Regenerative business models focus on restoring natural systems and creating positive environmental impact while generating sustainable profits, integrating circular economy principles and social equity. Impact investing directs capital towards companies and projects that deliver measurable social and environmental benefits alongside financial returns, targeting sectors like renewable energy and affordable housing. Explore in-depth insights on how these approaches are transforming sustainable finance and corporate responsibility.

Why it is important

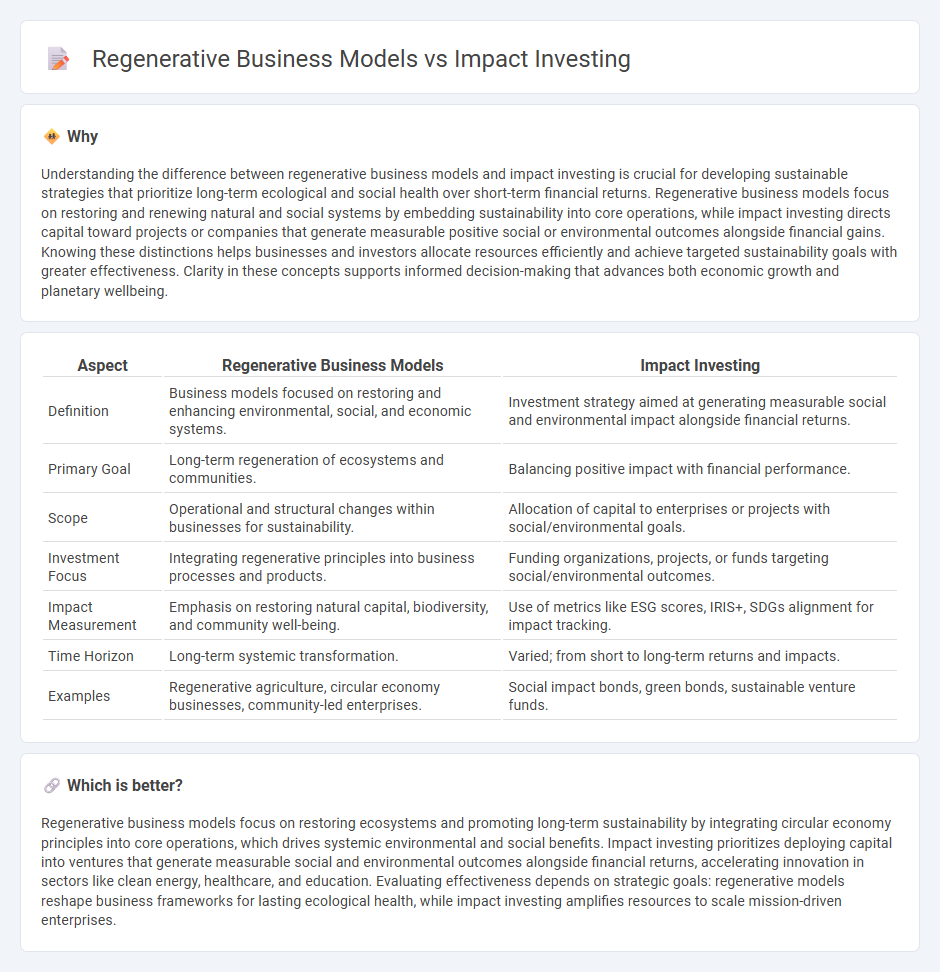

Understanding the difference between regenerative business models and impact investing is crucial for developing sustainable strategies that prioritize long-term ecological and social health over short-term financial returns. Regenerative business models focus on restoring and renewing natural and social systems by embedding sustainability into core operations, while impact investing directs capital toward projects or companies that generate measurable positive social or environmental outcomes alongside financial gains. Knowing these distinctions helps businesses and investors allocate resources efficiently and achieve targeted sustainability goals with greater effectiveness. Clarity in these concepts supports informed decision-making that advances both economic growth and planetary wellbeing.

Comparison Table

| Aspect | Regenerative Business Models | Impact Investing |

|---|---|---|

| Definition | Business models focused on restoring and enhancing environmental, social, and economic systems. | Investment strategy aimed at generating measurable social and environmental impact alongside financial returns. |

| Primary Goal | Long-term regeneration of ecosystems and communities. | Balancing positive impact with financial performance. |

| Scope | Operational and structural changes within businesses for sustainability. | Allocation of capital to enterprises or projects with social/environmental goals. |

| Investment Focus | Integrating regenerative principles into business processes and products. | Funding organizations, projects, or funds targeting social/environmental outcomes. |

| Impact Measurement | Emphasis on restoring natural capital, biodiversity, and community well-being. | Use of metrics like ESG scores, IRIS+, SDGs alignment for impact tracking. |

| Time Horizon | Long-term systemic transformation. | Varied; from short to long-term returns and impacts. |

| Examples | Regenerative agriculture, circular economy businesses, community-led enterprises. | Social impact bonds, green bonds, sustainable venture funds. |

Which is better?

Regenerative business models focus on restoring ecosystems and promoting long-term sustainability by integrating circular economy principles into core operations, which drives systemic environmental and social benefits. Impact investing prioritizes deploying capital into ventures that generate measurable social and environmental outcomes alongside financial returns, accelerating innovation in sectors like clean energy, healthcare, and education. Evaluating effectiveness depends on strategic goals: regenerative models reshape business frameworks for lasting ecological health, while impact investing amplifies resources to scale mission-driven enterprises.

Connection

Regenerative business models prioritize restoring and enhancing natural and social systems, aligning closely with impact investing, which directs capital towards ventures generating measurable environmental and social benefits. Both approaches emphasize long-term sustainability, resilience, and positive stakeholder value. This synergy drives transformative change by integrating profit with purpose in investment and business strategies.

Key Terms

Social Return on Investment (SROI)

Impact investing targets measurable social and environmental outcomes with quantifiable Social Return on Investment (SROI), using metrics to evaluate the effectiveness of capital deployment. Regenerative business models emphasize restoring and enhancing ecosystems and communities, embedding sustainability into core operations rather than solely seeking financial return. Explore how integrating SROI frameworks can optimize both impact investing strategies and regenerative business practices for scalable social benefits.

Systems Thinking

Impact investing prioritizes measurable social and environmental returns alongside financial profit, integrating Systems Thinking to address interconnected global challenges. Regenerative business models go further by restoring and enhancing natural systems, promoting circular economy principles and resilience through holistic design. Explore how combining impact investing with regenerative approaches advances sustainable transformation at scale.

Stakeholder Value Creation

Impact investing channels capital into enterprises that generate measurable social and environmental benefits alongside financial returns, emphasizing accountability and measurable outcomes. Regenerative business models prioritize restoring ecosystems and enhancing community well-being through sustainable practices that reintegrate and renew resources over time. Explore how combining these approaches can amplify stakeholder value creation by fostering long-term ecological and economic resilience.

Source and External Links

What you need to know about impact investing - Impact investing involves making investments with the intention to generate positive, measurable social or environmental impact alongside a financial return, across sectors such as energy, healthcare, and sustainable agriculture.

What is Impact Investing? | Fidelity - Impact investing aligns investment capital with personal and philanthropic values to achieve both social/environmental benefits and financial returns, with growing popularity especially among Millennials and institutional investors.

Impact Investing | UNDP Policy Centre - Impact investing supports sustainable development by deploying funds to generate measurable social or environmental benefits alongside financial returns, with platforms like the Global Islamic Finance and Impact Investing Platform promoting inclusive financial systems worldwide.

dowidth.com

dowidth.com