Girl math emphasizes practical budgeting strategies like tracking daily expenses and saving small amounts for larger goals, reflecting a hands-on approach to personal finance. Gen Z math incorporates digital tools and social media trends to optimize spending habits and financial decision-making. Explore how these generational differences shape modern economic behavior and money management techniques.

Why it is important

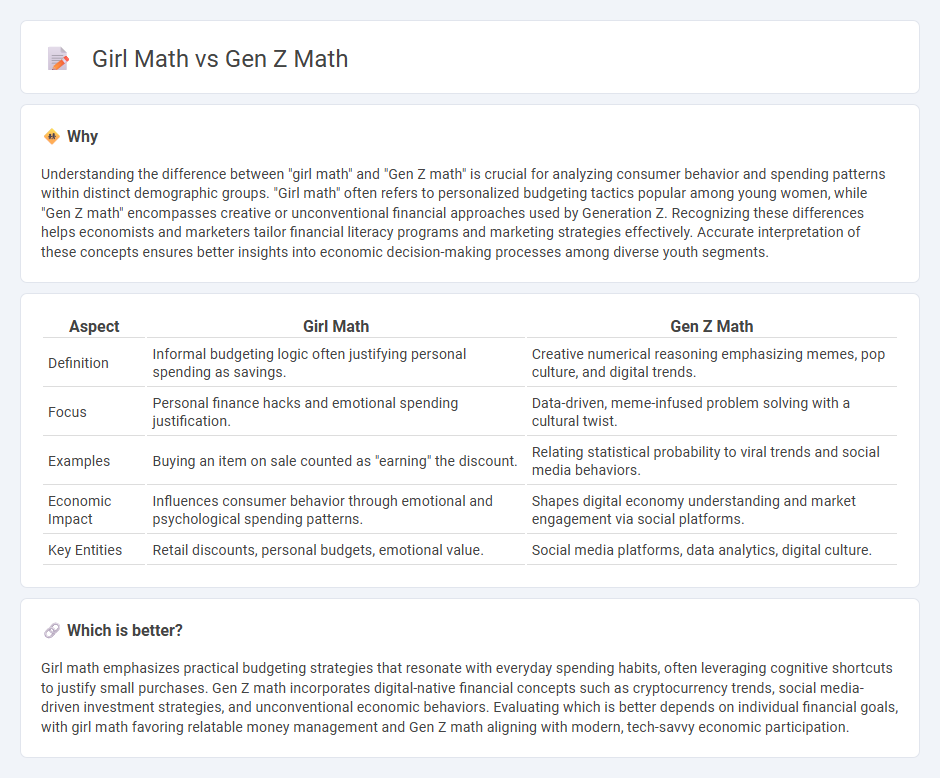

Understanding the difference between "girl math" and "Gen Z math" is crucial for analyzing consumer behavior and spending patterns within distinct demographic groups. "Girl math" often refers to personalized budgeting tactics popular among young women, while "Gen Z math" encompasses creative or unconventional financial approaches used by Generation Z. Recognizing these differences helps economists and marketers tailor financial literacy programs and marketing strategies effectively. Accurate interpretation of these concepts ensures better insights into economic decision-making processes among diverse youth segments.

Comparison Table

| Aspect | Girl Math | Gen Z Math |

|---|---|---|

| Definition | Informal budgeting logic often justifying personal spending as savings. | Creative numerical reasoning emphasizing memes, pop culture, and digital trends. |

| Focus | Personal finance hacks and emotional spending justification. | Data-driven, meme-infused problem solving with a cultural twist. |

| Examples | Buying an item on sale counted as "earning" the discount. | Relating statistical probability to viral trends and social media behaviors. |

| Economic Impact | Influences consumer behavior through emotional and psychological spending patterns. | Shapes digital economy understanding and market engagement via social platforms. |

| Key Entities | Retail discounts, personal budgets, emotional value. | Social media platforms, data analytics, digital culture. |

Which is better?

Girl math emphasizes practical budgeting strategies that resonate with everyday spending habits, often leveraging cognitive shortcuts to justify small purchases. Gen Z math incorporates digital-native financial concepts such as cryptocurrency trends, social media-driven investment strategies, and unconventional economic behaviors. Evaluating which is better depends on individual financial goals, with girl math favoring relatable money management and Gen Z math aligning with modern, tech-savvy economic participation.

Connection

Girl Math and Gen Z Math reflect evolving economic behaviors influenced by digital technology and social media trends, highlighting how younger generations optimize spending and saving strategies through informal financial heuristics. These approaches often emphasize psychological cost-benefit analyses and identity-driven consumption patterns, shaping new consumer economy dynamics. Understanding their connection offers insights into microeconomic decision-making and the future of personal finance within Gen Z demographics.

Key Terms

Spending behavior

Gen Z math prioritizes budget optimization and digital payment strategies, analyzing spending behavior through apps and subscription management. Girl math emphasizes rationalizing purchases as investments or savings, using creative justifications to balance emotional spending with practical financial goals. Discover more about how these unique math approaches shape smart spending habits.

Value perception

Gen Z math emphasizes practical calculations and data-driven decisions to maximize value perception, often incorporating digital tools and real-time analytics. Girl math focuses more on subjective value perception, linking emotional satisfaction and cost justification to optimize spending choices. Explore how these value perception strategies shape financial behaviors and decision-making styles.

Financial literacy

Gen Z math emphasizes practical calculations and budgeting skills critical for financial literacy, while girl math highlights intuitive money management strategies often linked to everyday spending habits. Both approaches contribute to a comprehensive understanding of personal finance, incorporating cognitive techniques and emotional intelligence for better decision-making. Explore how these distinct math perspectives enhance financial literacy and empower smarter financial choices.

Source and External Links

Gen Z Math - Purdue Global Library - Generation Z learns math differently with technology immersion, visual learning, and problem-based content designed to engage their independent and multitasking nature.

Are Gen Z lacking basic math skills? Bengaluru CEO's simple test exposes the truth - Despite digital proficiency, many Gen Z individuals struggle with basic problem-solving and financial literacy, exemplified by difficulty in answering a simple average speed math question.

Generation Z Goes to Math Class: How the Effective Mathematics Teaching Practices Can Support a New Generation of Learners - Effective math teaching for Generation Z should consider their digital engagement, preference for personalized learning, and need for real-world, socially relevant math tasks to deepen understanding.

dowidth.com

dowidth.com