Stakeholder capitalism emphasizes creating long-term value for all parties involved, including employees, customers, suppliers, and communities, whereas ESG focuses on measurable environmental, social, and governance criteria to assess corporate responsibility and sustainability. Companies integrating stakeholder capitalism adopt a broader perspective on value creation beyond shareholder profits, aligning business strategies with societal needs. Discover how consulting can bridge these frameworks to optimize corporate impact and growth.

Why it is important

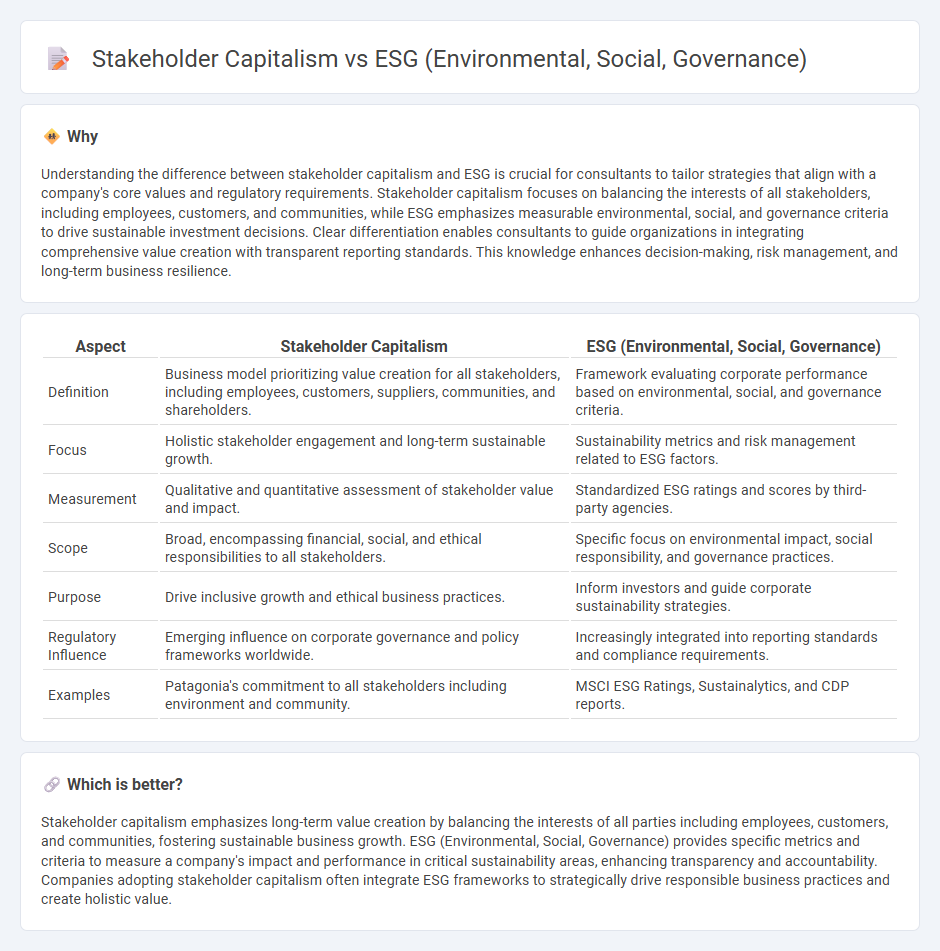

Understanding the difference between stakeholder capitalism and ESG is crucial for consultants to tailor strategies that align with a company's core values and regulatory requirements. Stakeholder capitalism focuses on balancing the interests of all stakeholders, including employees, customers, and communities, while ESG emphasizes measurable environmental, social, and governance criteria to drive sustainable investment decisions. Clear differentiation enables consultants to guide organizations in integrating comprehensive value creation with transparent reporting standards. This knowledge enhances decision-making, risk management, and long-term business resilience.

Comparison Table

| Aspect | Stakeholder Capitalism | ESG (Environmental, Social, Governance) |

|---|---|---|

| Definition | Business model prioritizing value creation for all stakeholders, including employees, customers, suppliers, communities, and shareholders. | Framework evaluating corporate performance based on environmental, social, and governance criteria. |

| Focus | Holistic stakeholder engagement and long-term sustainable growth. | Sustainability metrics and risk management related to ESG factors. |

| Measurement | Qualitative and quantitative assessment of stakeholder value and impact. | Standardized ESG ratings and scores by third-party agencies. |

| Scope | Broad, encompassing financial, social, and ethical responsibilities to all stakeholders. | Specific focus on environmental impact, social responsibility, and governance practices. |

| Purpose | Drive inclusive growth and ethical business practices. | Inform investors and guide corporate sustainability strategies. |

| Regulatory Influence | Emerging influence on corporate governance and policy frameworks worldwide. | Increasingly integrated into reporting standards and compliance requirements. |

| Examples | Patagonia's commitment to all stakeholders including environment and community. | MSCI ESG Ratings, Sustainalytics, and CDP reports. |

Which is better?

Stakeholder capitalism emphasizes long-term value creation by balancing the interests of all parties including employees, customers, and communities, fostering sustainable business growth. ESG (Environmental, Social, Governance) provides specific metrics and criteria to measure a company's impact and performance in critical sustainability areas, enhancing transparency and accountability. Companies adopting stakeholder capitalism often integrate ESG frameworks to strategically drive responsible business practices and create holistic value.

Connection

Stakeholder capitalism emphasizes the importance of considering all parties affected by business decisions, aligning closely with ESG principles that measure environmental, social, and governance impacts. Consulting firms integrate ESG metrics to help organizations enhance stakeholder value and ensure sustainable business practices. This connection drives long-term financial performance while addressing regulatory requirements and societal expectations.

Key Terms

Materiality Assessment

Materiality assessment in ESG centers on identifying environmental, social, and governance factors directly impacting a company's financial performance and long-term value. Stakeholder capitalism expands this scope by incorporating broader societal impacts and priorities of diverse stakeholder groups beyond shareholders. Explore how materiality assessments evolve to balance financial metrics with stakeholder-driven sustainability goals.

Triple Bottom Line

ESG (Environmental, Social, Governance) metrics provide a framework for companies to measure and report sustainability efforts, emphasizing accountability in environmental impact, social responsibility, and corporate governance. Stakeholder capitalism extends this approach by prioritizing the interests of all stakeholders--employees, customers, suppliers, communities--beyond just shareholders, aligning closely with the Triple Bottom Line concept that balances profit, people, and planet. Explore how integrating ESG principles within stakeholder capitalism drives sustainable business practices and long-term value creation.

Fiduciary Duty

Fiduciary duty in ESG emphasizes long-term value creation by integrating environmental, social, and governance factors, ensuring companies manage risks and opportunities for sustainable growth. Stakeholder capitalism broadens this approach by balancing shareholder interests with those of employees, customers, and communities, promoting inclusive and responsible business practices. Explore how these frameworks redefine corporate responsibility and fiduciary obligations today.

Source and External Links

What is ESG? A guide for businesses - ESG stands for Environmental, Social, and Governance, representing a set of standards that measure a business's impact on society and the environment, along with the transparency and robustness of its governance practices.

ESG (Environmental, Social, & Governance) - ESG is a framework that helps stakeholders assess how an organization manages risks and opportunities related to environmental, social, and governance factors, extending beyond environmental issues to include social impact and corporate governance.

What is Environmental, Social, and Governance (ESG)? - ESG refers to measurable standards used to evaluate an organization's environmental and social impact, as well as its governance, providing data and metrics that inform decision-making for businesses and investors.

dowidth.com

dowidth.com