Acquihire strategy focuses on acquiring a company's talent and expertise rather than its products or market share, making it a valuable approach in consulting for rapidly expanding skilled teams. In contrast, mergers typically involve combining entire organizations to achieve greater market presence, operational synergies, and diversified service offerings. Explore more about how choosing between acquihire and mergers can strategically impact your consulting firm's growth and competitive advantage.

Why it is important

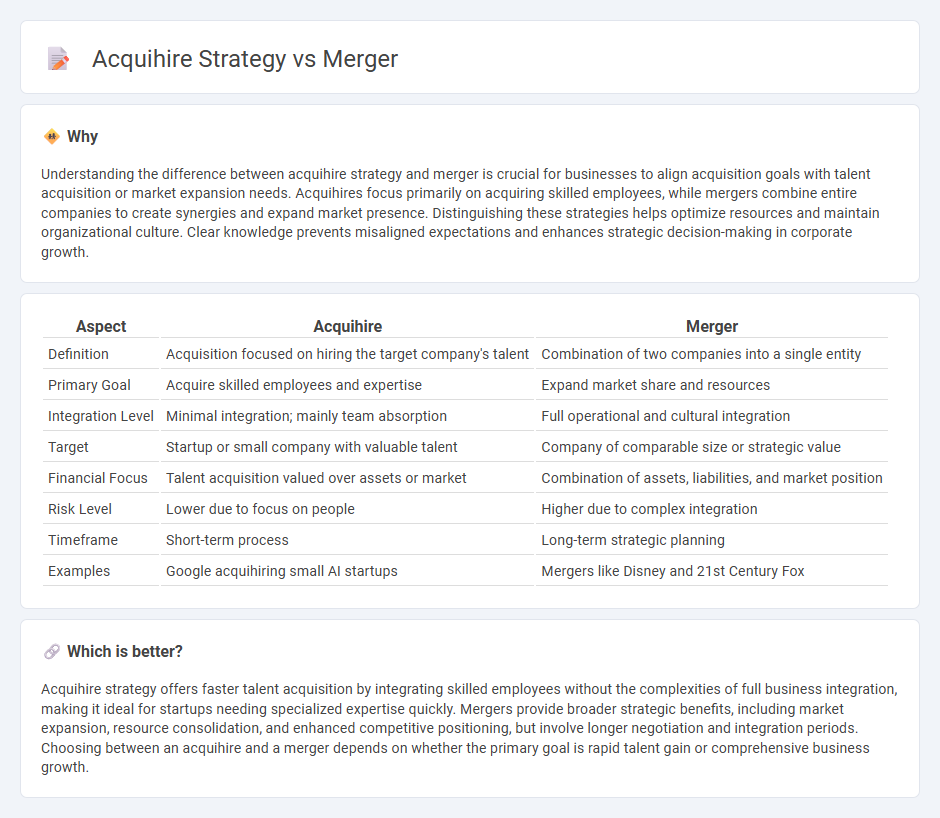

Understanding the difference between acquihire strategy and merger is crucial for businesses to align acquisition goals with talent acquisition or market expansion needs. Acquihires focus primarily on acquiring skilled employees, while mergers combine entire companies to create synergies and expand market presence. Distinguishing these strategies helps optimize resources and maintain organizational culture. Clear knowledge prevents misaligned expectations and enhances strategic decision-making in corporate growth.

Comparison Table

| Aspect | Acquihire | Merger |

|---|---|---|

| Definition | Acquisition focused on hiring the target company's talent | Combination of two companies into a single entity |

| Primary Goal | Acquire skilled employees and expertise | Expand market share and resources |

| Integration Level | Minimal integration; mainly team absorption | Full operational and cultural integration |

| Target | Startup or small company with valuable talent | Company of comparable size or strategic value |

| Financial Focus | Talent acquisition valued over assets or market | Combination of assets, liabilities, and market position |

| Risk Level | Lower due to focus on people | Higher due to complex integration |

| Timeframe | Short-term process | Long-term strategic planning |

| Examples | Google acquihiring small AI startups | Mergers like Disney and 21st Century Fox |

Which is better?

Acquihire strategy offers faster talent acquisition by integrating skilled employees without the complexities of full business integration, making it ideal for startups needing specialized expertise quickly. Mergers provide broader strategic benefits, including market expansion, resource consolidation, and enhanced competitive positioning, but involve longer negotiation and integration periods. Choosing between an acquihire and a merger depends on whether the primary goal is rapid talent gain or comprehensive business growth.

Connection

Acquihire strategy and mergers both aim to enhance a company's resources and capabilities, but acquihires focus specifically on acquiring skilled talent through company acquisition. In mergers, two companies combine operations and assets to achieve synergies, market expansion, or financial growth. The acquihire approach is often integrated into merger strategies to accelerate innovation and strengthen human capital within the merged entity.

Key Terms

Synergy

Merger strategies prioritize combining companies to achieve operational synergies such as cost reduction, expanded market reach, and enhanced innovation capabilities. Acquihire strategies focus primarily on acquiring talent to strengthen internal teams, often with less emphasis on integrating broader business operations. Explore detailed insights on how synergy shapes these strategic choices to optimize business growth.

Talent Acquisition

Merger strategies typically emphasize combining entire companies to achieve scale, market expansion, and operational synergies, whereas acquihire strategies focus specifically on acquiring talented teams or individuals to accelerate innovation and fill critical skill gaps. Acquihires are particularly valuable in competitive industries like tech, where access to specialized talent can drive product development and competitive advantage without the complexities of full mergers. Explore how organizations leverage these approaches to optimize talent acquisition and achieve strategic growth.

Integration

A merger strategy emphasizes the full integration of companies, combining resources, cultures, and operations to create synergies and streamline processes. An acquihire focuses primarily on integrating talent rather than businesses, often retaining teams while allowing the acquired firm's products and structure to remain separate. Explore detailed comparisons to understand which integration approach best fits your strategic goals.

Source and External Links

Merger - Overview, Types, Advantages and Disadvantages - A merger is a corporate strategy where two companies combine and operate as a single legal entity, often to increase market share and reduce competition, including types like horizontal, vertical, and conglomerate mergers.

What is a Merger? Definition, Types, and Examples - Mergers combine two independent companies into a new entity, often facilitated by investment bankers, and can be horizontal, vertical, or market extension types to reduce competition, expand markets, or streamline supply chains.

Mergers and acquisitions - A merger legally consolidates two businesses into one company as part of strategic management, differing from acquisitions where one company takes ownership over another, with regulatory oversight to prevent reduced competition or monopoly.

dowidth.com

dowidth.com