Cost-to-serve analysis focuses on evaluating the total expenses involved in delivering a product or service to customers, emphasizing customer-specific cost drivers and profitability. Activity-based costing allocates overhead and indirect costs to products based on actual activities, offering precise insight into product or service costing for strategic pricing and resource allocation. Explore how understanding these methodologies can optimize your business profitability and operational efficiency.

Why it is important

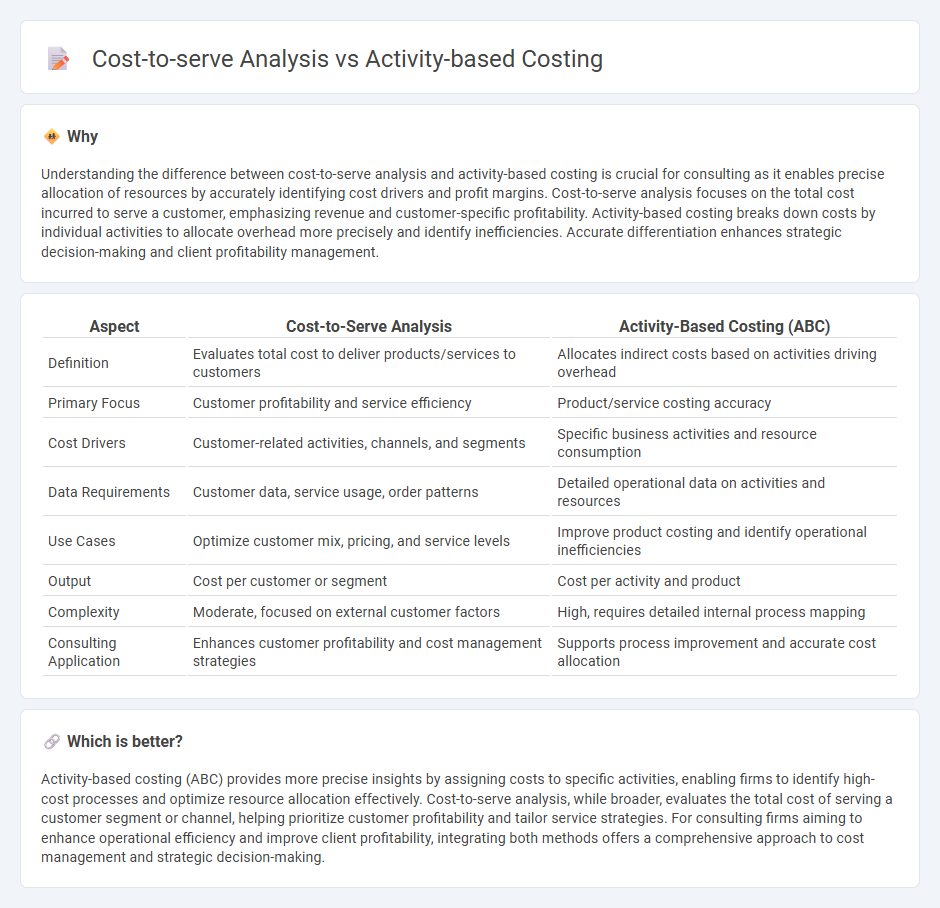

Understanding the difference between cost-to-serve analysis and activity-based costing is crucial for consulting as it enables precise allocation of resources by accurately identifying cost drivers and profit margins. Cost-to-serve analysis focuses on the total cost incurred to serve a customer, emphasizing revenue and customer-specific profitability. Activity-based costing breaks down costs by individual activities to allocate overhead more precisely and identify inefficiencies. Accurate differentiation enhances strategic decision-making and client profitability management.

Comparison Table

| Aspect | Cost-to-Serve Analysis | Activity-Based Costing (ABC) |

|---|---|---|

| Definition | Evaluates total cost to deliver products/services to customers | Allocates indirect costs based on activities driving overhead |

| Primary Focus | Customer profitability and service efficiency | Product/service costing accuracy |

| Cost Drivers | Customer-related activities, channels, and segments | Specific business activities and resource consumption |

| Data Requirements | Customer data, service usage, order patterns | Detailed operational data on activities and resources |

| Use Cases | Optimize customer mix, pricing, and service levels | Improve product costing and identify operational inefficiencies |

| Output | Cost per customer or segment | Cost per activity and product |

| Complexity | Moderate, focused on external customer factors | High, requires detailed internal process mapping |

| Consulting Application | Enhances customer profitability and cost management strategies | Supports process improvement and accurate cost allocation |

Which is better?

Activity-based costing (ABC) provides more precise insights by assigning costs to specific activities, enabling firms to identify high-cost processes and optimize resource allocation effectively. Cost-to-serve analysis, while broader, evaluates the total cost of serving a customer segment or channel, helping prioritize customer profitability and tailor service strategies. For consulting firms aiming to enhance operational efficiency and improve client profitability, integrating both methods offers a comprehensive approach to cost management and strategic decision-making.

Connection

Cost-to-serve analysis leverages Activity-Based Costing (ABC) to accurately allocate overhead and direct costs to specific customer segments, products, or services, providing granular insight into profitability. By identifying cost drivers and assigning costs based on actual resource consumption, ABC enables businesses to pinpoint inefficiencies and optimize supply chain operations. This connection enhances strategic decision-making in consulting by revealing precise cost structures essential for pricing, process improvement, and customer profitability analysis.

Key Terms

Cost Drivers

Activity-based costing (ABC) identifies cost drivers by tracing expenses to specific activities, enabling precise allocation based on resource consumption, such as machine hours or transaction counts. Cost-to-serve analysis extends this by evaluating the total cost to deliver a product or service to customers, including logistics, distribution, and customer service factors, often highlighting hidden cost drivers like order frequency or delivery complexity. Explore more to understand how integrating these methods can optimize cost management and improve profitability.

Resource Allocation

Activity-based costing (ABC) allocates overhead costs to specific activities based on actual resource consumption, enabling more precise identification of cost drivers for better resource allocation. Cost-to-serve analysis examines the total cost incurred to deliver a product or service to customers, emphasizing customer profitability and operational efficiency. Explore the detailed differences to optimize your resource allocation strategy effectively.

Profitability Analysis

Activity-based costing (ABC) allocates overhead costs to products based on specific activities, providing detailed insights into product-level profitability by identifying cost drivers and resource consumption. Cost-to-serve analysis evaluates the total cost associated with fulfilling customer orders, including logistics, service, and sales expenses, helping businesses understand profitability per customer segment or channel. Explore comprehensive profitability strategies by integrating ABC with cost-to-serve analysis for enhanced financial decision-making.

Source and External Links

Activity-Based Costing - Overview, Approach, Benefits - Activity-based costing (ABC) allocates overhead costs more accurately by linking them to the specific activities that generate those costs, rather than using broad measures like labor hours, making it especially useful in manufacturing for pricing and cost control.

Activity-Based Costing (ABC): Advantages and When To Use - Indeed - ABC tracks resource use and assigns indirect costs to products based on actual activities, helping businesses identify cost drivers and make informed decisions on pricing and production efficiency.

Activity Based Costing: In-Depth Explanation with Examples - This method assigns overhead costs to products based on the real cause of those costs (activities), avoiding the distortions of traditional costing systems that might allocate costs unfairly based on machine hours alone.

dowidth.com

dowidth.com