Stakeholder capitalism advisory focuses on helping organizations align their business strategies with the interests of key stakeholders, including employees, customers, communities, and investors. Integrated reporting consulting emphasizes the creation of unified financial and non-financial reports that highlight an organization's value creation over time by linking strategy, governance, performance, and prospects. Explore how these consulting services can drive sustainable growth and transparency in your organization.

Why it is important

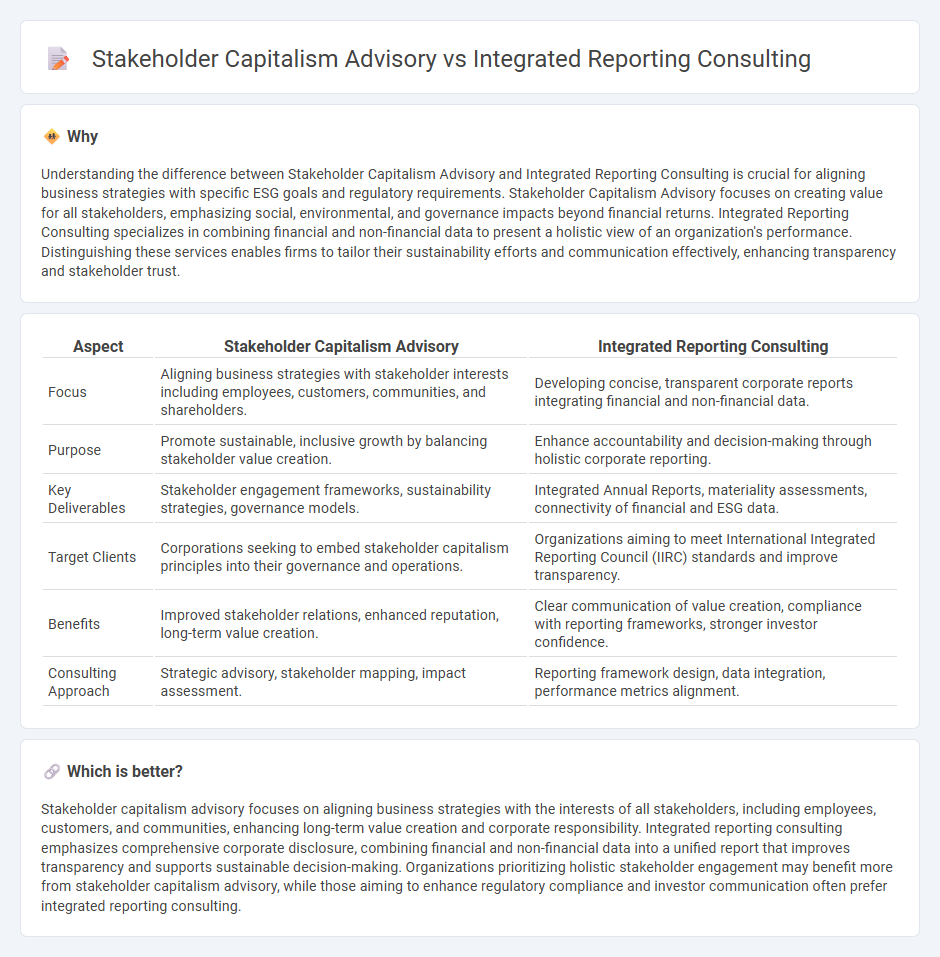

Understanding the difference between Stakeholder Capitalism Advisory and Integrated Reporting Consulting is crucial for aligning business strategies with specific ESG goals and regulatory requirements. Stakeholder Capitalism Advisory focuses on creating value for all stakeholders, emphasizing social, environmental, and governance impacts beyond financial returns. Integrated Reporting Consulting specializes in combining financial and non-financial data to present a holistic view of an organization's performance. Distinguishing these services enables firms to tailor their sustainability efforts and communication effectively, enhancing transparency and stakeholder trust.

