ESG due diligence evaluates environmental, social, and governance factors to identify risks and opportunities that impact sustainable business practices and long-term value creation. Tax due diligence focuses on assessing tax compliance, liabilities, and potential risks to ensure accurate financial reporting and avoid regulatory penalties. Explore how integrating ESG and tax due diligence can enhance comprehensive risk management.

Why it is important

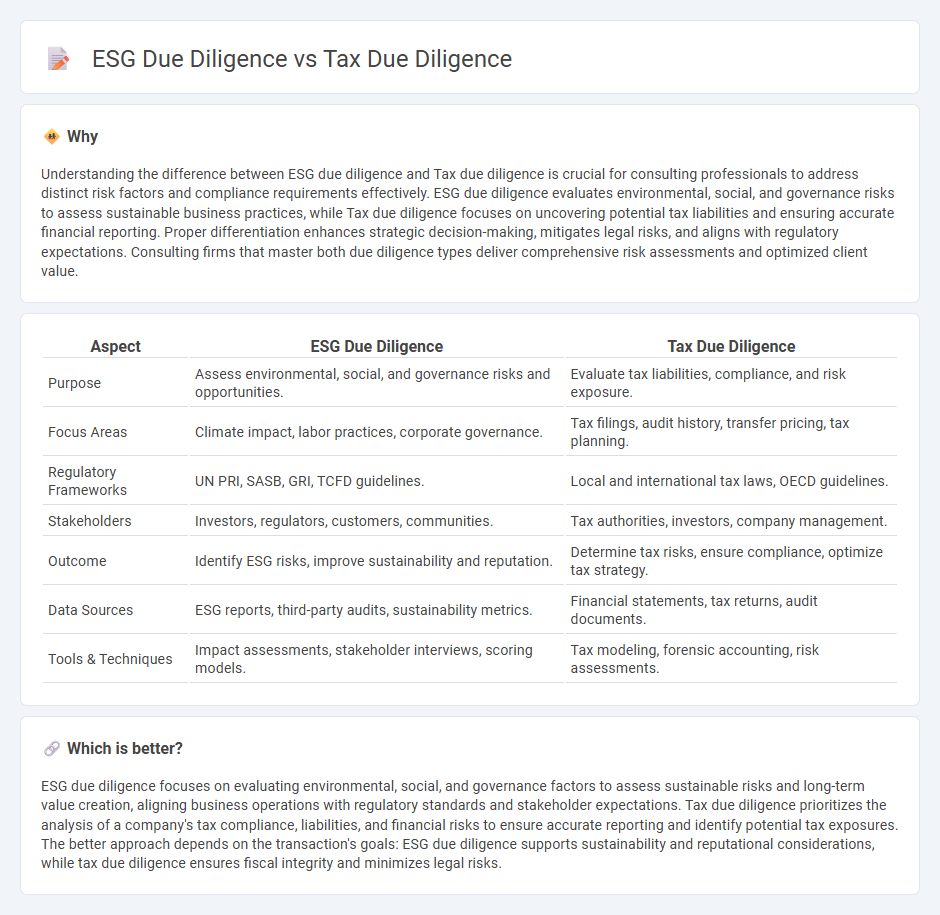

Understanding the difference between ESG due diligence and Tax due diligence is crucial for consulting professionals to address distinct risk factors and compliance requirements effectively. ESG due diligence evaluates environmental, social, and governance risks to assess sustainable business practices, while Tax due diligence focuses on uncovering potential tax liabilities and ensuring accurate financial reporting. Proper differentiation enhances strategic decision-making, mitigates legal risks, and aligns with regulatory expectations. Consulting firms that master both due diligence types deliver comprehensive risk assessments and optimized client value.

Comparison Table

| Aspect | ESG Due Diligence | Tax Due Diligence |

|---|---|---|

| Purpose | Assess environmental, social, and governance risks and opportunities. | Evaluate tax liabilities, compliance, and risk exposure. |

| Focus Areas | Climate impact, labor practices, corporate governance. | Tax filings, audit history, transfer pricing, tax planning. |

| Regulatory Frameworks | UN PRI, SASB, GRI, TCFD guidelines. | Local and international tax laws, OECD guidelines. |

| Stakeholders | Investors, regulators, customers, communities. | Tax authorities, investors, company management. |

| Outcome | Identify ESG risks, improve sustainability and reputation. | Determine tax risks, ensure compliance, optimize tax strategy. |

| Data Sources | ESG reports, third-party audits, sustainability metrics. | Financial statements, tax returns, audit documents. |

| Tools & Techniques | Impact assessments, stakeholder interviews, scoring models. | Tax modeling, forensic accounting, risk assessments. |

Which is better?

ESG due diligence focuses on evaluating environmental, social, and governance factors to assess sustainable risks and long-term value creation, aligning business operations with regulatory standards and stakeholder expectations. Tax due diligence prioritizes the analysis of a company's tax compliance, liabilities, and financial risks to ensure accurate reporting and identify potential tax exposures. The better approach depends on the transaction's goals: ESG due diligence supports sustainability and reputational considerations, while tax due diligence ensures fiscal integrity and minimizes legal risks.

Connection

ESG due diligence and Tax due diligence intersect by evaluating a company's compliance with environmental, social, and governance criteria alongside its adherence to tax regulations, ensuring comprehensive risk assessment. Both processes uncover potential financial liabilities and reputational risks linked to non-compliance, supporting informed decision-making in mergers and acquisitions. Integrating ESG and Tax due diligence enhances transparency and identifies sustainability-related tax risks that impact long-term value creation.

Key Terms

Compliance assessment

Tax due diligence involves a comprehensive analysis of a company's tax positions, liabilities, and compliance with tax regulations to identify potential risks and ensure accuracy in financial reporting. ESG due diligence, specifically focusing on compliance assessment, evaluates adherence to environmental, social, and governance laws, standards, and voluntary commitments that influence reputation and long-term sustainability. Explore our detailed insights to understand how integrating these assessments strengthens corporate compliance frameworks.

Risk identification

Tax due diligence primarily focuses on identifying fiscal risks such as tax liabilities, compliance gaps, and potential exposures from past transactions, ensuring adherence to local and international tax regulations. ESG due diligence centers on uncovering environmental, social, and governance risks that could affect a company's reputation, regulatory standing, or long-term sustainability, including issues like carbon emissions, labor practices, and board diversity. Explore further to understand how integrating these due diligence approaches enhances comprehensive risk management strategies.

Reporting standards

Tax due diligence focuses on compliance with tax laws, identifying liabilities, and verifying accurate financial reporting according to standards like IFRS and GAAP. ESG due diligence evaluates environmental, social, and governance factors, emphasizing adherence to frameworks such as GRI, SASB, and TCFD to ensure transparency and sustainability reporting. Explore more to understand how these due diligence processes impact corporate accountability and risk management.

Source and External Links

The Critical Importance of Tax Due Diligence in Modern Business Transactions - Tax due diligence is a detailed examination of a company's tax history and practices to identify tax risks, liabilities, and ensure compliance with tax laws before business transactions.

Tax Due Diligence For Mergers And Acquisitions - Ansarada - Tax due diligence in M&A involves reviewing tax obligations, historical compliance, and potential tax issues both from the buyer and seller side to avoid deal breakers and ensure smooth transactions.

What to know about tax due diligence in a merger - Tax due diligence assesses a company's maximum tax exposure and accurate tax positions by analyzing recent tax returns, financial statements, and tax provisions, benefiting both buyers and sellers during mergers.

dowidth.com

dowidth.com