ESG due diligence evaluates a company's environmental, social, and governance practices to identify risks and opportunities aligned with sustainability goals and investor expectations. Regulatory due diligence focuses on compliance with laws, regulations, and industry standards to prevent legal penalties and operational disruptions. Explore deeper insights into how each due diligence type enhances strategic decision-making.

Why it is important

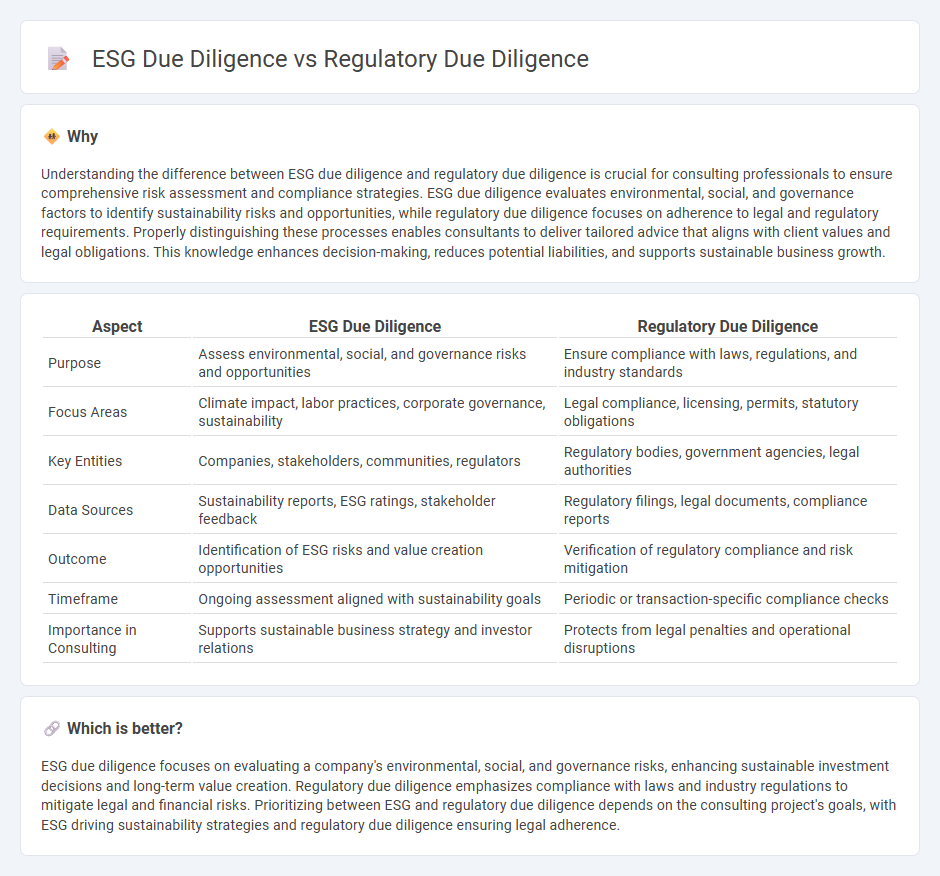

Understanding the difference between ESG due diligence and regulatory due diligence is crucial for consulting professionals to ensure comprehensive risk assessment and compliance strategies. ESG due diligence evaluates environmental, social, and governance factors to identify sustainability risks and opportunities, while regulatory due diligence focuses on adherence to legal and regulatory requirements. Properly distinguishing these processes enables consultants to deliver tailored advice that aligns with client values and legal obligations. This knowledge enhances decision-making, reduces potential liabilities, and supports sustainable business growth.

Comparison Table

| Aspect | ESG Due Diligence | Regulatory Due Diligence |

|---|---|---|

| Purpose | Assess environmental, social, and governance risks and opportunities | Ensure compliance with laws, regulations, and industry standards |

| Focus Areas | Climate impact, labor practices, corporate governance, sustainability | Legal compliance, licensing, permits, statutory obligations |

| Key Entities | Companies, stakeholders, communities, regulators | Regulatory bodies, government agencies, legal authorities |

| Data Sources | Sustainability reports, ESG ratings, stakeholder feedback | Regulatory filings, legal documents, compliance reports |

| Outcome | Identification of ESG risks and value creation opportunities | Verification of regulatory compliance and risk mitigation |

| Timeframe | Ongoing assessment aligned with sustainability goals | Periodic or transaction-specific compliance checks |

| Importance in Consulting | Supports sustainable business strategy and investor relations | Protects from legal penalties and operational disruptions |

Which is better?

ESG due diligence focuses on evaluating a company's environmental, social, and governance risks, enhancing sustainable investment decisions and long-term value creation. Regulatory due diligence emphasizes compliance with laws and industry regulations to mitigate legal and financial risks. Prioritizing between ESG and regulatory due diligence depends on the consulting project's goals, with ESG driving sustainability strategies and regulatory due diligence ensuring legal adherence.

Connection

ESG due diligence and regulatory due diligence intersect by ensuring compliance with environmental, social, and governance standards while adhering to legal and regulatory frameworks. Both processes assess risks related to sustainability practices, corporate governance, and regulatory obligations to inform better decision-making in mergers, acquisitions, and investments. Integrating ESG factors into regulatory due diligence enhances transparency and mitigates potential legal, financial, and reputational risks for organizations.

Key Terms

Compliance Assessment

Regulatory due diligence involves a comprehensive evaluation of a company's adherence to applicable laws, regulations, and industry standards to mitigate legal and compliance risks. ESG due diligence, while encompassing regulatory compliance, extends to assessing environmental, social, and governance factors that impact long-term sustainability and stakeholder value. Explore further to understand the nuanced differences and strategic importance of these due diligence processes.

Risk Identification

Regulatory due diligence centers on verifying compliance with laws, regulations, and industry standards to identify legal and financial risks that could impact a company's operations or reputation. ESG due diligence evaluates environmental, social, and governance factors to uncover risks related to sustainability, ethical practices, and long-term value creation. Explore deeper insights into how these due diligence approaches mitigate risks in corporate decision-making.

Sustainability Metrics

Regulatory due diligence evaluates compliance with legal requirements, focusing on environmental, social, and governance (ESG) criteria as part of broader risk management. ESG due diligence emphasizes sustainability metrics such as carbon emissions, energy efficiency, labor practices, and board diversity to assess long-term impacts and value creation. Explore detailed insights into how integrating these due diligence processes enhances sustainable business practices and investment decisions.

Source and External Links

Regulatory Due Diligence | LexisNexis Int - Regulatory due diligence is a comprehensive process assessing compliance status of your organization and third parties to reveal issues, mitigate risks, and ensure regulatory obligations are met to avoid legal and reputational problems.

The Compliance and Regulatory Due Diligence Process for Pharma - In FDA-regulated industries, regulatory due diligence during mergers and acquisitions assesses compliance, internal controls, remediation processes, and highlights risks tied to fines and prosecutions.

Regulatory Due Diligence - Checklist & Best Practices - Regulatory due diligence evaluates business processes against federal regulatory requirements such as antitrust, data privacy, AML, and ESG in M&A, IPOs, or audits to save costs and enable continuous compliance improvement.

dowidth.com

dowidth.com