Comparison Table

| Aspect | Stakeholder Capitalism Advisory | Integrated Reporting Consulting |

|---|---|---|

| Focus | Aligning business strategies with stakeholder interests including employees, customers, communities, and shareholders. | Developing concise, transparent corporate reports integrating financial and non-financial data. |

| Purpose | Promote sustainable, inclusive growth by balancing stakeholder value creation. | Enhance accountability and decision-making through holistic corporate reporting. |

| Key Deliverables | Stakeholder engagement frameworks, sustainability strategies, governance models. | Integrated Annual Reports, materiality assessments, connectivity of financial and ESG data. |

| Target Clients | Corporations seeking to embed stakeholder capitalism principles into their governance and operations. | Organizations aiming to meet International Integrated Reporting Council (IIRC) standards and improve transparency. |

| Benefits | Improved stakeholder relations, enhanced reputation, long-term value creation. | Clear communication of value creation, compliance with reporting frameworks, stronger investor confidence. |

| Consulting Approach | Strategic advisory, stakeholder mapping, impact assessment. | Reporting framework design, data integration, performance metrics alignment. |

Which is better?

Stakeholder capitalism advisory focuses on aligning business strategies with the interests of all stakeholders, including employees, customers, and communities, enhancing long-term value creation and corporate responsibility. Integrated reporting consulting emphasizes comprehensive corporate disclosure, combining financial and non-financial data into a unified report that improves transparency and supports sustainable decision-making. Organizations prioritizing holistic stakeholder engagement may benefit more from stakeholder capitalism advisory, while those aiming to enhance regulatory compliance and investor communication often prefer integrated reporting consulting.

Connection

Stakeholder capitalism advisory focuses on aligning business strategies with the values and interests of all stakeholders, including employees, customers, and communities. Integrated reporting consulting supports this approach by providing comprehensive frameworks that combine financial and non-financial data, enhancing transparency and accountability. Together, they drive sustainable business practices and improve stakeholder trust through holistic performance communication.

Key Terms

**Integrated reporting consulting:**

Integrated reporting consulting enhances corporate transparency by combining financial data with environmental, social, and governance (ESG) metrics to provide a holistic view of organizational performance. This approach supports compliance with global frameworks such as the International Integrated Reporting Council (IIRC) and helps companies attract sustainable investments. Discover how integrated reporting consulting can transform your corporate disclosures and drive long-term value creation.

Value creation

Integrated reporting consulting emphasizes transparent disclosure of financial, environmental, social, and governance (ESG) metrics to showcase how organizations create short-term and long-term value. Stakeholder capitalism advisory prioritizes aligning business strategies with the interests of employees, customers, suppliers, communities, and shareholders to foster sustainable value creation across multiple dimensions. Discover how each approach drives comprehensive value creation frameworks tailored to evolving corporate responsibilities.

Materiality assessment

Integrated reporting consulting emphasizes comprehensive materiality assessments to identify and disclose financially material information aligning with the International Integrated Reporting Framework. Stakeholder capitalism advisory prioritizes broader stakeholder materiality, evaluating environmental, social, and governance (ESG) risks and opportunities influencing long-term value creation for diverse stakeholders. Explore our expert services to understand how materiality assessments enhance transparent and strategic business communication.

Source and External Links

Integrated Reporting Consulting and Training - Mike Krzus - Mike Krzus offers a hybrid consulting-training program that helps corporate teams create prototype integrated reports and support full integrated reporting implementation to address risks, societal expectations, and innovation.

Integrated Reporting: An Urgent Need And Opportunity For ... - Deloitte - Deloitte provides integrated reporting consulting by assessing corporate reporting maturity and delivering expert guidance involving finance, sustainability, risk, and communications to help organizations implement integrated reporting effectively.

Integrated Reporting - PwC - PwC supports companies in adopting integrated thinking and reporting by focusing on holistic strategies that connect financial, environmental, social, and governance factors, helping organizations communicate value creation over short, medium, and long terms.

dowidth.com

dowidth.com