Embedded finance integrates banking services directly into non-financial platforms, streamlining payment processing, lending, and insurance within apps and websites to enhance customer experience. Regtech employs advanced technologies like AI and big data to automate regulatory compliance and risk management for financial institutions, reducing costs and improving accuracy. Explore how these innovations reshape entrepreneurship by driving efficiency and fostering growth.

Why it is important

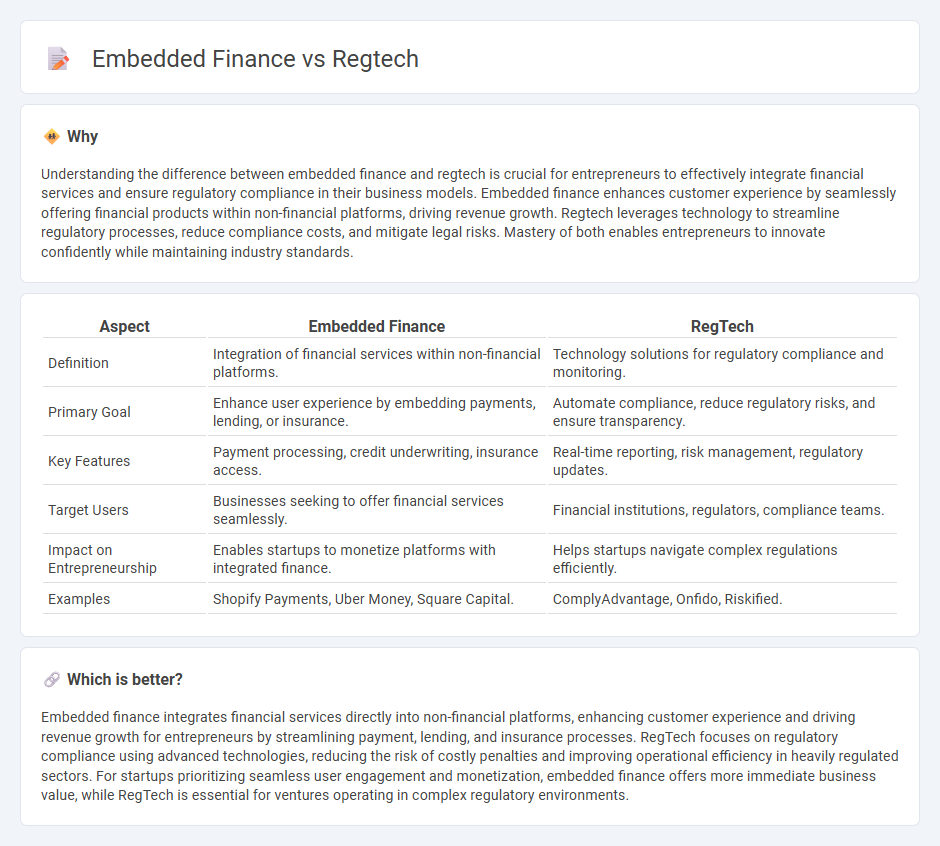

Understanding the difference between embedded finance and regtech is crucial for entrepreneurs to effectively integrate financial services and ensure regulatory compliance in their business models. Embedded finance enhances customer experience by seamlessly offering financial products within non-financial platforms, driving revenue growth. Regtech leverages technology to streamline regulatory processes, reduce compliance costs, and mitigate legal risks. Mastery of both enables entrepreneurs to innovate confidently while maintaining industry standards.

Comparison Table

| Aspect | Embedded Finance | RegTech |

|---|---|---|

| Definition | Integration of financial services within non-financial platforms. | Technology solutions for regulatory compliance and monitoring. |

| Primary Goal | Enhance user experience by embedding payments, lending, or insurance. | Automate compliance, reduce regulatory risks, and ensure transparency. |

| Key Features | Payment processing, credit underwriting, insurance access. | Real-time reporting, risk management, regulatory updates. |

| Target Users | Businesses seeking to offer financial services seamlessly. | Financial institutions, regulators, compliance teams. |

| Impact on Entrepreneurship | Enables startups to monetize platforms with integrated finance. | Helps startups navigate complex regulations efficiently. |

| Examples | Shopify Payments, Uber Money, Square Capital. | ComplyAdvantage, Onfido, Riskified. |

Which is better?

Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience and driving revenue growth for entrepreneurs by streamlining payment, lending, and insurance processes. RegTech focuses on regulatory compliance using advanced technologies, reducing the risk of costly penalties and improving operational efficiency in heavily regulated sectors. For startups prioritizing seamless user engagement and monetization, embedded finance offers more immediate business value, while RegTech is essential for ventures operating in complex regulatory environments.

Connection

Embedded finance streamlines access to financial services within entrepreneurial platforms, enabling seamless transactions and improved cash flow management. Regtech supports this integration by ensuring real-time compliance with regulatory requirements, reducing fraud risk and operational costs. Together, they empower startups to innovate rapidly while maintaining regulatory adherence.

Key Terms

Compliance Automation (RegTech)

RegTech leverages advanced compliance automation technologies to streamline regulatory reporting, risk management, and real-time monitoring, significantly reducing manual efforts and errors for financial institutions. Embedded finance integrates financial services directly into non-financial platforms, enhancing user experience but often relying on RegTech solutions to ensure compliance within these seamless transactions. Explore further to understand how compliance automation drives the synergy between RegTech and embedded finance.

API Integration (Embedded Finance)

API integration in embedded finance enables seamless incorporation of financial services directly into non-financial platforms, enhancing user experience and operational efficiency. Regtech, by contrast, focuses on automating compliance processes and risk management through advanced technologies like AI and machine learning. Explore how these technologies shape the future of financial innovation and compliance by learning more about their distinct API strategies.

Customer Onboarding

RegTech enhances customer onboarding by automating regulatory compliance processes, reducing risks of fraud and ensuring adherence to KYC and AML standards. Embedded finance integrates seamless financial services directly within customer onboarding workflows, improving user experience and accelerating service access. Explore the latest innovations in RegTech and embedded finance to optimize your customer onboarding strategy.

Source and External Links

What is regtech? - Moody's - Regtech (regulatory technology) refers to SaaS solutions designed to automate regulatory compliance processes, mainly in financial services to combat financial crime and enable better compliance experiences, emerging notably after the 2008 financial crisis to meet new regulations efficiently.

What is RegTech (Regulatory Technology)? - Tipalti - Regtech uses technologies like machine learning and big data to manage compliance risks in real time by detecting fraud, money laundering and cyber risks, facilitating regulatory adherence for financial institutions through automation and digital transformation.

Regulatory technology - Wikipedia - RegTech enhances regulatory monitoring, reporting, and compliance primarily in heavily regulated industries by digitizing manual processes to improve transparency, consistency, and reduce costs, with financial services as a core focus but expanding across sectors.

dowidth.com

dowidth.com