Greenwashing risk assessment consulting focuses on identifying and mitigating false or misleading environmental claims to protect brand integrity and ensure regulatory compliance. ESG reporting consulting helps organizations accurately measure and disclose their environmental, social, and governance performance to meet investor and stakeholder demands. Explore how specialized consulting services can enhance transparency and credibility in sustainability efforts.

Why it is important

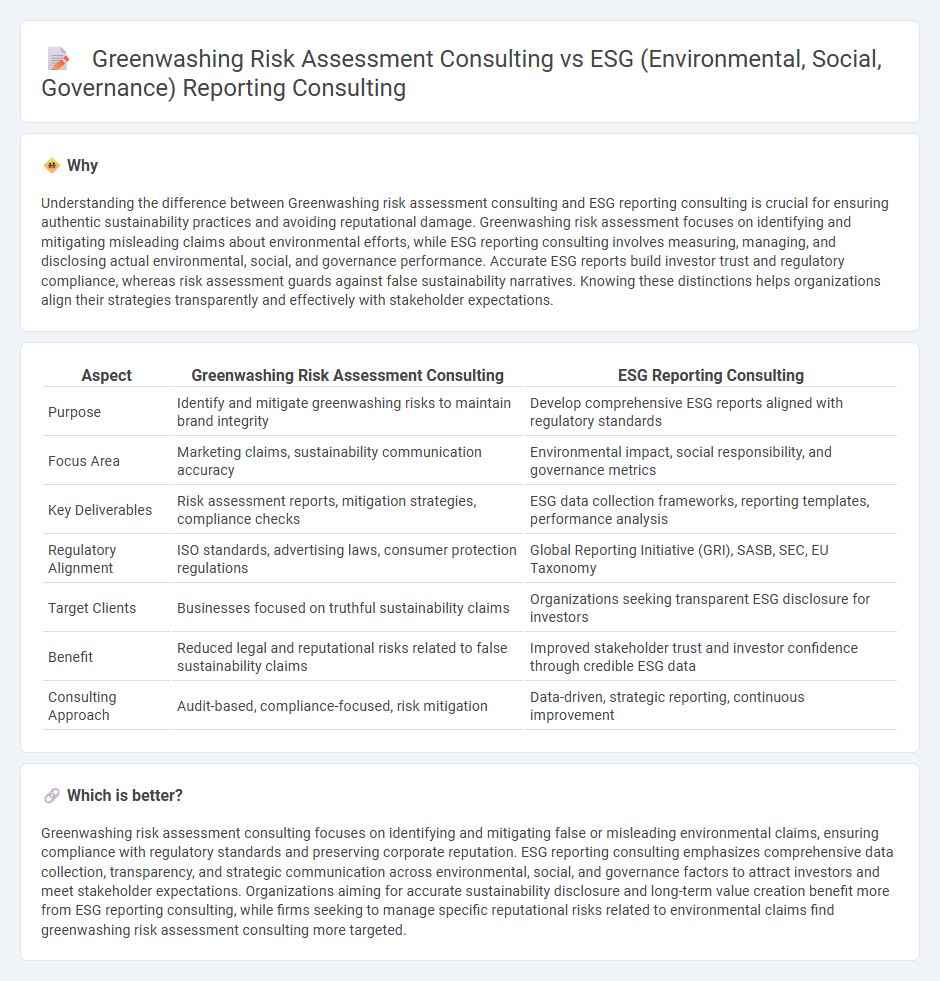

Understanding the difference between Greenwashing risk assessment consulting and ESG reporting consulting is crucial for ensuring authentic sustainability practices and avoiding reputational damage. Greenwashing risk assessment focuses on identifying and mitigating misleading claims about environmental efforts, while ESG reporting consulting involves measuring, managing, and disclosing actual environmental, social, and governance performance. Accurate ESG reports build investor trust and regulatory compliance, whereas risk assessment guards against false sustainability narratives. Knowing these distinctions helps organizations align their strategies transparently and effectively with stakeholder expectations.

