Innovation audits analyze a company's capacity for creativity, product development, and market adaptability, focusing on idea generation and implementation effectiveness. Financial health assessments evaluate liquidity, solvency, profitability, and cash flow stability to determine overall fiscal sustainability and risk exposure. Explore these essential diagnostic tools to enhance strategic decision-making and business growth.

Why it is important

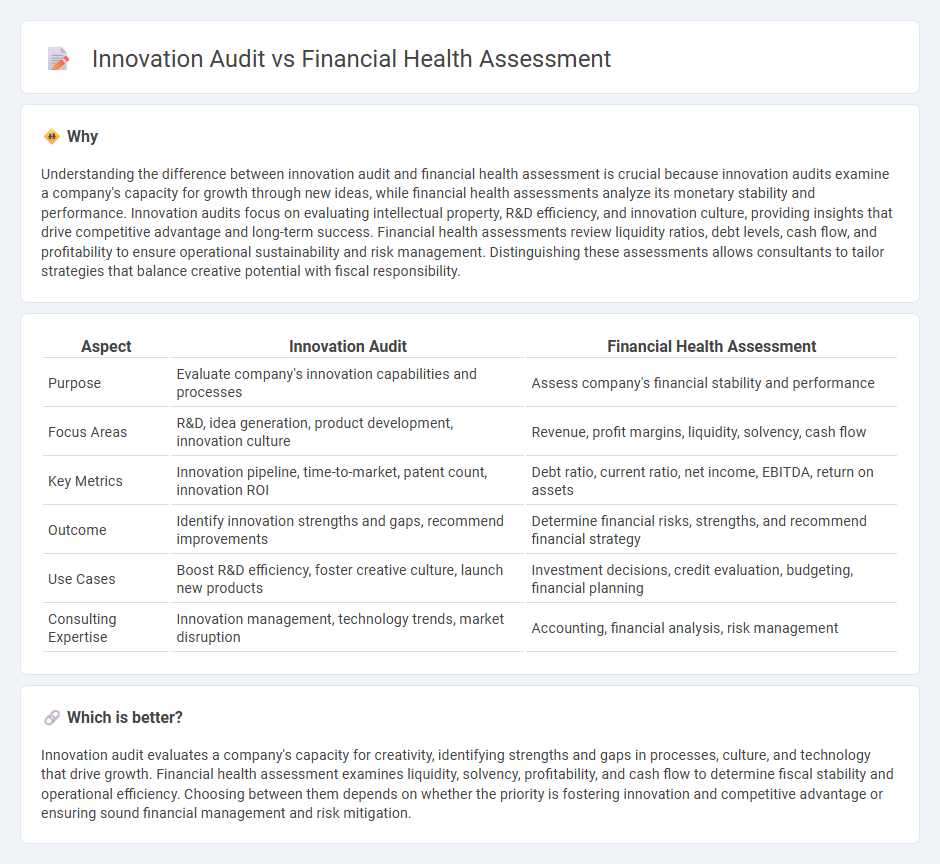

Understanding the difference between innovation audit and financial health assessment is crucial because innovation audits examine a company's capacity for growth through new ideas, while financial health assessments analyze its monetary stability and performance. Innovation audits focus on evaluating intellectual property, R&D efficiency, and innovation culture, providing insights that drive competitive advantage and long-term success. Financial health assessments review liquidity ratios, debt levels, cash flow, and profitability to ensure operational sustainability and risk management. Distinguishing these assessments allows consultants to tailor strategies that balance creative potential with fiscal responsibility.

Comparison Table

| Aspect | Innovation Audit | Financial Health Assessment |

|---|---|---|

| Purpose | Evaluate company's innovation capabilities and processes | Assess company's financial stability and performance |

| Focus Areas | R&D, idea generation, product development, innovation culture | Revenue, profit margins, liquidity, solvency, cash flow |

| Key Metrics | Innovation pipeline, time-to-market, patent count, innovation ROI | Debt ratio, current ratio, net income, EBITDA, return on assets |

| Outcome | Identify innovation strengths and gaps, recommend improvements | Determine financial risks, strengths, and recommend financial strategy |

| Use Cases | Boost R&D efficiency, foster creative culture, launch new products | Investment decisions, credit evaluation, budgeting, financial planning |

| Consulting Expertise | Innovation management, technology trends, market disruption | Accounting, financial analysis, risk management |

Which is better?

Innovation audit evaluates a company's capacity for creativity, identifying strengths and gaps in processes, culture, and technology that drive growth. Financial health assessment examines liquidity, solvency, profitability, and cash flow to determine fiscal stability and operational efficiency. Choosing between them depends on whether the priority is fostering innovation and competitive advantage or ensuring sound financial management and risk mitigation.

Connection

Innovation audit evaluates a company's capacity to generate and implement new ideas, directly impacting strategic growth and competitive advantage. Financial health assessment measures a firm's economic stability, liquidity, and profitability, which determine the resources available to support innovation initiatives. Together, these evaluations provide a comprehensive view of an organization's ability to fund, sustain, and benefit from innovative activities, ensuring long-term success.

Key Terms

**Financial Health Assessment:**

Financial Health Assessment evaluates a company's liquidity, solvency, profitability, and operational efficiency through quantitative metrics like current ratio, debt-to-equity ratio, and return on assets. This process identifies financial risks, cash flow stability, and overall fiscal sustainability critical for strategic planning and investor confidence. Explore detailed methodologies and key performance indicators to enhance your financial oversight and business resilience.

Liquidity Ratios

Liquidity ratios are critical financial health assessment tools that measure a company's ability to cover short-term obligations using its most liquid assets, including the current ratio, quick ratio, and cash ratio. Innovation audits, while primarily focused on evaluating a firm's innovation capabilities, may incorporate liquidity ratios to understand if financial fluidity supports ongoing research and development activities. Explore how integrating liquidity ratios in financial and innovation evaluations enhances strategic decision-making and business growth.

Debt-to-Equity

Debt-to-equity ratio serves as a critical metric in financial health assessments, revealing a company's leverage and risk level by comparing total liabilities to shareholders' equity. In innovation audits, this ratio helps evaluate whether funding for R&D and new initiatives is sustainably sourced or overly reliant on debt, impacting long-term growth potential. Explore further to understand how balancing debt and equity influences both financial stability and innovation capacity.

Source and External Links

Financial Health - NerdWallet - Financial health is measured by your ability to manage financial stressors and achieve long-term goals, focusing on savings, debt paydown, debt-to-income ratio, credit score, emergency funds, insurance, and financial planning.

Financial health check: Evaluate your financial health - Ameriprise - A thorough financial health assessment involves defining goals, organizing financial records, calculating net worth, and determining debt-to-income ratio to strategize for short-, medium-, and long-term financial success.

FinHealth Score(r) Toolkit - Financial Health Network - The FinHealth Score toolkit assesses financial health by scoring individual behaviors in spending, saving, borrowing, and planning, classifying individuals as Financially Healthy, Coping, or Vulnerable to guide improvements.

dowidth.com

dowidth.com