Thought partnership fosters collaborative problem-solving and strategic innovation, focusing on long-term value creation by aligning expertise with client goals. In contrast, audits emphasize compliance, risk assessment, and financial accuracy through systematic examination of records and processes. Explore how choosing between thought partnership and audit can transform your business outcomes.

Why it is important

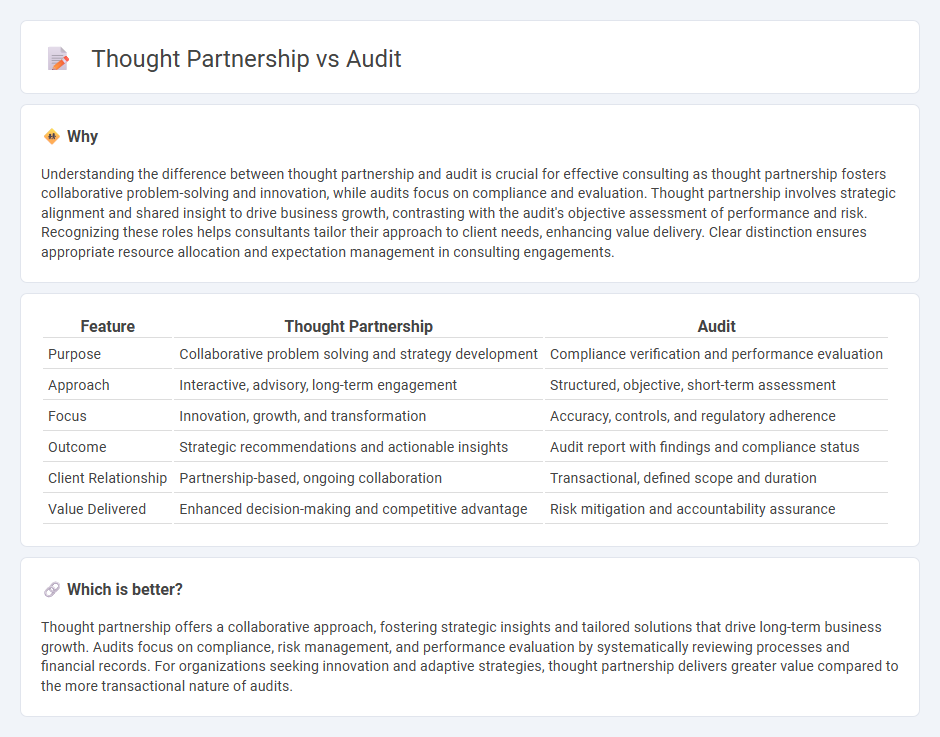

Understanding the difference between thought partnership and audit is crucial for effective consulting as thought partnership fosters collaborative problem-solving and innovation, while audits focus on compliance and evaluation. Thought partnership involves strategic alignment and shared insight to drive business growth, contrasting with the audit's objective assessment of performance and risk. Recognizing these roles helps consultants tailor their approach to client needs, enhancing value delivery. Clear distinction ensures appropriate resource allocation and expectation management in consulting engagements.

Comparison Table

| Feature | Thought Partnership | Audit |

|---|---|---|

| Purpose | Collaborative problem solving and strategy development | Compliance verification and performance evaluation |

| Approach | Interactive, advisory, long-term engagement | Structured, objective, short-term assessment |

| Focus | Innovation, growth, and transformation | Accuracy, controls, and regulatory adherence |

| Outcome | Strategic recommendations and actionable insights | Audit report with findings and compliance status |

| Client Relationship | Partnership-based, ongoing collaboration | Transactional, defined scope and duration |

| Value Delivered | Enhanced decision-making and competitive advantage | Risk mitigation and accountability assurance |

Which is better?

Thought partnership offers a collaborative approach, fostering strategic insights and tailored solutions that drive long-term business growth. Audits focus on compliance, risk management, and performance evaluation by systematically reviewing processes and financial records. For organizations seeking innovation and adaptive strategies, thought partnership delivers greater value compared to the more transactional nature of audits.

Connection

Thought partnership enhances consulting effectiveness by fostering collaborative problem-solving and strategic insight, which aligns closely with the objectives of an audit. Audits provide thorough evaluations of processes and controls, supplying critical data that thought partners analyze to recommend tailored improvements. Together, these elements drive informed decision-making and continuous organizational growth.

Key Terms

Compliance

Audit emphasizes systematic evaluation of compliance with regulatory standards, identifying gaps and ensuring adherence to policies through rigorous reviews and documentation. Thought partnership involves collaborative problem-solving to enhance compliance strategies, fostering innovative approaches and strategic insights for sustained regulatory alignment. Explore how integrating audit and thought partnership can optimize your compliance framework.

Insight

Audits emphasize systematic evaluation and compliance verification to identify discrepancies and ensure accuracy, while thought partnerships prioritize collaborative insight generation and strategic problem-solving. Thought partnerships foster innovative thinking and deeper understanding by blending diverse expertise, which leads to actionable insights beyond standard audit findings. Explore how combining audit rigor with thought partnership creativity can transform organizational decision-making.

Co-creation

Audit emphasizes rigorous evaluation and verification of processes to ensure compliance and accuracy, often relying on independent assessments and standardized criteria. Thought partnership centers on collaborative problem-solving and co-creation, fostering innovation through shared insights and mutual expertise. Explore how integrating these approaches can enhance strategic alignment and drive transformative value in your organization.

Source and External Links

What is an Audit? - An audit is an independent examination of a company's financial report to ensure it reflects the financial position accurately.

Audit - An audit is an independent examination of financial information to express an opinion on whether it is free from material misstatement.

IRS Audits - An IRS audit reviews financial records to ensure tax returns are accurate and comply with tax laws.

dowidth.com

dowidth.com