Operational due diligence focuses on assessing a company's internal processes, management effectiveness, and operational risks to ensure sustainable performance and value creation. Regulatory due diligence examines compliance with legal requirements, industry standards, and regulatory frameworks to mitigate legal risks and avoid penalties. Discover how integrating both approaches can optimize your investment strategy and safeguard your business.

Why it is important

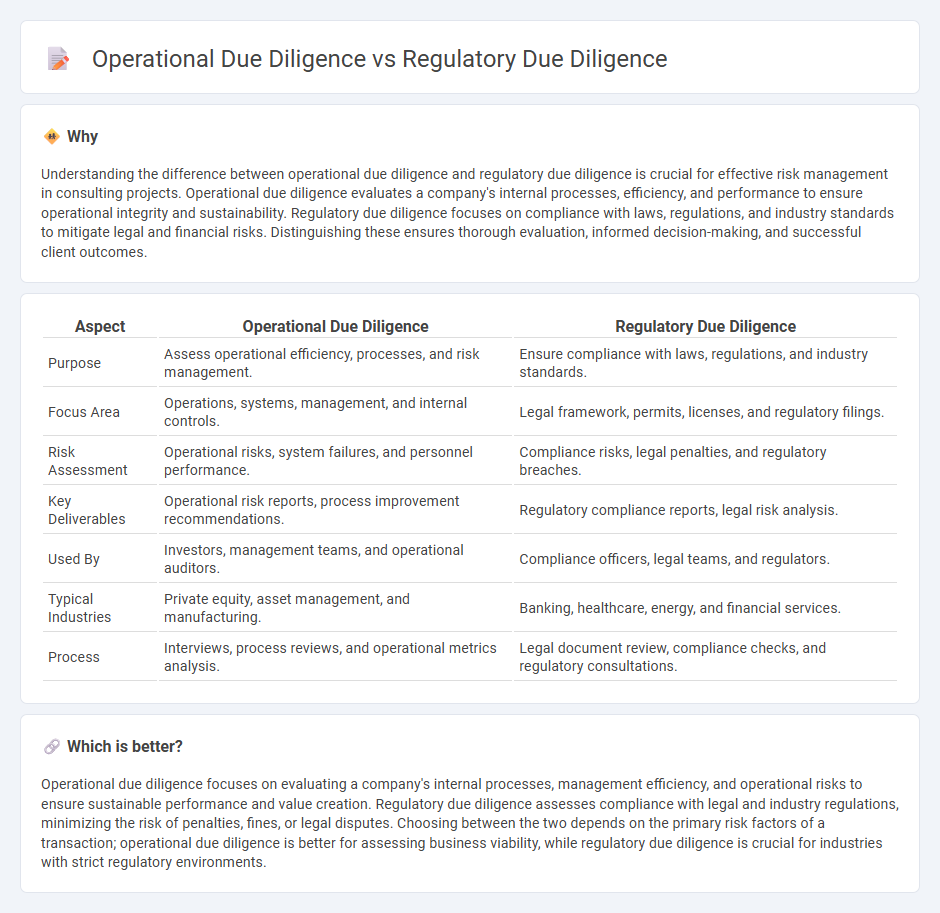

Understanding the difference between operational due diligence and regulatory due diligence is crucial for effective risk management in consulting projects. Operational due diligence evaluates a company's internal processes, efficiency, and performance to ensure operational integrity and sustainability. Regulatory due diligence focuses on compliance with laws, regulations, and industry standards to mitigate legal and financial risks. Distinguishing these ensures thorough evaluation, informed decision-making, and successful client outcomes.

Comparison Table

| Aspect | Operational Due Diligence | Regulatory Due Diligence |

|---|---|---|

| Purpose | Assess operational efficiency, processes, and risk management. | Ensure compliance with laws, regulations, and industry standards. |

| Focus Area | Operations, systems, management, and internal controls. | Legal framework, permits, licenses, and regulatory filings. |

| Risk Assessment | Operational risks, system failures, and personnel performance. | Compliance risks, legal penalties, and regulatory breaches. |

| Key Deliverables | Operational risk reports, process improvement recommendations. | Regulatory compliance reports, legal risk analysis. |

| Used By | Investors, management teams, and operational auditors. | Compliance officers, legal teams, and regulators. |

| Typical Industries | Private equity, asset management, and manufacturing. | Banking, healthcare, energy, and financial services. |

| Process | Interviews, process reviews, and operational metrics analysis. | Legal document review, compliance checks, and regulatory consultations. |

Which is better?

Operational due diligence focuses on evaluating a company's internal processes, management efficiency, and operational risks to ensure sustainable performance and value creation. Regulatory due diligence assesses compliance with legal and industry regulations, minimizing the risk of penalties, fines, or legal disputes. Choosing between the two depends on the primary risk factors of a transaction; operational due diligence is better for assessing business viability, while regulatory due diligence is crucial for industries with strict regulatory environments.

Connection

Operational due diligence evaluates a company's internal processes, systems, and team capabilities to identify risks and inefficiencies, while regulatory due diligence focuses on compliance with laws and industry regulations. Both are integral to consulting as they ensure that business operations align with legal standards and minimize compliance risks. Their connection lies in providing a comprehensive risk assessment that supports informed decision-making and sustainable growth strategies.

Key Terms

**Regulatory Due Diligence:**

Regulatory due diligence involves a comprehensive review of a company's compliance with laws, regulations, and industry standards, including environmental rules, licensing requirements, and data privacy laws. This process identifies potential legal risks, regulatory liabilities, and assesses adherence to sector-specific mandates such as financial regulations or healthcare compliance standards. Explore more to understand how regulatory due diligence safeguards investments and ensures long-term business viability.

Compliance

Regulatory due diligence centers on verifying adherence to laws, regulations, and industry standards to mitigate legal risks and ensure compliance frameworks are robust. Operational due diligence evaluates internal processes, policies, and controls to assess an organization's efficiency and operational risk exposure. Explore further to understand how compliance intersects across both due diligence types in various industries.

Licenses

Regulatory due diligence centers on verifying the presence, validity, and compliance of licenses with local, national, and international legal standards to ensure the target business operates within the required legal framework. Operational due diligence evaluates how effectively these licenses are managed and integrated into business processes to support ongoing operational efficiency and risk mitigation. Explore deeper insights into how license assessments impact investment decisions and operational success.

Source and External Links

Regulatory Due Diligence | LexisNexis Int - Regulatory due diligence is the comprehensive assessment of compliance status for your own organization and business partners, aimed at revealing issues, mitigating risk, understanding obligations, and verifying legitimacy to avoid legal and financial problems.

Regulatory Due Diligence - Critical for Healthcare Mergers and Acquisitions - It identifies compliance gaps in laws and regulations, recommends corrective actions to mitigate liability, and involves expert assessments including audits and monitoring to prevent future liabilities while increasing ROI.

Regulatory Due Diligence - Checklist & Best Practices - Regulatory due diligence evaluates business processes against federal rules during M&A, IPOs, or audits, focusing on areas like antitrust, data privacy, AML, and ESG compliance to reduce costs, improve procedures, and support continuous regulatory adherence.

dowidth.com

dowidth.com