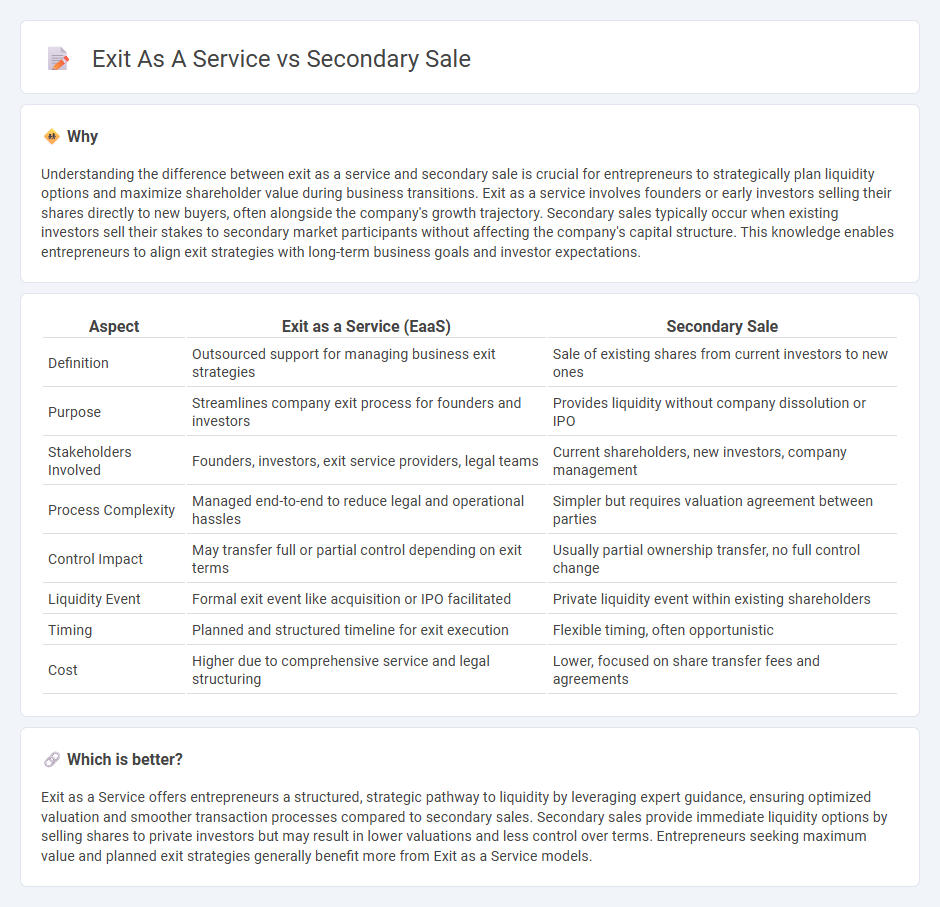

Understanding the difference between exit as a service and secondary sale is crucial for entrepreneurs to strategically plan liquidity options and maximize shareholder value during business transitions. Exit as a service involves founders or early investors selling their shares directly to new buyers, often alongside the company's growth trajectory. Secondary sales typically occur when existing investors sell their stakes to secondary market participants without affecting the company's capital structure. This knowledge enables entrepreneurs to align exit strategies with long-term business goals and investor expectations.

Comparison Table

| Aspect | Exit as a Service (EaaS) | Secondary Sale |

|---|---|---|

| Definition | Outsourced support for managing business exit strategies | Sale of existing shares from current investors to new ones |

| Purpose | Streamlines company exit process for founders and investors | Provides liquidity without company dissolution or IPO |

| Stakeholders Involved | Founders, investors, exit service providers, legal teams | Current shareholders, new investors, company management |

| Process Complexity | Managed end-to-end to reduce legal and operational hassles | Simpler but requires valuation agreement between parties |

| Control Impact | May transfer full or partial control depending on exit terms | Usually partial ownership transfer, no full control change |

| Liquidity Event | Formal exit event like acquisition or IPO facilitated | Private liquidity event within existing shareholders |

| Timing | Planned and structured timeline for exit execution | Flexible timing, often opportunistic |

| Cost | Higher due to comprehensive service and legal structuring | Lower, focused on share transfer fees and agreements |

Which is better?

Exit as a Service offers entrepreneurs a structured, strategic pathway to liquidity by leveraging expert guidance, ensuring optimized valuation and smoother transaction processes compared to secondary sales. Secondary sales provide immediate liquidity options by selling shares to private investors but may result in lower valuations and less control over terms. Entrepreneurs seeking maximum value and planned exit strategies generally benefit more from Exit as a Service models.

Connection

Exit as a service (EaaS) provides entrepreneurs and investors with structured options to sell their stakes, facilitating smoother secondary sales in private markets. Secondary sales allow shareholders to liquidate their positions before a company's initial public offering (IPO) or acquisition, aligning with EaaS platforms that streamline these transactions. This connection enhances liquidity, reduces market friction, and supports sustained capital flow within the entrepreneurial ecosystem.

Key Terms

Liquidity

Secondary sale offers liquidity by enabling shareholders to sell their existing shares to new investors without affecting company operations, providing immediate cash access. Exit as a Service facilitates a structured, often partial, exit strategy for founders and early investors, optimizing valuation and timing while maintaining company continuity. Explore detailed strategies to enhance liquidity through tailored secondary sales and exit solutions.

Ownership Transfer

Secondary sale involves the transfer of existing ownership stakes between investors, enabling liquidity without impacting company shares, whereas exit as a service facilitates a comprehensive ownership transfer by managing the entire process of selling a business or stake to new owners. Ownership transfer in secondary sales is typically limited to private transactions between shareholders, maintaining business continuity, while exit as a service incorporates valuation, negotiation, and legal compliance to ensure a seamless transition. Explore deeper insights into how these ownership transfer methods affect investor strategies and business growth.

Acquisition

Secondary sale involves the transfer of existing shares from one investor to another, offering liquidity without company involvement, whereas exit as a service provides structured acquisition solutions facilitating the full purchase of a startup or business. Acquisition-focused secondary sales provide investors with partial liquidity while allowing founders to retain control, contrasting with exit as a service where the entire company ownership changes hands. Discover more about how acquisition strategies differ in secondary sales and exit as a service models.

Source and External Links

Secondaries | A guide to secondary share sales - Ledgy - Secondary sales are transactions where existing shareholders of a private company sell their shares to other investors, enabling early investors or employees to liquidate stakes before IPO or acquisition, often involving company approval and structured programs.

A Guide to Secondary Sales - Sydecar - A secondary sale is any sale of ownership in a startup where the seller is not the company itself, historically used to provide liquidity to investors and now facilitated by various secondary vehicles amid fluctuating market conditions.

Secondary Markets & Secondary Market Transactions - Carta - Venture secondary transactions include tender offers, allowing multiple sellers to sell shares at a set price with company oversight, and direct secondary sales, which are private trades negotiated between seller and buyer that may be restricted by company rights such as first refusal.

dowidth.com

dowidth.com