Excess savings represent the amount households save beyond their typical spending, creating a significant gap between savings and consumption. This imbalance impacts economic growth by reducing immediate demand for goods and services, influencing inflation and investment patterns. Explore how this gap shapes fiscal policies and market trends to understand its broader economic implications.

Why it is important

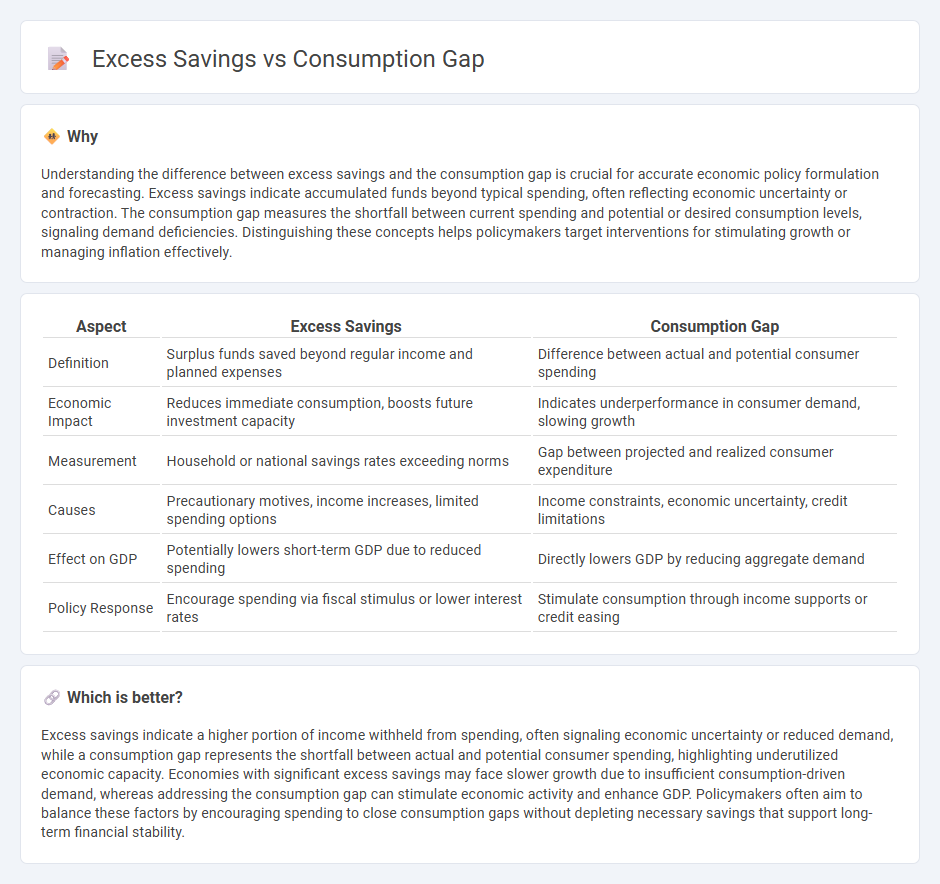

Understanding the difference between excess savings and the consumption gap is crucial for accurate economic policy formulation and forecasting. Excess savings indicate accumulated funds beyond typical spending, often reflecting economic uncertainty or contraction. The consumption gap measures the shortfall between current spending and potential or desired consumption levels, signaling demand deficiencies. Distinguishing these concepts helps policymakers target interventions for stimulating growth or managing inflation effectively.

Comparison Table

| Aspect | Excess Savings | Consumption Gap |

|---|---|---|

| Definition | Surplus funds saved beyond regular income and planned expenses | Difference between actual and potential consumer spending |

| Economic Impact | Reduces immediate consumption, boosts future investment capacity | Indicates underperformance in consumer demand, slowing growth |

| Measurement | Household or national savings rates exceeding norms | Gap between projected and realized consumer expenditure |

| Causes | Precautionary motives, income increases, limited spending options | Income constraints, economic uncertainty, credit limitations |

| Effect on GDP | Potentially lowers short-term GDP due to reduced spending | Directly lowers GDP by reducing aggregate demand |

| Policy Response | Encourage spending via fiscal stimulus or lower interest rates | Stimulate consumption through income supports or credit easing |

Which is better?

Excess savings indicate a higher portion of income withheld from spending, often signaling economic uncertainty or reduced demand, while a consumption gap represents the shortfall between actual and potential consumer spending, highlighting underutilized economic capacity. Economies with significant excess savings may face slower growth due to insufficient consumption-driven demand, whereas addressing the consumption gap can stimulate economic activity and enhance GDP. Policymakers often aim to balance these factors by encouraging spending to close consumption gaps without depleting necessary savings that support long-term financial stability.

Connection

Excess savings occur when households or businesses save more than they spend, leading to a consumption gap where aggregate demand falls short of potential output. This gap reduces economic growth by limiting consumer spending, a primary driver of GDP. Persistent excess savings can result in lower investments and increased unemployment, disrupting economic equilibrium.

Key Terms

Disposable income

The consumption gap reflects the shortfall between actual spending and the expected expenditures based on disposable income levels, highlighting potential underutilization of available funds. Excess savings occur when households accumulate savings beyond their average historical rates relative to disposable income, often signaling precautionary financial behavior or income uncertainty. Explore the intricate relationship between disposable income fluctuations, consumption patterns, and savings trends to better understand economic resilience.

Marginal propensity to consume

The consumption gap reflects the difference between actual consumption and potential consumption levels during economic fluctuations, heavily influenced by the marginal propensity to consume (MPC). Excess savings occur when households defer spending, often due to uncertainty or economic downturns, leading to reduced aggregate demand, with MPC determining how much of additional income is spent versus saved. Understanding the interplay between consumption gap, excess savings, and MPC is crucial for economic policy design; explore more insights to grasp their impact on growth and recovery strategies.

Household savings rate

The consumption gap represents the shortfall between actual consumer spending and potential spending capacity, often influenced by the household savings rate, which measures the proportion of disposable income saved rather than spent. Excess savings occur when households save more than necessary for normal economic conditions, leading to reduced consumption and potential slowdowns in economic growth. Exploring how fluctuations in household savings rates impact the consumption gap offers valuable insights into economic recovery patterns and fiscal policy effectiveness; learn more about these dynamics to understand future economic trends.

Source and External Links

The Retirement Consumption Gap: Evidence from the HRS - Retirees with median wealth exhibit an average consumption gap of about 8%, while the wealthier show gaps up to 45.6%, due to slow consumption of financial assets influenced by longevity uncertainty, medical costs, and bequest motives.

Spending in Retirement: Determining the Consumption Gap - The retirement consumption gap exists where actual spending is less than what retirees could afford, with wealthier retirees still holding a gap as high as 47% after accounting for reserves to cover risks and bequests.

Why Most Retirees Never Spend Their Retirement Assets - Most retirees maintain or grow their portfolios rather than spend them down, not necessarily due to inefficiency but as a prudent strategy to manage longevity risk, inflation, and uncertainty over retirement duration, resulting in a practical "consumption gap."

dowidth.com

dowidth.com