Due diligence deep dive involves comprehensive analysis of financial, legal, and operational aspects to assess risks and validate assumptions before a transaction. An operational review focuses on evaluating internal processes, efficiency, and performance to identify improvement opportunities and optimize business operations. Explore further to understand which approach suits your strategic goals best.

Why it is important

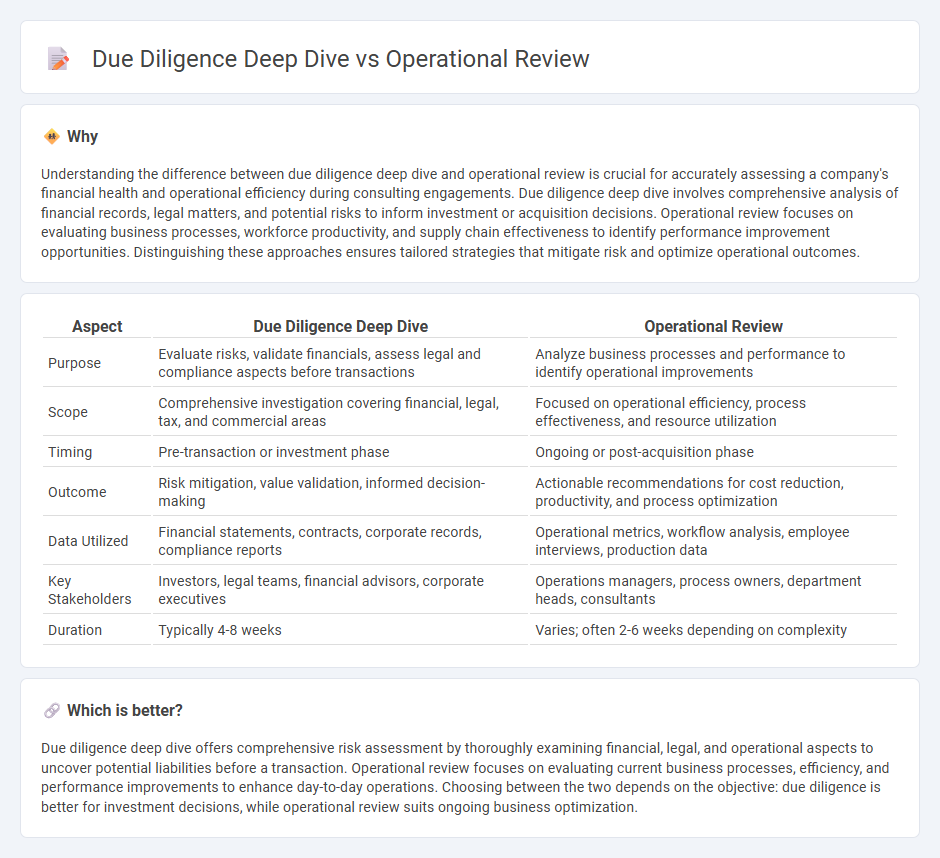

Understanding the difference between due diligence deep dive and operational review is crucial for accurately assessing a company's financial health and operational efficiency during consulting engagements. Due diligence deep dive involves comprehensive analysis of financial records, legal matters, and potential risks to inform investment or acquisition decisions. Operational review focuses on evaluating business processes, workforce productivity, and supply chain effectiveness to identify performance improvement opportunities. Distinguishing these approaches ensures tailored strategies that mitigate risk and optimize operational outcomes.

Comparison Table

| Aspect | Due Diligence Deep Dive | Operational Review |

|---|---|---|

| Purpose | Evaluate risks, validate financials, assess legal and compliance aspects before transactions | Analyze business processes and performance to identify operational improvements |

| Scope | Comprehensive investigation covering financial, legal, tax, and commercial areas | Focused on operational efficiency, process effectiveness, and resource utilization |

| Timing | Pre-transaction or investment phase | Ongoing or post-acquisition phase |

| Outcome | Risk mitigation, value validation, informed decision-making | Actionable recommendations for cost reduction, productivity, and process optimization |

| Data Utilized | Financial statements, contracts, corporate records, compliance reports | Operational metrics, workflow analysis, employee interviews, production data |

| Key Stakeholders | Investors, legal teams, financial advisors, corporate executives | Operations managers, process owners, department heads, consultants |

| Duration | Typically 4-8 weeks | Varies; often 2-6 weeks depending on complexity |

Which is better?

Due diligence deep dive offers comprehensive risk assessment by thoroughly examining financial, legal, and operational aspects to uncover potential liabilities before a transaction. Operational review focuses on evaluating current business processes, efficiency, and performance improvements to enhance day-to-day operations. Choosing between the two depends on the objective: due diligence is better for investment decisions, while operational review suits ongoing business optimization.

Connection

Due diligence deep dive and operational review are interconnected processes that evaluate a company's internal functions and risks before transactions or investments. Due diligence deep dive focuses on a comprehensive assessment of financial, legal, and operational data to identify potential liabilities and growth opportunities. Operational review complements this by analyzing day-to-day business performance, efficiency, and management practices to optimize strategies and enhance value.

Key Terms

Process Optimization

Operational reviews evaluate existing processes to identify inefficiencies and areas for immediate improvement, emphasizing cost reduction and productivity enhancement within current operations. Due diligence deep dives thoroughly assess process workflows, compliance, and scalability potential during mergers, acquisitions, or investments, aiming to uncover hidden risks and validate operational assumptions. Explore our comprehensive insights to understand how process optimization techniques differ in these critical business evaluations.

Risk Assessment

Operational review focuses on evaluating internal processes and controls to identify potential risks that could disrupt business operations. Due diligence deep dive involves a comprehensive analysis of financial, legal, and operational risks to support informed decision-making during mergers and acquisitions. Explore the nuances of these risk assessment approaches to enhance your strategic risk management.

Performance Metrics

Operational review analyzes key performance metrics such as productivity, cost efficiency, and operational bottlenecks to assess current business health, while due diligence deep dive evaluates these metrics within a broader context of financial, legal, and market risks to guide investment decisions. Performance metrics in operational reviews emphasize internal process optimization, whereas due diligence incorporates these metrics to validate assumptions about future profitability and sustainability. Explore in-depth comparisons to understand how each approach impacts decision-making effectiveness.

Source and External Links

How to carry out an Operational Review - Denizon - An operational review process typically involves six steps including preparatory work, interviews, document collection, and presenting the final report, customized to the organization's specific needs and objectives.

What are Operational Reviews - Denizon - Workforce Management - An operational review is an in-depth, objective evaluation of an organization or its segment to assess compliance, identify problems, evaluate effectiveness, and find opportunities to improve profitability and efficiency.

What is an Operation Review and why you need it? - An Operational Review identifies flaws and risks in operational practices through a third-party assessment, providing feedback and recommendations to improve safety and risk management, required at least every five years by some industry standards.

dowidth.com

dowidth.com