Sustainability benchmarking evaluates a company's environmental, social, and governance (ESG) performance against industry standards to identify strengths and gaps. ESG reporting involves disclosing specific data on a company's sustainability practices and risks to stakeholders, often aligning with frameworks like GRI or SASB. Explore how integrating these approaches can enhance corporate transparency and drive meaningful improvements.

Why it is important

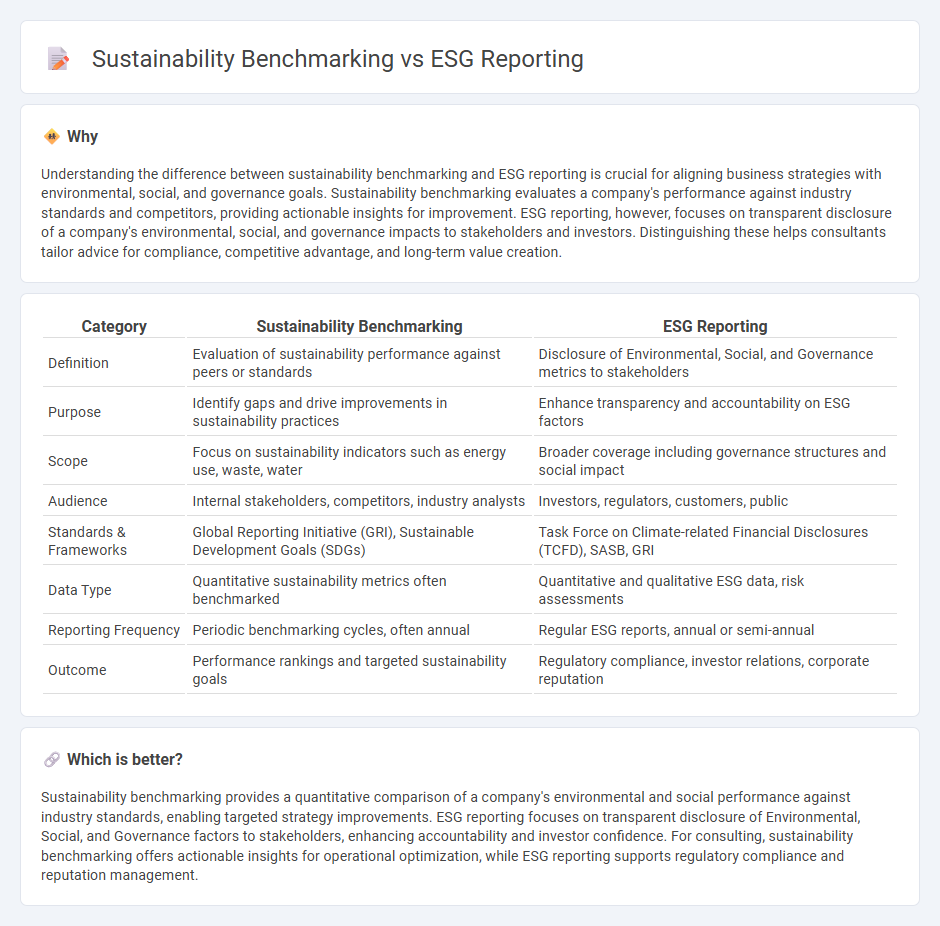

Understanding the difference between sustainability benchmarking and ESG reporting is crucial for aligning business strategies with environmental, social, and governance goals. Sustainability benchmarking evaluates a company's performance against industry standards and competitors, providing actionable insights for improvement. ESG reporting, however, focuses on transparent disclosure of a company's environmental, social, and governance impacts to stakeholders and investors. Distinguishing these helps consultants tailor advice for compliance, competitive advantage, and long-term value creation.

Comparison Table

| Category | Sustainability Benchmarking | ESG Reporting |

|---|---|---|

| Definition | Evaluation of sustainability performance against peers or standards | Disclosure of Environmental, Social, and Governance metrics to stakeholders |

| Purpose | Identify gaps and drive improvements in sustainability practices | Enhance transparency and accountability on ESG factors |

| Scope | Focus on sustainability indicators such as energy use, waste, water | Broader coverage including governance structures and social impact |

| Audience | Internal stakeholders, competitors, industry analysts | Investors, regulators, customers, public |

| Standards & Frameworks | Global Reporting Initiative (GRI), Sustainable Development Goals (SDGs) | Task Force on Climate-related Financial Disclosures (TCFD), SASB, GRI |

| Data Type | Quantitative sustainability metrics often benchmarked | Quantitative and qualitative ESG data, risk assessments |

| Reporting Frequency | Periodic benchmarking cycles, often annual | Regular ESG reports, annual or semi-annual |

| Outcome | Performance rankings and targeted sustainability goals | Regulatory compliance, investor relations, corporate reputation |

Which is better?

Sustainability benchmarking provides a quantitative comparison of a company's environmental and social performance against industry standards, enabling targeted strategy improvements. ESG reporting focuses on transparent disclosure of Environmental, Social, and Governance factors to stakeholders, enhancing accountability and investor confidence. For consulting, sustainability benchmarking offers actionable insights for operational optimization, while ESG reporting supports regulatory compliance and reputation management.

Connection

Sustainability benchmarking measures a company's environmental, social, and governance (ESG) performance against industry standards, providing critical data for transparent ESG reporting. ESG reporting relies on benchmarking insights to disclose measurable progress and areas for improvement, enhancing stakeholder trust and regulatory compliance. This interconnected process drives strategic decision-making and promotes sustainable business practices in consulting engagements.

Key Terms

Materiality Assessment

Materiality assessment is crucial in ESG reporting, identifying the most significant environmental, social, and governance factors that impact a company's long-term value and stakeholder interests. In sustainability benchmarking, materiality assessment helps compare a company's performance against industry standards by focusing on relevant and impactful sustainability metrics. Explore how integrating materiality assessment enhances strategic decision-making and reporting accuracy.

Performance Metrics

ESG reporting involves disclosing environmental, social, and governance data to stakeholders, emphasizing transparency and compliance with standards such as SASB or GRI. Sustainability benchmarking compares organizational performance metrics like carbon footprint, energy efficiency, and waste reduction against industry peers to identify strengths and improvement opportunities. Explore how integrating ESG reporting with sustainability benchmarking can optimize your company's performance metrics for enhanced strategic decision-making.

Disclosure Standards

ESG reporting centers on standardized disclosure frameworks such as GRI, SASB, and TCFD, ensuring transparent communication of environmental, social, and governance metrics to investors and stakeholders. Sustainability benchmarking evaluates organizational performance against industry-specific criteria or best practices, using metrics aligned with standards like CDP or ISS ESG to identify strengths and improvement areas. Explore our detailed analysis to understand how these approaches impact corporate transparency and strategic decision-making.

Source and External Links

ESG reporting: Your comprehensive guide for 2025 - This guide offers a structured approach to ESG reporting, emphasizing goal setting, materiality assessment, and stakeholder engagement to ensure accuracy and transparency in environmental, social, and governance performance reporting.

What is ESG reporting, and should you be doing it? - This resource explains the basics of ESG reporting, including its relevance, mandatory regulations like SECR and TCFD, and the benefits of implementing such reporting in a business context.

What Is ESG Reporting? - This overview provides an introduction to ESG reporting, highlighting its role in measuring a company's environmental, social, and governance initiatives against industry benchmarks and informing stakeholder decision-making.

dowidth.com

dowidth.com