Comparison Table

| Aspect | Greenwashing Risk Assessment Consulting | ESG Reporting Consulting |

|---|---|---|

| Purpose | Identify and mitigate greenwashing risks to maintain brand integrity | Develop comprehensive ESG reports aligned with regulatory standards |

| Focus Area | Marketing claims, sustainability communication accuracy | Environmental impact, social responsibility, and governance metrics |

| Key Deliverables | Risk assessment reports, mitigation strategies, compliance checks | ESG data collection frameworks, reporting templates, performance analysis |

| Regulatory Alignment | ISO standards, advertising laws, consumer protection regulations | Global Reporting Initiative (GRI), SASB, SEC, EU Taxonomy |

| Target Clients | Businesses focused on truthful sustainability claims | Organizations seeking transparent ESG disclosure for investors |

| Benefit | Reduced legal and reputational risks related to false sustainability claims | Improved stakeholder trust and investor confidence through credible ESG data |

| Consulting Approach | Audit-based, compliance-focused, risk mitigation | Data-driven, strategic reporting, continuous improvement |

Which is better?

Greenwashing risk assessment consulting focuses on identifying and mitigating false or misleading environmental claims, ensuring compliance with regulatory standards and preserving corporate reputation. ESG reporting consulting emphasizes comprehensive data collection, transparency, and strategic communication across environmental, social, and governance factors to attract investors and meet stakeholder expectations. Organizations aiming for accurate sustainability disclosure and long-term value creation benefit more from ESG reporting consulting, while firms seeking to manage specific reputational risks related to environmental claims find greenwashing risk assessment consulting more targeted.

Connection

Greenwashing risk assessment consulting plays a crucial role in ensuring the accuracy and transparency of ESG reporting by identifying misleading claims and promoting genuine sustainability practices. ESG reporting consulting integrates these risk assessments to help organizations deliver credible environmental, social, and governance disclosures aligned with regulatory standards. This connection strengthens corporate accountability and investor confidence in sustainability initiatives.

Key Terms

**ESG Reporting Consulting:**

ESG reporting consulting helps organizations accurately measure, disclose, and enhance their environmental, social, and governance performance through verified, transparent data frameworks like GRI, SASB, and TCFD. This type of consulting supports regulatory compliance, investor engagement, and improved corporate reputation by ensuring sustainability claims are substantiated with credible metrics. Discover how expert ESG reporting consulting can drive authentic sustainability progress and mitigate reputational risks.

Materiality Assessment

ESG reporting consulting emphasizes transparent disclosure of a company's environmental, social, and governance impacts, focusing on comprehensive Materiality Assessment to identify and prioritize relevant sustainability issues that influence stakeholder decisions. Greenwashing risk assessment consulting rigorously evaluates the authenticity and accuracy of ESG claims, preventing misleading information by scrutinizing the alignment between reported data and actual practices in Materiality Assessment. Explore how integrating advanced Materiality Assessment techniques enhances credibility and mitigates greenwashing risks in your ESG strategy.

Sustainability Disclosure Standards (e.g., GRI, SASB)

ESG reporting consulting centers on aligning corporate disclosures with established Sustainability Disclosure Standards such as GRI and SASB to enhance transparency and stakeholder trust. Greenwashing risk assessment consulting evaluates potential misrepresentations in sustainability claims, mitigating brand damage and regulatory penalties by ensuring authenticity and compliance with frameworks like the EU Taxonomy and TCFD. Explore how expert consulting services can strengthen your sustainability strategy and safeguard corporate integrity.

Source and External Links

Sustainability and ESG Consulting Services - KERAMIDA - KERAMIDA offers ESG consulting to improve ESG ratings, develop sustainability strategies, support ESG disclosure and reporting, including CDP, SASB, IFRS, and greenhouse gas reduction strategies for long-term value creation.

ESG & Sustainability | Baker Tilly - Baker Tilly provides comprehensive ESG advisory services including materiality assessments, ESG and sustainability reporting aligned to global standards (ISSB, GRI), climate risk reporting, GHG emissions data gathering and digital data solutions for compliance and assurance.

ESG Consulting - Georgeson - Georgeson delivers ESG advisory and strategy, ESG reporting and audit readiness, gap and peer analysis, investor engagement, and training to help companies manage ESG risks, meet disclosure obligations, and communicate effectively with investors.

dowidth.com

dowidth.com