No code implementation consulting focuses on enabling businesses to rapidly develop software applications without traditional coding, leveraging platforms like Bubble or Airtable to accelerate digital transformation and reduce development costs. M&A consulting specializes in guiding companies through mergers and acquisitions, providing expertise in valuation, due diligence, integration, and regulatory compliance to maximize transaction value and minimize risks. Discover how these distinct consulting services can strategically impact your organization's growth and operational efficiency.

Why it is important

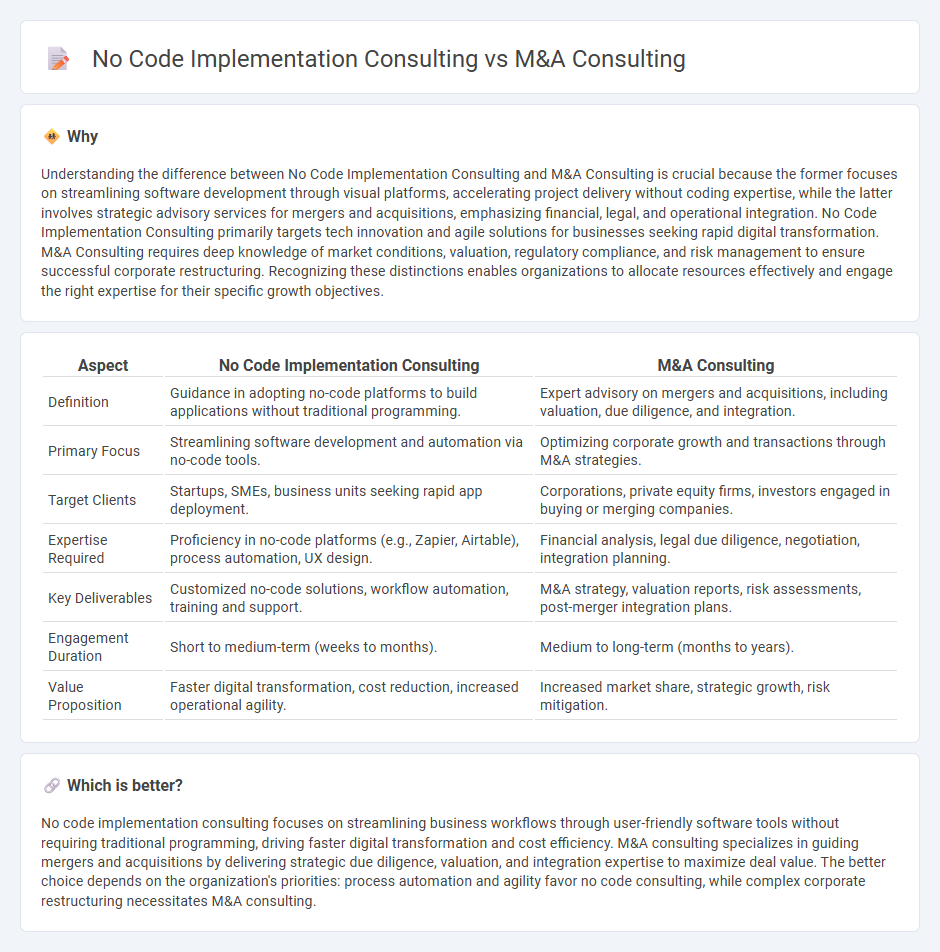

Understanding the difference between No Code Implementation Consulting and M&A Consulting is crucial because the former focuses on streamlining software development through visual platforms, accelerating project delivery without coding expertise, while the latter involves strategic advisory services for mergers and acquisitions, emphasizing financial, legal, and operational integration. No Code Implementation Consulting primarily targets tech innovation and agile solutions for businesses seeking rapid digital transformation. M&A Consulting requires deep knowledge of market conditions, valuation, regulatory compliance, and risk management to ensure successful corporate restructuring. Recognizing these distinctions enables organizations to allocate resources effectively and engage the right expertise for their specific growth objectives.

Comparison Table

| Aspect | No Code Implementation Consulting | M&A Consulting |

|---|---|---|

| Definition | Guidance in adopting no-code platforms to build applications without traditional programming. | Expert advisory on mergers and acquisitions, including valuation, due diligence, and integration. |

| Primary Focus | Streamlining software development and automation via no-code tools. | Optimizing corporate growth and transactions through M&A strategies. |

| Target Clients | Startups, SMEs, business units seeking rapid app deployment. | Corporations, private equity firms, investors engaged in buying or merging companies. |

| Expertise Required | Proficiency in no-code platforms (e.g., Zapier, Airtable), process automation, UX design. | Financial analysis, legal due diligence, negotiation, integration planning. |

| Key Deliverables | Customized no-code solutions, workflow automation, training and support. | M&A strategy, valuation reports, risk assessments, post-merger integration plans. |

| Engagement Duration | Short to medium-term (weeks to months). | Medium to long-term (months to years). |

| Value Proposition | Faster digital transformation, cost reduction, increased operational agility. | Increased market share, strategic growth, risk mitigation. |

Which is better?

No code implementation consulting focuses on streamlining business workflows through user-friendly software tools without requiring traditional programming, driving faster digital transformation and cost efficiency. M&A consulting specializes in guiding mergers and acquisitions by delivering strategic due diligence, valuation, and integration expertise to maximize deal value. The better choice depends on the organization's priorities: process automation and agility favor no code consulting, while complex corporate restructuring necessitates M&A consulting.

Connection

No-code implementation consulting accelerates digital transformation by enabling rapid application development without traditional coding, which aligns with M&A consulting's need for swift integration of disparate IT systems during mergers and acquisitions. Both consulting services focus on streamlining operational workflows, reducing costs, and enhancing agility in technology adoption. Leveraging no-code platforms in M&A scenarios minimizes integration risks and supports seamless data migration and process unification.

Key Terms

M&A Consulting:

M&A consulting specializes in guiding companies through mergers and acquisitions, focusing on due diligence, valuation, post-merger integration, and strategic alignment to maximize transaction value. This consulting type requires deep expertise in financial analysis, legal frameworks, and market dynamics to ensure successful deal execution and risk mitigation. Explore more about how M&A consulting can enhance your business growth and acquisition strategies.

Due Diligence

M&A consulting specializes in thorough due diligence by evaluating financial statements, legal contracts, and operational risks to ensure informed transaction decisions. No code implementation consulting focuses on assessing technical feasibility, integration risks, and workflow optimizations during due diligence to streamline software adoption and minimize implementation errors. Explore our detailed insights to understand how each consulting approach enhances the due diligence process.

Valuation

M&A consulting centers on comprehensive valuation techniques, employing financial modeling, due diligence, and market comparables to determine the fair value of target companies. No code implementation consulting focuses on assessing the cost-benefit and scalability value of no-code platforms, emphasizing efficiency gains and reduced development expenses. Explore how specialized valuation approaches in both domains can maximize strategic outcomes.

Source and External Links

The Ultimate Beginner's Guide to M&A Consulting - M&A consulting involves advising companies on strategic transactions such as mergers, acquisitions, divestitures, and joint ventures, assisting clients at various deal stages to maximize value and mitigate risks.

M&A (Mergers & Acquisitions) Strategy Consulting | BCG - BCG's M&A consultants help clients develop strategic, repeatable M&A processes, assess targets, validate synergies, and support end-to-end deal execution with a focus on value creation and risk avoidance.

M&A consulting - EY's M&A consulting services range from growth strategy and portfolio reshaping to due diligence, integration, restructuring, and leveraging AI and analytics for more valuable and aligned deals.

dowidth.com

dowidth.com