Liquidity crunch occurs when financial institutions or markets experience a sudden shortage of liquid assets, limiting the ability to meet short-term obligations, while a market freeze denotes a situation where trading activity halts due to extreme uncertainty or lack of buyers. Both scenarios disrupt normal economic functions and can precipitate broader financial instability. Explore further to understand the distinct impacts and policy responses to these critical economic events.

Why it is important

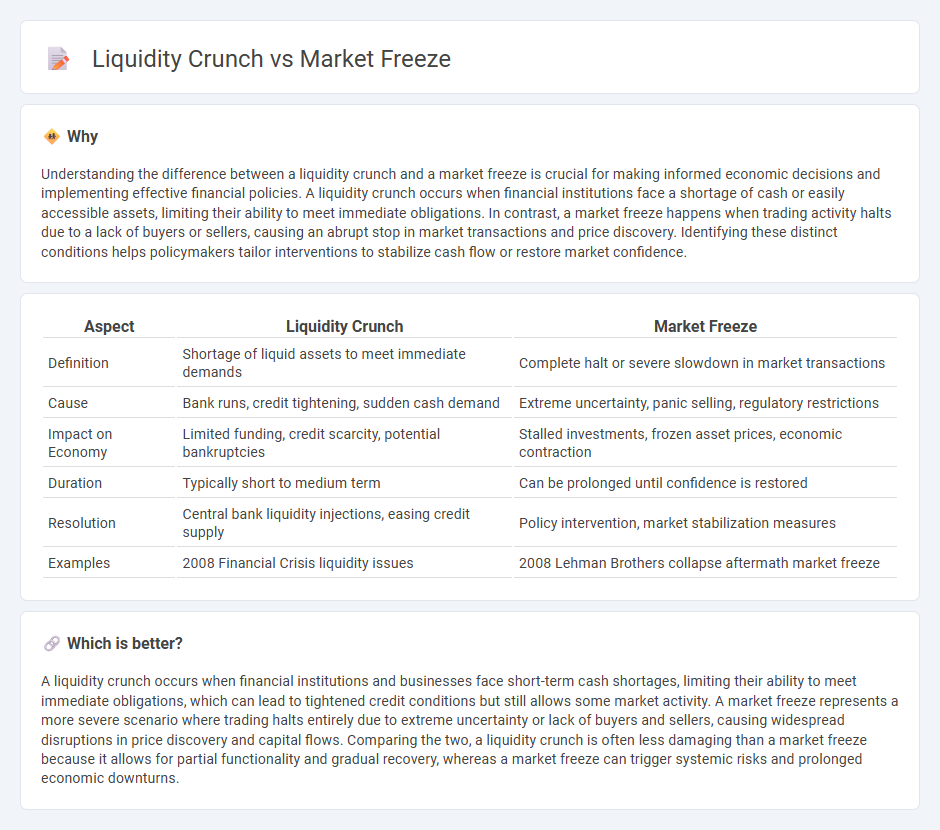

Understanding the difference between a liquidity crunch and a market freeze is crucial for making informed economic decisions and implementing effective financial policies. A liquidity crunch occurs when financial institutions face a shortage of cash or easily accessible assets, limiting their ability to meet immediate obligations. In contrast, a market freeze happens when trading activity halts due to a lack of buyers or sellers, causing an abrupt stop in market transactions and price discovery. Identifying these distinct conditions helps policymakers tailor interventions to stabilize cash flow or restore market confidence.

Comparison Table

| Aspect | Liquidity Crunch | Market Freeze |

|---|---|---|

| Definition | Shortage of liquid assets to meet immediate demands | Complete halt or severe slowdown in market transactions |

| Cause | Bank runs, credit tightening, sudden cash demand | Extreme uncertainty, panic selling, regulatory restrictions |

| Impact on Economy | Limited funding, credit scarcity, potential bankruptcies | Stalled investments, frozen asset prices, economic contraction |

| Duration | Typically short to medium term | Can be prolonged until confidence is restored |

| Resolution | Central bank liquidity injections, easing credit supply | Policy intervention, market stabilization measures |

| Examples | 2008 Financial Crisis liquidity issues | 2008 Lehman Brothers collapse aftermath market freeze |

Which is better?

A liquidity crunch occurs when financial institutions and businesses face short-term cash shortages, limiting their ability to meet immediate obligations, which can lead to tightened credit conditions but still allows some market activity. A market freeze represents a more severe scenario where trading halts entirely due to extreme uncertainty or lack of buyers and sellers, causing widespread disruptions in price discovery and capital flows. Comparing the two, a liquidity crunch is often less damaging than a market freeze because it allows for partial functionality and gradual recovery, whereas a market freeze can trigger systemic risks and prolonged economic downturns.

Connection

Liquidity crunch occurs when financial institutions and markets face a shortage of liquid assets, limiting their ability to meet short-term obligations and impacting overall market confidence. This lack of liquidity leads to a market freeze, where trading volumes drop significantly, asset prices become volatile, and buyers and sellers struggle to execute transactions. The interdependence between liquidity availability and market functionality underscores the critical role of central banks and regulatory measures in stabilizing financial systems during economic stress.

Key Terms

Credit Availability

Market freeze occurs when trading activity halts due to a sudden lack of buyers or sellers, severely limiting credit availability and causing financial institutions to retract lending. Liquidity crunch refers to a short-term shortage of liquid assets or cash in the market, making it difficult for businesses and consumers to access credit despite ongoing trading. Explore the mechanisms behind these phenomena and their impact on credit availability to better understand financial stability risks.

Asset Valuation

A market freeze occurs when trading activity halts, severely impairing asset valuation due to the absence of price discovery and resulting in increased uncertainty. In contrast, a liquidity crunch restricts the availability of buyers and sellers, causing asset prices to deviate significantly from their intrinsic values due to forced sales or reduced market depth. Explore further to understand the implications of these conditions on your investment strategies and portfolio management.

Solvency

A market freeze occurs when trading activity halts due to extreme uncertainty, reducing price discovery and causing asset valuations to stagnate. A liquidity crunch happens when institutions cannot meet short-term obligations because liquid assets are scarce, directly threatening solvency by forcing fire sales or default. Explore how these phenomena impact financial stability and corporate solvency risk in depth.

Source and External Links

Why Do Markets Freeze? - This article discusses why markets sometimes fail to function properly and "freeze," often due to uncertainty or fear among investors, as seen in the collapse of mortgage-backed securities trading during the financial crisis.

Why Do Markets Freeze? - This document explores theories behind market freezes, including investor behavior such as avoiding buying or selling due to concerns about asset prices.

Getty Images Market Freeze - This service temporarily removes assets from a content library, preventing others from licensing them during a project to ensure uniqueness.

dowidth.com

dowidth.com