Operational due diligence evaluates a company's internal processes, systems, and risk management to ensure efficiency and identify potential operational risks. Tax due diligence focuses on assessing tax compliance, liabilities, and potential exposures to mitigate financial and legal risks related to taxation. Explore more to understand how both types of due diligence contribute to informed investment decisions.

Why it is important

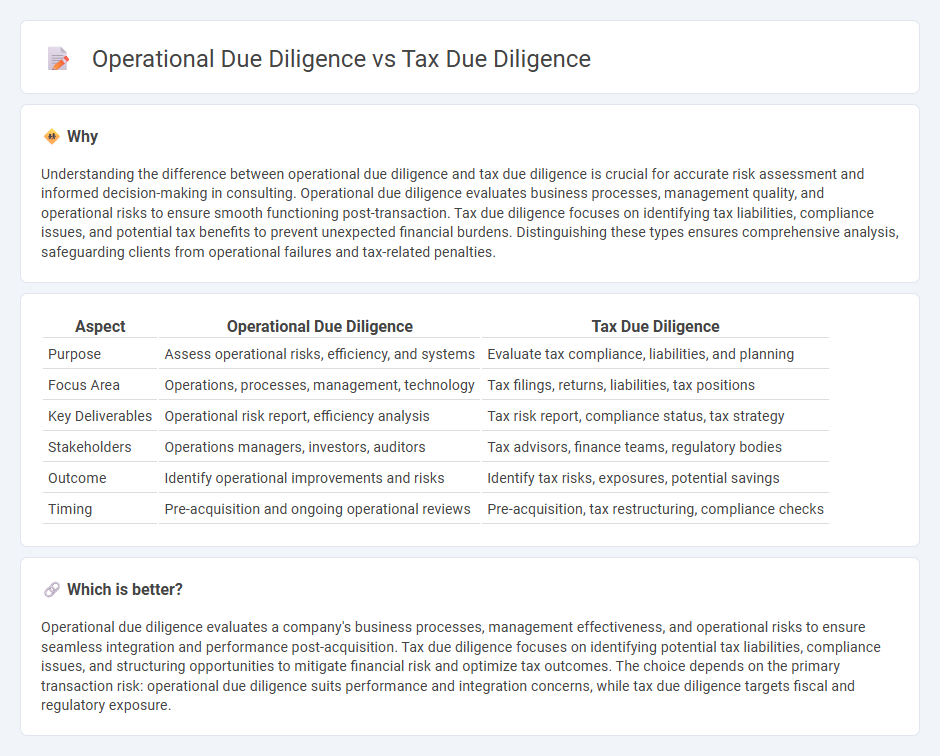

Understanding the difference between operational due diligence and tax due diligence is crucial for accurate risk assessment and informed decision-making in consulting. Operational due diligence evaluates business processes, management quality, and operational risks to ensure smooth functioning post-transaction. Tax due diligence focuses on identifying tax liabilities, compliance issues, and potential tax benefits to prevent unexpected financial burdens. Distinguishing these types ensures comprehensive analysis, safeguarding clients from operational failures and tax-related penalties.

Comparison Table

| Aspect | Operational Due Diligence | Tax Due Diligence |

|---|---|---|

| Purpose | Assess operational risks, efficiency, and systems | Evaluate tax compliance, liabilities, and planning |

| Focus Area | Operations, processes, management, technology | Tax filings, returns, liabilities, tax positions |

| Key Deliverables | Operational risk report, efficiency analysis | Tax risk report, compliance status, tax strategy |

| Stakeholders | Operations managers, investors, auditors | Tax advisors, finance teams, regulatory bodies |

| Outcome | Identify operational improvements and risks | Identify tax risks, exposures, potential savings |

| Timing | Pre-acquisition and ongoing operational reviews | Pre-acquisition, tax restructuring, compliance checks |

Which is better?

Operational due diligence evaluates a company's business processes, management effectiveness, and operational risks to ensure seamless integration and performance post-acquisition. Tax due diligence focuses on identifying potential tax liabilities, compliance issues, and structuring opportunities to mitigate financial risk and optimize tax outcomes. The choice depends on the primary transaction risk: operational due diligence suits performance and integration concerns, while tax due diligence targets fiscal and regulatory exposure.

Connection

Operational due diligence evaluates the efficiency and risks of a company's internal processes, while tax due diligence assesses its tax obligations and compliance. Both are connected through their role in identifying potential liabilities and operational risks that could impact financial performance. Integrating insights from operational and tax due diligence ensures a comprehensive risk assessment during mergers and acquisitions.

Key Terms

**Tax Due Diligence:**

Tax due diligence involves a thorough examination of a company's tax compliance, liabilities, and potential risks to ensure accurate financial reporting and mitigate future tax disputes. Key areas include reviewing tax returns, identifying tax exposure, and evaluating the impact of tax regulations on transactions. Explore detailed insights into tax due diligence to enhance your financial decision-making and risk management strategies.

Tax Liabilities

Tax due diligence centers on assessing a company's tax liabilities, compliance with tax laws, and potential risks related to tax obligations, such as outstanding tax debts, litigation, or exposure to penalties. Operational due diligence, while broader in scope, includes evaluation of the operational aspects influencing tax exposure but primarily focuses on business processes, efficiency, and risk management unrelated directly to tax specifics. Explore how a detailed tax due diligence process can safeguard your investment and reveal hidden fiscal risks.

Compliance Status

Tax due diligence primarily assesses a company's tax compliance status, identifying potential liabilities, unpaid taxes, and adherence to local tax laws and regulations. Operational due diligence examines broader compliance aspects, including regulatory adherence, internal controls, and risk management within the business operations. Explore detailed insights on how both types of due diligence impact organizational compliance and risk mitigation strategies.

Source and External Links

The Critical Importance of Tax Due Diligence in Modern Business Transactions - Tax due diligence is a detailed review of a company's tax history, compliance, and potential liabilities to uncover risks that could impact business valuation or lead to future tax obligations.

Tax Due Diligence For Mergers And Acquisitions - This process involves analyzing a target company's tax structure, compliance history, and potential exposures to identify deal-breakers and ensure a smooth transaction for both buyers and sellers.

How to Efficiently Conduct Tax Due Diligence - Tax due diligence examines all tax liabilities a company may face in an M&A deal, clarifying where taxes arise to support informed decision-making, not to avoid taxes but to understand and manage them.

dowidth.com

dowidth.com