Zero-based budgeting requires every expense to be justified from scratch, promoting cost-efficiency and resource allocation aligned with current business priorities. Flexible budgeting adjusts expenses based on actual activity levels, providing adaptability and more accurate financial control during fluctuating operational conditions. Discover how choosing between zero-based and flexible budgeting can optimize your organization's financial strategy.

Why it is important

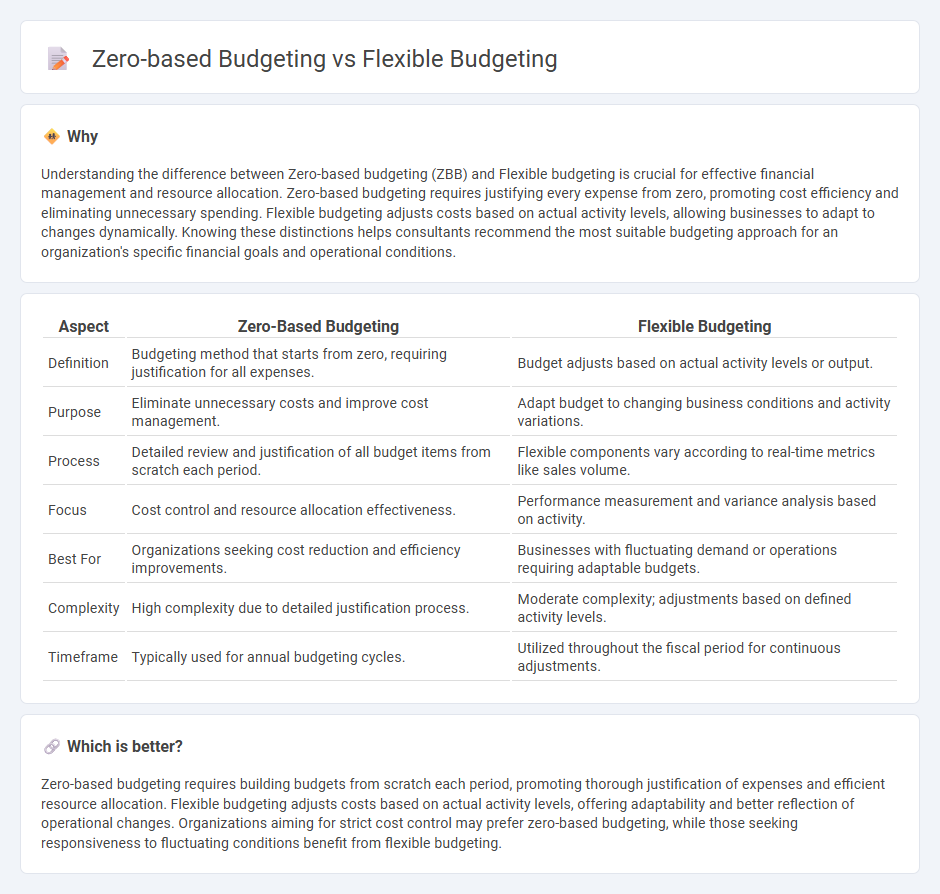

Understanding the difference between Zero-based budgeting (ZBB) and Flexible budgeting is crucial for effective financial management and resource allocation. Zero-based budgeting requires justifying every expense from zero, promoting cost efficiency and eliminating unnecessary spending. Flexible budgeting adjusts costs based on actual activity levels, allowing businesses to adapt to changes dynamically. Knowing these distinctions helps consultants recommend the most suitable budgeting approach for an organization's specific financial goals and operational conditions.

Comparison Table

| Aspect | Zero-Based Budgeting | Flexible Budgeting |

|---|---|---|

| Definition | Budgeting method that starts from zero, requiring justification for all expenses. | Budget adjusts based on actual activity levels or output. |

| Purpose | Eliminate unnecessary costs and improve cost management. | Adapt budget to changing business conditions and activity variations. |

| Process | Detailed review and justification of all budget items from scratch each period. | Flexible components vary according to real-time metrics like sales volume. |

| Focus | Cost control and resource allocation effectiveness. | Performance measurement and variance analysis based on activity. |

| Best For | Organizations seeking cost reduction and efficiency improvements. | Businesses with fluctuating demand or operations requiring adaptable budgets. |

| Complexity | High complexity due to detailed justification process. | Moderate complexity; adjustments based on defined activity levels. |

| Timeframe | Typically used for annual budgeting cycles. | Utilized throughout the fiscal period for continuous adjustments. |

Which is better?

Zero-based budgeting requires building budgets from scratch each period, promoting thorough justification of expenses and efficient resource allocation. Flexible budgeting adjusts costs based on actual activity levels, offering adaptability and better reflection of operational changes. Organizations aiming for strict cost control may prefer zero-based budgeting, while those seeking responsiveness to fluctuating conditions benefit from flexible budgeting.

Connection

Zero-based budgeting and flexible budgeting both prioritize efficient resource allocation by adjusting financial plans according to actual needs and performance metrics. Zero-based budgeting requires justifying every expense from a zero base, promoting cost control and eliminating redundancies, while flexible budgeting adapts budgetary allocations based on varying levels of activity or workload. Integrating these approaches enables organizations to maintain fiscal discipline while dynamically responding to operational changes and financial uncertainties.

Key Terms

Cost Control

Flexible budgeting adjusts expenses based on actual activity levels, allowing dynamic cost control aligned with operational changes. Zero-based budgeting requires justifying all expenses from scratch, promoting rigorous cost management by eliminating unnecessary spending. Explore detailed strategies to optimize your cost control through flexible and zero-based budgeting approaches.

Resource Allocation

Flexible budgeting adapts resource allocation based on actual activity levels, allowing for dynamic adjustments that align expenses with operational needs. Zero-based budgeting requires each expense to be justified from scratch, promoting efficient resource use by eliminating unnecessary costs. Discover more insights on optimizing resource allocation through these budgeting methods.

Baseline Assumptions

Flexible budgeting adjusts expenditure estimates based on actual activity levels, ensuring budget responsiveness to operational fluctuations, while zero-based budgeting starts from a zero base, requiring justification for all costs, promoting cost-efficiency and strategic allocation. The baseline assumption in flexible budgeting presumes variable costs will change with volume, whereas zero-based budgeting assumes no prior expenses are justified without analysis. Explore detailed methodologies and applications to optimize your budgeting strategy.

Source and External Links

How To Use a Flexible Budget (2025) - Shopify - A flexible budget adjusts spending based on actual business activity, typically tying variable costs to changes in revenue, allowing companies to scale expenses up or down in response to real-time sales performance.

What Is Flexible Budgeting? - Vena Solutions - Flexible budgeting is a financial planning method that dynamically adjusts expense and revenue projections according to actual business performance, making it ideal for organizations facing unpredictable or seasonal activity.

Flexible budget definition - AccountingTools - A flexible budget is recalculated using actual revenue or activity levels after each accounting period, providing a tailored comparison to actual expenses that yields more relevant and actionable budget variances than static budgets.

dowidth.com

dowidth.com