Ecosystem strategy focuses on creating value through collaborative networks of partners, leveraging shared resources and innovation to drive competitive advantage. Mergers and acquisitions strategy emphasizes growth and market expansion by combining companies' assets and capabilities to achieve synergies. Discover more about how each strategy can shape your organization's future success.

Why it is important

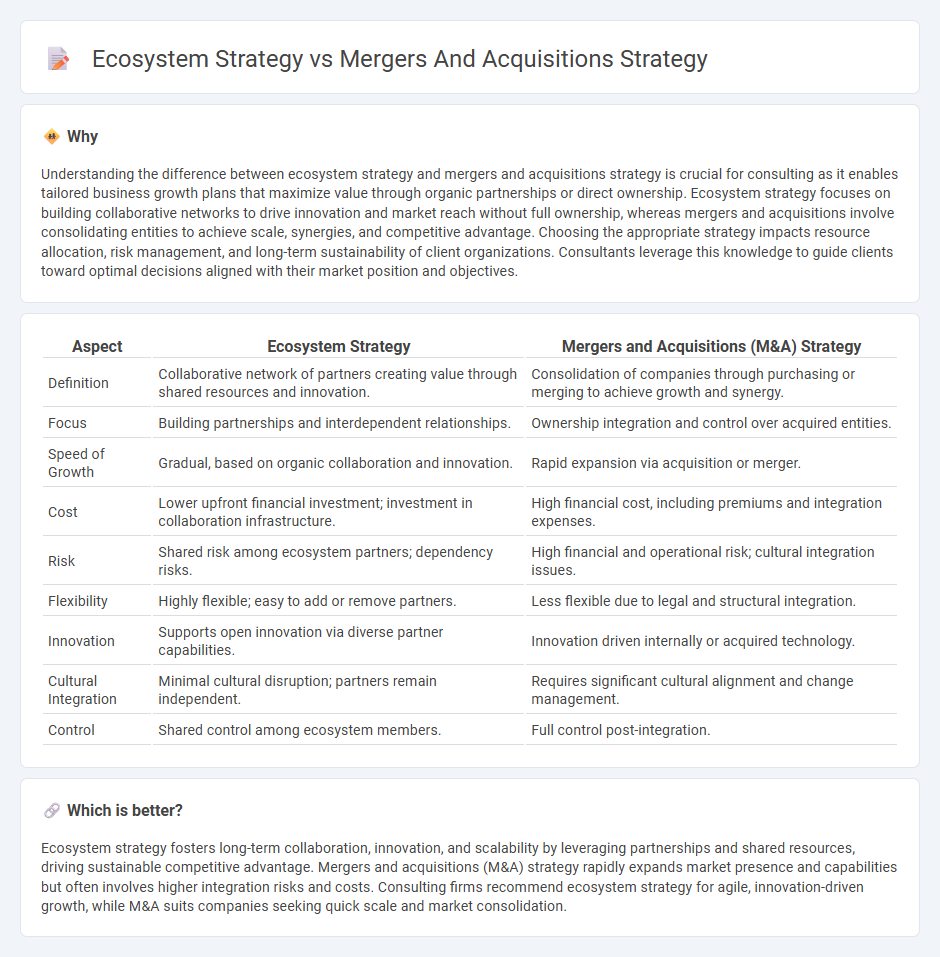

Understanding the difference between ecosystem strategy and mergers and acquisitions strategy is crucial for consulting as it enables tailored business growth plans that maximize value through organic partnerships or direct ownership. Ecosystem strategy focuses on building collaborative networks to drive innovation and market reach without full ownership, whereas mergers and acquisitions involve consolidating entities to achieve scale, synergies, and competitive advantage. Choosing the appropriate strategy impacts resource allocation, risk management, and long-term sustainability of client organizations. Consultants leverage this knowledge to guide clients toward optimal decisions aligned with their market position and objectives.

Comparison Table

| Aspect | Ecosystem Strategy | Mergers and Acquisitions (M&A) Strategy |

|---|---|---|

| Definition | Collaborative network of partners creating value through shared resources and innovation. | Consolidation of companies through purchasing or merging to achieve growth and synergy. |

| Focus | Building partnerships and interdependent relationships. | Ownership integration and control over acquired entities. |

| Speed of Growth | Gradual, based on organic collaboration and innovation. | Rapid expansion via acquisition or merger. |

| Cost | Lower upfront financial investment; investment in collaboration infrastructure. | High financial cost, including premiums and integration expenses. |

| Risk | Shared risk among ecosystem partners; dependency risks. | High financial and operational risk; cultural integration issues. |

| Flexibility | Highly flexible; easy to add or remove partners. | Less flexible due to legal and structural integration. |

| Innovation | Supports open innovation via diverse partner capabilities. | Innovation driven internally or acquired technology. |

| Cultural Integration | Minimal cultural disruption; partners remain independent. | Requires significant cultural alignment and change management. |

| Control | Shared control among ecosystem members. | Full control post-integration. |

Which is better?

Ecosystem strategy fosters long-term collaboration, innovation, and scalability by leveraging partnerships and shared resources, driving sustainable competitive advantage. Mergers and acquisitions (M&A) strategy rapidly expands market presence and capabilities but often involves higher integration risks and costs. Consulting firms recommend ecosystem strategy for agile, innovation-driven growth, while M&A suits companies seeking quick scale and market consolidation.

Connection

Ecosystem strategy and mergers and acquisitions (M&A) strategy are interconnected by enabling companies to expand their market reach and capabilities through collaborative networks and strategic acquisitions. Integrating ecosystem partners via M&A accelerates innovation, drives competitive advantage, and enhances value creation across interconnected industries. This synergy helps firms leverage complementary assets, optimize resource allocation, and scale efficiently in dynamic business environments.

Key Terms

Synergy

Mergers and acquisitions (M&A) strategy focuses on creating synergy through combining resources, capabilities, and market share to enhance competitive advantage and operational efficiency. Ecosystem strategy emphasizes collaboration among diverse stakeholders, fostering innovation and value co-creation within interconnected networks. Explore how leveraging synergy differs between M&A and ecosystem strategies for strategic growth insights.

Integration

Mergers and acquisitions strategies emphasize consolidating companies to achieve synergies, streamline operations, and capture greater market share through direct integration of assets and processes. Ecosystem strategies prioritize creating interconnected networks of partners, customers, and suppliers to foster innovation, flexibility, and shared value without complete ownership. Explore how businesses balance these approaches for optimal integration and growth.

Partnerships

Mergers and acquisitions strategy focuses on consolidating companies to achieve growth, access new markets, and enhance competitive advantage through ownership. Ecosystem strategy emphasizes building collaborative partnerships and interconnected networks to drive innovation, share resources, and co-create value without full ownership. Explore how leveraging partnerships within these strategies can transform business growth and competitive positioning.

Source and External Links

The Complete Guide to a Successful M&A Strategy - Allegrow - An M&A strategy is a carefully crafted plan that aligns mergers and acquisitions efforts with clear objectives, due diligence, integration planning, and risk management to achieve goals such as market expansion or technological advancement.

Proven Strategies for Mergers and Acquisitions Success - M&A strategy involves selecting the right type of merger or acquisition (horizontal, vertical, conglomerate, etc.) with focus on strategic planning, thorough due diligence, cultural alignment, and mitigating risks for successful integration and business growth.

Acquisition as a Growth Strategy - High-Growth Approach (2025) - Developing a growth through acquisition strategy involves evaluating goals, market conditions, expected synergies, due diligence readiness, integration planning, employee retention, and aligning M&A practices with overall growth objectives.

dowidth.com

dowidth.com