ESG due diligence evaluates environmental, social, and governance risks and opportunities in investments to ensure sustainable and ethical outcomes. Technical due diligence focuses on assessing the operational, technological, and infrastructure aspects of a project or asset for performance and compliance. Explore more to understand how integrating both approaches strengthens investment decisions.

Why it is important

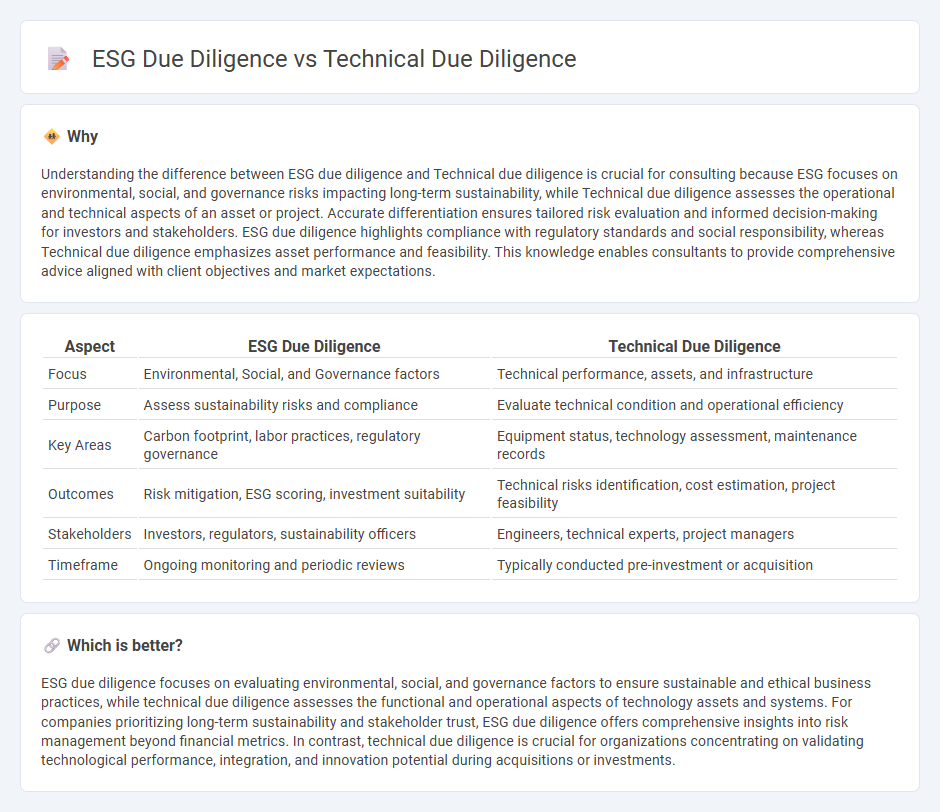

Understanding the difference between ESG due diligence and Technical due diligence is crucial for consulting because ESG focuses on environmental, social, and governance risks impacting long-term sustainability, while Technical due diligence assesses the operational and technical aspects of an asset or project. Accurate differentiation ensures tailored risk evaluation and informed decision-making for investors and stakeholders. ESG due diligence highlights compliance with regulatory standards and social responsibility, whereas Technical due diligence emphasizes asset performance and feasibility. This knowledge enables consultants to provide comprehensive advice aligned with client objectives and market expectations.

Comparison Table

| Aspect | ESG Due Diligence | Technical Due Diligence |

|---|---|---|

| Focus | Environmental, Social, and Governance factors | Technical performance, assets, and infrastructure |

| Purpose | Assess sustainability risks and compliance | Evaluate technical condition and operational efficiency |

| Key Areas | Carbon footprint, labor practices, regulatory governance | Equipment status, technology assessment, maintenance records |

| Outcomes | Risk mitigation, ESG scoring, investment suitability | Technical risks identification, cost estimation, project feasibility |

| Stakeholders | Investors, regulators, sustainability officers | Engineers, technical experts, project managers |

| Timeframe | Ongoing monitoring and periodic reviews | Typically conducted pre-investment or acquisition |

Which is better?

ESG due diligence focuses on evaluating environmental, social, and governance factors to ensure sustainable and ethical business practices, while technical due diligence assesses the functional and operational aspects of technology assets and systems. For companies prioritizing long-term sustainability and stakeholder trust, ESG due diligence offers comprehensive insights into risk management beyond financial metrics. In contrast, technical due diligence is crucial for organizations concentrating on validating technological performance, integration, and innovation potential during acquisitions or investments.

Connection

ESG due diligence and Technical due diligence are interconnected by evaluating a company's environmental, social, and governance risks alongside its technical infrastructure and operational capabilities. Technical due diligence assesses the integrity and functionality of physical assets, while ESG due diligence ensures these assets meet sustainability and regulatory standards. Integrating both analyses enables consulting firms to offer comprehensive risk management and long-term value creation strategies.

Key Terms

Risk Assessment

Technical due diligence evaluates potential project risks by examining engineering designs, system functionalities, and compliance with industry standards to ensure operational reliability. ESG due diligence assesses environmental, social, and governance risks, including carbon footprint, labor practices, and regulatory adherence, which may impact sustainability and long-term viability. Explore further to understand how integrating both approaches enhances comprehensive risk management.

Compliance

Technical due diligence assesses compliance with industry standards, safety regulations, and operational efficiencies to mitigate risks and ensure asset reliability. ESG due diligence evaluates adherence to environmental laws, social responsibility criteria, and governance frameworks, emphasizing sustainability and ethical practices. Explore how integrating both due diligence types can strengthen compliance and drive long-term value.

Value Creation

Technical due diligence assesses the operational, technological, and risk aspects of a business to ensure asset reliability and performance, directly impacting value creation by identifying efficiencies and potential liabilities. ESG due diligence evaluates environmental, social, and governance factors to mitigate sustainability risks and enhance long-term value, addressing regulatory compliance and stakeholder expectations. Explore how integrating both due diligence types drives comprehensive value creation strategies in investment decisions.

Source and External Links

What is Technical Due Diligence - CloudShare - Technical due diligence is a detailed assessment of a company's technical aspects performed before investment, merger, or IPO, covering software and hardware architecture, code quality, security, scalability, processes, and development strategy.

What is Technical Due Diligence (TDD)? - Snyk - The TDD process involves stages like code review, planning with stakeholders, and documentation/research to analyze the product's technical and business aspects comprehensively.

Technical Due Diligence: Meaning, Process, plus Checklist - Tech due diligence is an independent audit of product code quality and architecture involving preparation, detailed code review, documentation check, and identifying both strengths and weaknesses for prioritization.

dowidth.com

dowidth.com