Shrinkflation reduces product size or quality while maintaining prices, eroding consumer purchasing power subtly. Wage stagnation occurs when incomes fail to keep up with inflation, limiting household spending and economic growth. Explore how these trends impact your finances and the broader economy.

Why it is important

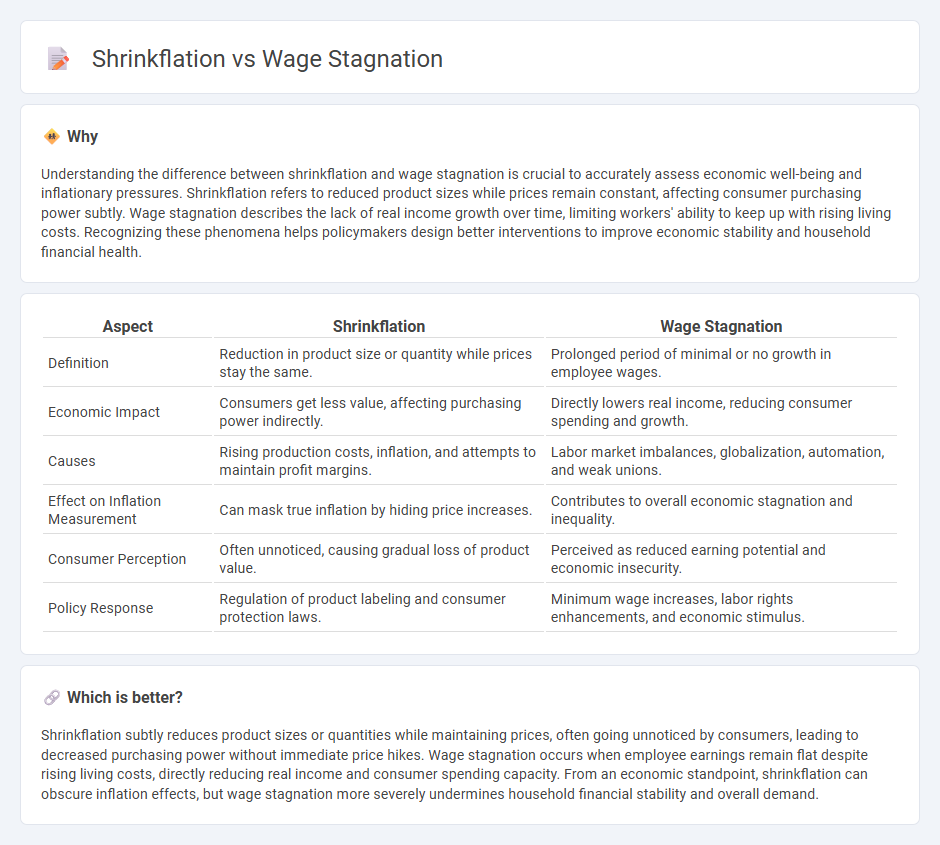

Understanding the difference between shrinkflation and wage stagnation is crucial to accurately assess economic well-being and inflationary pressures. Shrinkflation refers to reduced product sizes while prices remain constant, affecting consumer purchasing power subtly. Wage stagnation describes the lack of real income growth over time, limiting workers' ability to keep up with rising living costs. Recognizing these phenomena helps policymakers design better interventions to improve economic stability and household financial health.

Comparison Table

| Aspect | Shrinkflation | Wage Stagnation |

|---|---|---|

| Definition | Reduction in product size or quantity while prices stay the same. | Prolonged period of minimal or no growth in employee wages. |

| Economic Impact | Consumers get less value, affecting purchasing power indirectly. | Directly lowers real income, reducing consumer spending and growth. |

| Causes | Rising production costs, inflation, and attempts to maintain profit margins. | Labor market imbalances, globalization, automation, and weak unions. |

| Effect on Inflation Measurement | Can mask true inflation by hiding price increases. | Contributes to overall economic stagnation and inequality. |

| Consumer Perception | Often unnoticed, causing gradual loss of product value. | Perceived as reduced earning potential and economic insecurity. |

| Policy Response | Regulation of product labeling and consumer protection laws. | Minimum wage increases, labor rights enhancements, and economic stimulus. |

Which is better?

Shrinkflation subtly reduces product sizes or quantities while maintaining prices, often going unnoticed by consumers, leading to decreased purchasing power without immediate price hikes. Wage stagnation occurs when employee earnings remain flat despite rising living costs, directly reducing real income and consumer spending capacity. From an economic standpoint, shrinkflation can obscure inflation effects, but wage stagnation more severely undermines household financial stability and overall demand.

Connection

Shrinkflation reduces the quantity or quality of goods while prices remain steady, effectively decreasing consumers' purchasing power. Wage stagnation limits income growth, preventing workers from offsetting higher costs caused by shrinkflation. This combination intensifies financial strain on households, curbing overall economic demand and slowing growth.

Key Terms

Real Wages

Wage stagnation occurs when workers' nominal wages remain flat over time, causing real wages to decline due to rising inflation, while shrinkflation refers to the practice of companies reducing product size or quantity without lowering prices, effectively eroding consumer purchasing power. Both phenomena contribute to diminished real wages by limiting consumers' ability to buy goods and services despite paycheck amounts appearing unchanged. Explore how these trends impact household budgets and economic well-being to better understand their effects on living standards.

Inflation

Wage stagnation keeps workers' incomes flat despite rising living costs, while shrinkflation reduces product sizes without lowering prices, both exacerbating the impact of inflation on household budgets. Inflation erodes purchasing power, making it harder for consumers to afford essentials when wages do not keep pace and product quantities shrink unnoticed. Explore the deeper effects of inflation-driven wage stagnation and shrinkflation on your finances to better manage your budget.

Purchasing Power

Wage stagnation limits income growth, reducing consumers' purchasing power as living costs rise, while shrinkflation covertly decreases product sizes without lowering prices, eroding value for money. Both phenomena contribute significantly to inflation's impact, creating financial strain without overt price hikes. Explore more on how these trends affect your budget and economic well-being.

Source and External Links

Employer Concentration and Stagnant Wages | NBER - Wage stagnation is linked to increased employer monopsony power, with rising industrial consolidation reducing competition in local job markets and thereby suppressing wage growth over the past four decades.

For most U.S. workers, real wages have barely budged in decades - Real wages for most U.S. workers have not increased in about 40 years, possibly due to rising employer benefit costs restricting wage growth despite inflation adjustments.

Workers say wage stagnation is keeping their dreams out of reach - Many workers report that stagnant wages combined with rising living costs hinder their ability to achieve major life milestones such as homeownership and retirement, impacting motivation and mental well-being.

dowidth.com

dowidth.com