ESG due diligence focuses on evaluating environmental, social, and governance factors to ensure sustainable and ethical business practices, while human resources due diligence examines workforce-related risks, compliance, and talent management during mergers and acquisitions. Both processes are vital for mitigating risks and enhancing long-term value in corporate transactions. Discover how integrating ESG and HR insights can optimize your due diligence strategy.

Why it is important

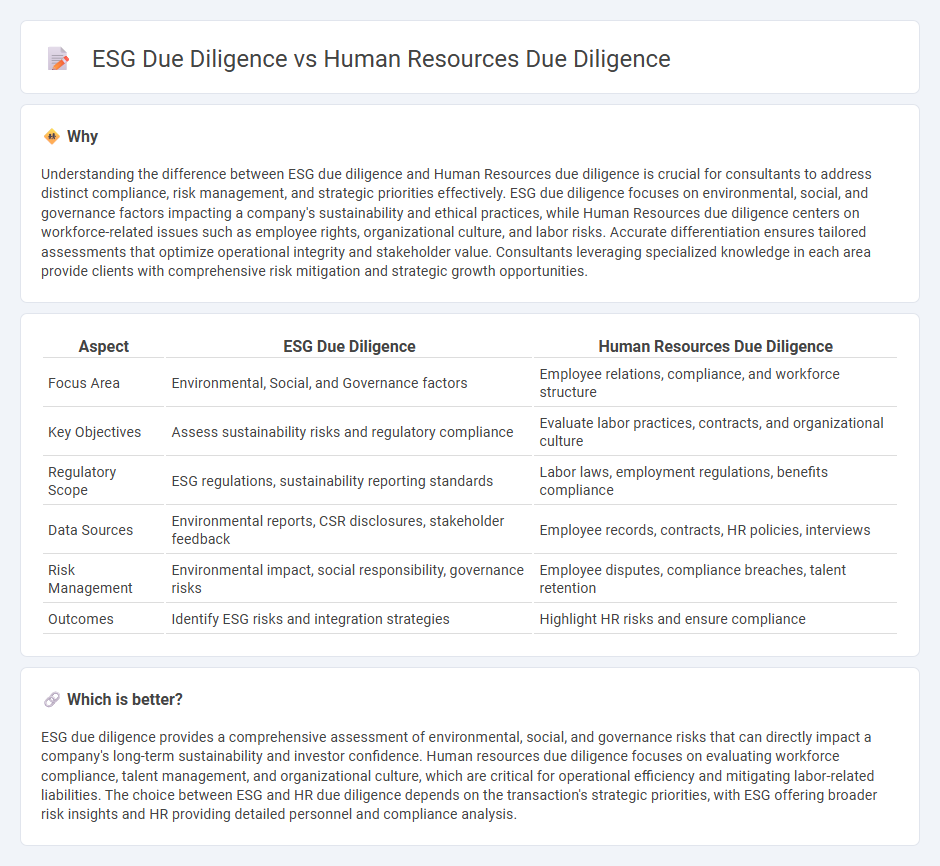

Understanding the difference between ESG due diligence and Human Resources due diligence is crucial for consultants to address distinct compliance, risk management, and strategic priorities effectively. ESG due diligence focuses on environmental, social, and governance factors impacting a company's sustainability and ethical practices, while Human Resources due diligence centers on workforce-related issues such as employee rights, organizational culture, and labor risks. Accurate differentiation ensures tailored assessments that optimize operational integrity and stakeholder value. Consultants leveraging specialized knowledge in each area provide clients with comprehensive risk mitigation and strategic growth opportunities.

Comparison Table

| Aspect | ESG Due Diligence | Human Resources Due Diligence |

|---|---|---|

| Focus Area | Environmental, Social, and Governance factors | Employee relations, compliance, and workforce structure |

| Key Objectives | Assess sustainability risks and regulatory compliance | Evaluate labor practices, contracts, and organizational culture |

| Regulatory Scope | ESG regulations, sustainability reporting standards | Labor laws, employment regulations, benefits compliance |

| Data Sources | Environmental reports, CSR disclosures, stakeholder feedback | Employee records, contracts, HR policies, interviews |

| Risk Management | Environmental impact, social responsibility, governance risks | Employee disputes, compliance breaches, talent retention |

| Outcomes | Identify ESG risks and integration strategies | Highlight HR risks and ensure compliance |

Which is better?

ESG due diligence provides a comprehensive assessment of environmental, social, and governance risks that can directly impact a company's long-term sustainability and investor confidence. Human resources due diligence focuses on evaluating workforce compliance, talent management, and organizational culture, which are critical for operational efficiency and mitigating labor-related liabilities. The choice between ESG and HR due diligence depends on the transaction's strategic priorities, with ESG offering broader risk insights and HR providing detailed personnel and compliance analysis.

Connection

ESG due diligence and Human Resources due diligence are interconnected through their shared focus on assessing a company's social and governance practices, including employee relations, diversity, labor standards, and workplace culture. Both processes evaluate risks related to workforce management, compliance with labor laws, and human capital sustainability, which are critical for long-term organizational performance and investor confidence. Integrating ESG criteria into HR due diligence enhances decision-making by identifying potential social risks and opportunities that impact a company's environmental, social, and governance profile.

Key Terms

Talent Assessment (Human resources due diligence)

Human resources due diligence emphasizes comprehensive talent assessment by evaluating employee skills, organizational culture, and leadership effectiveness to identify workforce risks and opportunities during mergers and acquisitions. ESG due diligence incorporates talent assessment within the broader scope of environmental, social, and governance criteria, focusing on diversity, equity, inclusion, and employee well-being as key indicators of sustainable business practices. Explore how integrating these approaches enhances decision-making and drives long-term value creation.

Diversity & Inclusion Metrics (ESG due diligence)

Human resources due diligence primarily evaluates employee qualifications, labor practices, and compliance with employment laws, while ESG due diligence emphasizes Diversity & Inclusion (D&I) metrics such as workforce demographics, pay equity, and leadership diversity to assess social responsibility and corporate governance. ESG due diligence integrates these D&I factors to measure long-term sustainability and stakeholder impact, aligning with investor and regulatory expectations. Explore in-depth strategies to enhance your due diligence practices by focusing on comprehensive Diversity & Inclusion metrics.

Compliance & Labor Practices (Relevant to both)

Human resources due diligence emphasizes verifying compliance with labor laws, employee rights, and workplace safety standards to mitigate legal and operational risks. ESG due diligence expands this focus by integrating environmental, social, and governance criteria, particularly assessing fair labor practices, diversity, equity, inclusion, and supply chain responsibility. Explore deeper insights into how aligning HR and ESG due diligence drives sustainable business growth and stakeholder trust.

Source and External Links

How to Efficiently Conduct HR Due Diligence - HR due diligence is the process through which an acquiring company analyzes a target company's human capital, policies, and procedures, focusing on staff overview, HR policies, legal compliance, and employee benefits to assess risks and capabilities during a merger or acquisition.

2025 HR Due Diligence Checklist & Guide for HR Leaders - HR due diligence involves a detailed review of a target company's people, culture, compensation, policies, and legal compliance to uncover risks and integration challenges, primarily conducted by HR teams with legal and financial collaboration to support acquisition decisions.

What Is HR Due Diligence? (Plus Why It's Necessary) - HR due diligence evaluates a company's workforce and HR practices during acquisitions, including key staff details, training, HR information systems audit, and operational costs, helping acquirers understand employee roles, expertise, and potential liabilities.

dowidth.com

dowidth.com