Digital nomad visas offer remote workers legal permission to live and work in a foreign country for extended periods, often ranging from six months to two years, with streamlined application processes focused on proof of income and employment. Freelancer registration, in contrast, typically involves setting up a business entity or tax registration in the country of residence, ensuring compliance with local labor laws and social security contributions. Explore the key differences in eligibility, benefits, and obligations to determine which pathway suits your professional lifestyle best.

Why it is important

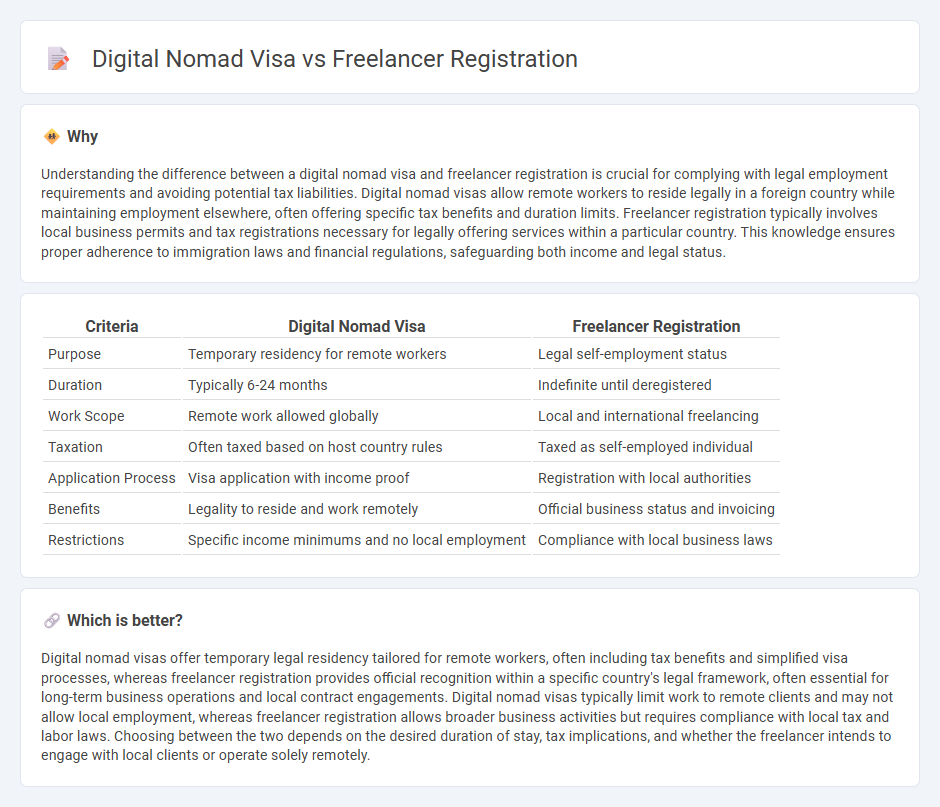

Understanding the difference between a digital nomad visa and freelancer registration is crucial for complying with legal employment requirements and avoiding potential tax liabilities. Digital nomad visas allow remote workers to reside legally in a foreign country while maintaining employment elsewhere, often offering specific tax benefits and duration limits. Freelancer registration typically involves local business permits and tax registrations necessary for legally offering services within a particular country. This knowledge ensures proper adherence to immigration laws and financial regulations, safeguarding both income and legal status.

Comparison Table

| Criteria | Digital Nomad Visa | Freelancer Registration |

|---|---|---|

| Purpose | Temporary residency for remote workers | Legal self-employment status |

| Duration | Typically 6-24 months | Indefinite until deregistered |

| Work Scope | Remote work allowed globally | Local and international freelancing |

| Taxation | Often taxed based on host country rules | Taxed as self-employed individual |

| Application Process | Visa application with income proof | Registration with local authorities |

| Benefits | Legality to reside and work remotely | Official business status and invoicing |

| Restrictions | Specific income minimums and no local employment | Compliance with local business laws |

Which is better?

Digital nomad visas offer temporary legal residency tailored for remote workers, often including tax benefits and simplified visa processes, whereas freelancer registration provides official recognition within a specific country's legal framework, often essential for long-term business operations and local contract engagements. Digital nomad visas typically limit work to remote clients and may not allow local employment, whereas freelancer registration allows broader business activities but requires compliance with local tax and labor laws. Choosing between the two depends on the desired duration of stay, tax implications, and whether the freelancer intends to engage with local clients or operate solely remotely.

Connection

Digital nomad visas and freelancer registration are interconnected as both enable remote work opportunities across borders, officially legitimizing independent employment status in host countries. These frameworks require digital nomads to register as freelancers or self-employed individuals, ensuring compliance with local tax and labor regulations. This synergy facilitates seamless global employment, promoting economic flexibility and legal protection for remote workers.

Key Terms

Legal status

Freelancer registration grants individuals the ability to operate legally within a specific country, often requiring tax registration and compliance with local labor laws. Digital nomad visas provide a formal legal status permitting remote workers to reside and work in the host country for an extended period, often with benefits like simplified visa processes and legal protections. Explore the detailed legal distinctions and application requirements to determine the best fit for your entrepreneurial lifestyle.

Tax obligations

Freelancer registration typically requires individuals to comply with local tax regulations, including income tax filings, social security contributions, and potential value-added tax (VAT) obligations based on their country's laws. Digital nomad visas often provide tax benefits or exemptions by allowing remote workers to maintain tax residency in their home country while legally residing abroad, reducing double taxation risks. Explore further to understand specific tax implications and choose the best option for your remote work lifestyle.

Work location flexibility

Freelancer registration allows individuals to operate legally from various locations with greater geographic flexibility, adapting quickly to project demands worldwide. Digital nomad visas typically tie work authorization to a specific country, granting temporary legal residence but often limiting freedom to move frequently between nations. Explore the comparative benefits of each option to optimize your work location flexibility and lifestyle preferences.

Source and External Links

How to Register Your Business Legally as a Freelancer in the United States - This guide explains the steps to legally register your freelance business, including choosing a business structure like sole proprietorship or LLC, and highlights the benefits of formal registration for protection and growth.

Getting started on Freelancer.com | General - This resource details how to create an account on Freelancer.com, including signing up via Google, Facebook, or email, setting a username, and completing profile details to begin freelancing on the platform.

How to get registered as a freelancer in the United States - Paraform - The article outlines that freelancers usually operate as sole proprietors without needing formal business registration but recommends obtaining an EIN and opening a business bank account for better tax filing and financial management.

dowidth.com

dowidth.com