Due diligence deep dives focus on comprehensive evaluations of financial, legal, and operational risks to ensure informed decision-making during mergers and acquisitions. Organizational restructuring targets enhancing efficiency and agility by realigning company structure, processes, and resource allocation to achieve strategic goals. Discover how combining these consulting approaches can maximize business value and operational success.

Why it is important

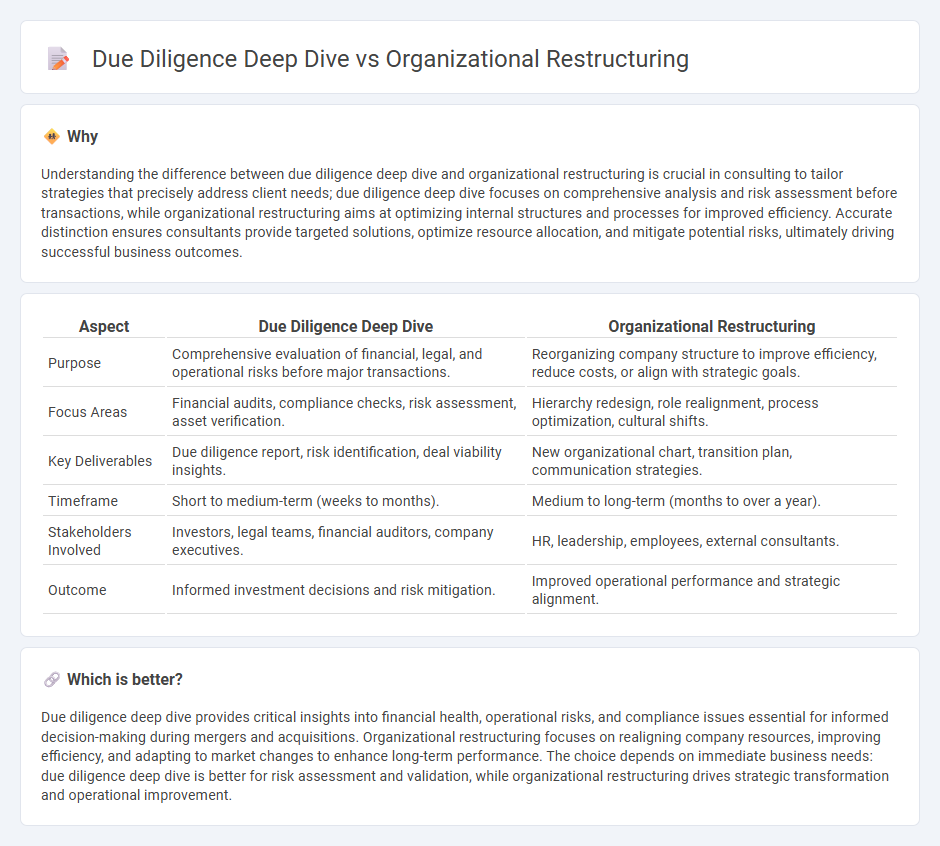

Understanding the difference between due diligence deep dive and organizational restructuring is crucial in consulting to tailor strategies that precisely address client needs; due diligence deep dive focuses on comprehensive analysis and risk assessment before transactions, while organizational restructuring aims at optimizing internal structures and processes for improved efficiency. Accurate distinction ensures consultants provide targeted solutions, optimize resource allocation, and mitigate potential risks, ultimately driving successful business outcomes.

Comparison Table

| Aspect | Due Diligence Deep Dive | Organizational Restructuring |

|---|---|---|

| Purpose | Comprehensive evaluation of financial, legal, and operational risks before major transactions. | Reorganizing company structure to improve efficiency, reduce costs, or align with strategic goals. |

| Focus Areas | Financial audits, compliance checks, risk assessment, asset verification. | Hierarchy redesign, role realignment, process optimization, cultural shifts. |

| Key Deliverables | Due diligence report, risk identification, deal viability insights. | New organizational chart, transition plan, communication strategies. |

| Timeframe | Short to medium-term (weeks to months). | Medium to long-term (months to over a year). |

| Stakeholders Involved | Investors, legal teams, financial auditors, company executives. | HR, leadership, employees, external consultants. |

| Outcome | Informed investment decisions and risk mitigation. | Improved operational performance and strategic alignment. |

Which is better?

Due diligence deep dive provides critical insights into financial health, operational risks, and compliance issues essential for informed decision-making during mergers and acquisitions. Organizational restructuring focuses on realigning company resources, improving efficiency, and adapting to market changes to enhance long-term performance. The choice depends on immediate business needs: due diligence deep dive is better for risk assessment and validation, while organizational restructuring drives strategic transformation and operational improvement.

Connection

Due diligence deep dive uncovers critical insights into financial, legal, and operational risks that inform organizational restructuring strategies. By identifying inefficiencies and compliance issues, consulting firms design targeted restructuring plans to optimize workflows, reduce costs, and align resources with strategic goals. This integration ensures a data-driven approach, enhancing decision-making accuracy and long-term organizational resilience.

Key Terms

Organizational Restructuring:

Organizational restructuring involves realigning a company's internal structure to improve efficiency, adapt to market changes, or support strategic goals, often through changes in hierarchy, departmental shifts, or workforce realignment. This process requires detailed analysis of operational workflows, resource allocation, and cultural impact to ensure sustainable transformation and enhanced organizational performance. Explore further to understand key strategies and best practices for successful restructuring initiatives.

Span of Control

Span of control is a critical factor in organizational restructuring, directly impacting managerial efficiency and communication flow within teams. Due diligence deep dives assess span of control to identify bottlenecks, optimize resource allocation, and improve overall organizational performance. Explore detailed strategies to balance span of control for effective restructuring and due diligence processes.

Organizational Design

Organizational restructuring involves redefining roles, hierarchies, and workflows to enhance efficiency and alignment with strategic goals, while due diligence deep dive assesses operational and financial risks during mergers or acquisitions, emphasizing validation of organizational design viability. Emphasizing organizational design during restructuring ensures optimal resource allocation and improved communication channels, critical for seamless transitions and sustained performance. Explore how integrating organizational design principles into due diligence deep dives can transform restructuring outcomes for your business.

Source and External Links

Organizational Restructuring: Meaning | Process | Examples - Organizational restructuring involves altering an organization's structure or operations to enhance efficiency, align with strategic goals, or adapt to external changes, involving steps such as assessing needs, defining objectives, and analyzing current state for improvement.

Organizational Restructuring: 7 Strategies for HR (Plus Free Template) - Organizational restructuring is a strategic process aimed at improving efficiency and competitiveness by realigning departments, redefining roles, and sometimes downsizing, driven by factors like economic pressures, mergers, or leadership changes.

What Is Corporate Restructuring? Process, Examples & More - Prosci - Corporate restructuring involves changing internal structures to enhance processes and efficiency, following a process including goal identification, strategic planning integrating technical and people sides, and phased implementation with progress monitoring.

dowidth.com

dowidth.com