Zero-based budgeting requires justifying every expense from scratch, promoting efficient allocation of resources, while line-item budgeting focuses on adjusting previous budgets by category, ensuring stable and predictable financial planning. Zero-based budgeting enhances cost control and adaptability in dynamic industries, whereas line-item budgeting offers simplicity and ease of implementation for organizations with steady expenses. Discover how choosing between zero-based and line-item budgeting can optimize your consulting financial strategies.

Why it is important

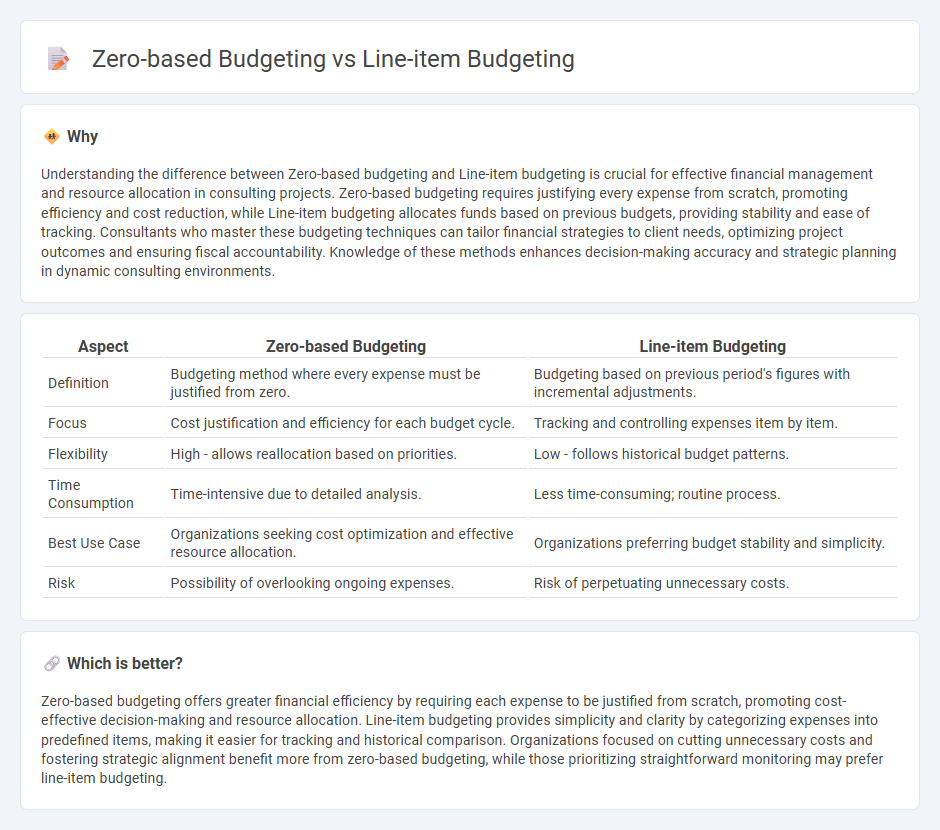

Understanding the difference between Zero-based budgeting and Line-item budgeting is crucial for effective financial management and resource allocation in consulting projects. Zero-based budgeting requires justifying every expense from scratch, promoting efficiency and cost reduction, while Line-item budgeting allocates funds based on previous budgets, providing stability and ease of tracking. Consultants who master these budgeting techniques can tailor financial strategies to client needs, optimizing project outcomes and ensuring fiscal accountability. Knowledge of these methods enhances decision-making accuracy and strategic planning in dynamic consulting environments.

Comparison Table

| Aspect | Zero-based Budgeting | Line-item Budgeting |

|---|---|---|

| Definition | Budgeting method where every expense must be justified from zero. | Budgeting based on previous period's figures with incremental adjustments. |

| Focus | Cost justification and efficiency for each budget cycle. | Tracking and controlling expenses item by item. |

| Flexibility | High - allows reallocation based on priorities. | Low - follows historical budget patterns. |

| Time Consumption | Time-intensive due to detailed analysis. | Less time-consuming; routine process. |

| Best Use Case | Organizations seeking cost optimization and effective resource allocation. | Organizations preferring budget stability and simplicity. |

| Risk | Possibility of overlooking ongoing expenses. | Risk of perpetuating unnecessary costs. |

Which is better?

Zero-based budgeting offers greater financial efficiency by requiring each expense to be justified from scratch, promoting cost-effective decision-making and resource allocation. Line-item budgeting provides simplicity and clarity by categorizing expenses into predefined items, making it easier for tracking and historical comparison. Organizations focused on cutting unnecessary costs and fostering strategic alignment benefit more from zero-based budgeting, while those prioritizing straightforward monitoring may prefer line-item budgeting.

Connection

Zero-based budgeting and line-item budgeting are connected through their shared focus on detailed financial planning and cost control, where zero-based budgeting requires justifying every expense from a zero base each period, and line-item budgeting organizes these justified expenses into specific categories or accounts. Both methods enhance transparency by providing a structured approach to allocating resources and tracking expenditures within consulting projects. This connection allows consulting firms to optimize budget efficiency and align spending closely with strategic priorities.

Key Terms

Cost Categories

Line-item budgeting allocates funds based on predefined cost categories, emphasizing historical expenditures for categories like salaries, utilities, and supplies. Zero-based budgeting requires justifying every expense from zero, scrutinizing each cost category to ensure alignment with current organizational priorities and eliminating unnecessary costs. Explore the detailed differences to optimize your budgeting strategy.

Justification Process

Line-item budgeting allocates funds based on previous budgets and fixed categories, requiring minimal justification for recurring expenses. Zero-based budgeting mandates a detailed justification for every expense from scratch, ensuring all budget items are essential and aligned with organizational goals. Explore the differences in justification processes to optimize your budgeting strategy effectively.

Baseline Assumptions

Line-item budgeting relies on historical expense data as baseline assumptions, projecting future budgets by adjusting previous spending levels with incremental changes. Zero-based budgeting discards past expenditures, requiring each budget cycle to justify all expenses from a zero base, fostering a more detailed and objective evaluation of resource allocation. Explore the nuances of these budgeting methodologies to optimize financial planning and control.

Source and External Links

What is a Line Item Budget: A Comprehensive Guide - Vyde - A line item budget is a detailed financial plan that itemizes monthly expenses and income, providing a comprehensive breakdown of anticipated costs within each category for better tracking and resource allocation.

2009 Edition - Chapter 3: Budgeting -- Budgetary Approaches - Line-item budgeting organizes expenses by organizational unit and object, offering simplicity, enhanced organizational control, and the ability to accumulate expenditure data for historical or trend analysis.

Line Item Budget: Definition, Tips, Examples and Templates | SoFi - This approach allows you to organize income and expenses into specific categories on separate lines, making it easy to monitor spending, compare actual vs. projected costs, and prevent overspending in any area.

dowidth.com

dowidth.com