Interim executive placement focuses on providing temporary leadership to maintain business continuity and drive transformation during periods of change. Mergers and acquisitions advisory specializes in strategic guidance for buying, selling, or merging companies to maximize value and mitigate risks. Explore the unique advantages of each consulting service to determine the best fit for your organizational needs.

Why it is important

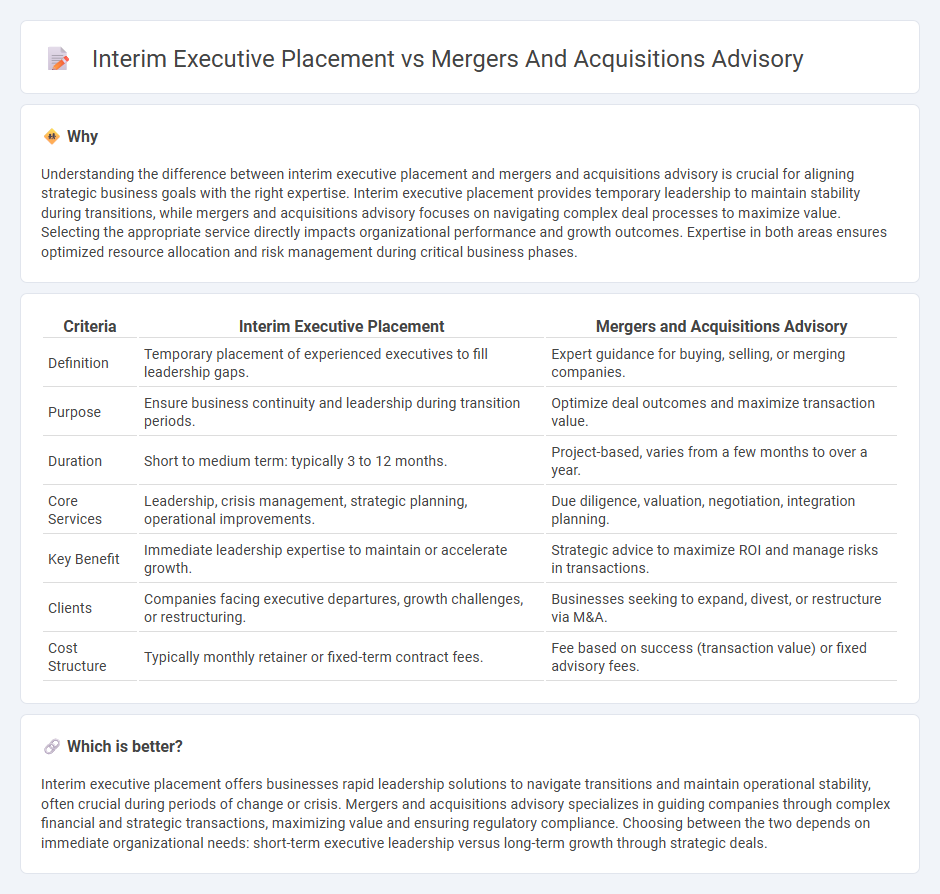

Understanding the difference between interim executive placement and mergers and acquisitions advisory is crucial for aligning strategic business goals with the right expertise. Interim executive placement provides temporary leadership to maintain stability during transitions, while mergers and acquisitions advisory focuses on navigating complex deal processes to maximize value. Selecting the appropriate service directly impacts organizational performance and growth outcomes. Expertise in both areas ensures optimized resource allocation and risk management during critical business phases.

Comparison Table

| Criteria | Interim Executive Placement | Mergers and Acquisitions Advisory |

|---|---|---|

| Definition | Temporary placement of experienced executives to fill leadership gaps. | Expert guidance for buying, selling, or merging companies. |

| Purpose | Ensure business continuity and leadership during transition periods. | Optimize deal outcomes and maximize transaction value. |

| Duration | Short to medium term: typically 3 to 12 months. | Project-based, varies from a few months to over a year. |

| Core Services | Leadership, crisis management, strategic planning, operational improvements. | Due diligence, valuation, negotiation, integration planning. |

| Key Benefit | Immediate leadership expertise to maintain or accelerate growth. | Strategic advice to maximize ROI and manage risks in transactions. |

| Clients | Companies facing executive departures, growth challenges, or restructuring. | Businesses seeking to expand, divest, or restructure via M&A. |

| Cost Structure | Typically monthly retainer or fixed-term contract fees. | Fee based on success (transaction value) or fixed advisory fees. |

Which is better?

Interim executive placement offers businesses rapid leadership solutions to navigate transitions and maintain operational stability, often crucial during periods of change or crisis. Mergers and acquisitions advisory specializes in guiding companies through complex financial and strategic transactions, maximizing value and ensuring regulatory compliance. Choosing between the two depends on immediate organizational needs: short-term executive leadership versus long-term growth through strategic deals.

Connection

Interim executive placement provides critical leadership during transitional phases in mergers and acquisitions, ensuring operational stability and strategic alignment. Mergers and acquisitions advisory leverages these interim leaders to execute integration plans and manage change effectively. This synergy enhances deal success by combining expert guidance with agile, experienced management.

Key Terms

**Mergers and Acquisitions Advisory:**

Mergers and acquisitions advisory involves providing expert guidance on deal structuring, valuation, due diligence, and negotiation to help companies successfully execute mergers, acquisitions, and divestitures. Advisors play a critical role in identifying strategic opportunities, assessing financial risks, and maximizing shareholder value during complex transactions. Discover how specialized M&A advisory services can drive business growth and optimize investment outcomes.

Due Diligence

Mergers and acquisitions advisory centers on comprehensive due diligence to assess financial, legal, and operational risks, ensuring informed decision-making during transactions. Interim executive placement emphasizes due diligence in evaluating leadership fit and strategic alignment to stabilize transition periods effectively. Explore more to understand how targeted due diligence drives success in both advisory and executive placement.

Valuation

Mergers and acquisitions advisory specializes in comprehensive company valuations to determine fair market value during transactions, leveraging financial analysis, market conditions, and comparative metrics. Interim executive placement focuses on placing seasoned leaders who can drive value creation and operational improvements that often directly influence company valuation during transitional periods. Discover how leveraging expert advisory and strategic leadership can optimize your business valuation.

Source and External Links

What is M&A Advisory? Key Roles and Functions - M&A advisory firms guide companies through mergers and acquisitions by providing strategic planning, market analysis, valuation, deal structuring, due diligence, negotiation, financing assistance, legal compliance, and post-deal integration support.

Who are M&A Advisors and What Do They Do? - M&A advisors specialize in advising both buy-side and sell-side clients on complex transactions, handling deal evaluation, negotiation, legal and financial aspects, and earning fees typically based on a percentage of the transaction value or a retainer.

M&A Advisor Guide for CFOs & Corporate Development - M&A advisory services are provided by both large investment banks and specialized boutique firms, offering services such as deal origination, valuation, marketing, negotiation, closing, capital raising, and company restructuring, with boutique firms often providing more focused, industry-specific expertise.

dowidth.com

dowidth.com