Carbon accounting advisory focuses on measuring, managing, and reporting greenhouse gas emissions to ensure accurate sustainability tracking and regulatory compliance. Green finance advisory helps organizations access funding and investment opportunities that support environmentally sustainable projects and initiatives. Explore our expert consulting services to learn how carbon accounting and green finance can drive your business's environmental and financial goals.

Why it is important

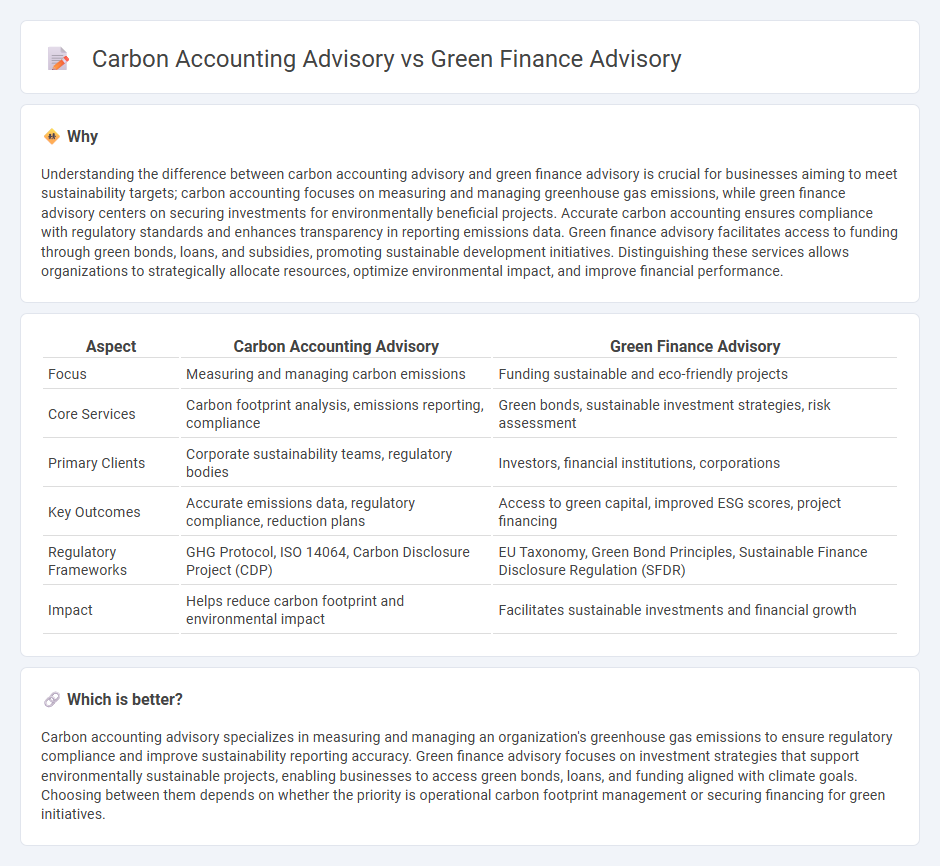

Understanding the difference between carbon accounting advisory and green finance advisory is crucial for businesses aiming to meet sustainability targets; carbon accounting focuses on measuring and managing greenhouse gas emissions, while green finance advisory centers on securing investments for environmentally beneficial projects. Accurate carbon accounting ensures compliance with regulatory standards and enhances transparency in reporting emissions data. Green finance advisory facilitates access to funding through green bonds, loans, and subsidies, promoting sustainable development initiatives. Distinguishing these services allows organizations to strategically allocate resources, optimize environmental impact, and improve financial performance.

Comparison Table

| Aspect | Carbon Accounting Advisory | Green Finance Advisory |

|---|---|---|

| Focus | Measuring and managing carbon emissions | Funding sustainable and eco-friendly projects |

| Core Services | Carbon footprint analysis, emissions reporting, compliance | Green bonds, sustainable investment strategies, risk assessment |

| Primary Clients | Corporate sustainability teams, regulatory bodies | Investors, financial institutions, corporations |

| Key Outcomes | Accurate emissions data, regulatory compliance, reduction plans | Access to green capital, improved ESG scores, project financing |

| Regulatory Frameworks | GHG Protocol, ISO 14064, Carbon Disclosure Project (CDP) | EU Taxonomy, Green Bond Principles, Sustainable Finance Disclosure Regulation (SFDR) |

| Impact | Helps reduce carbon footprint and environmental impact | Facilitates sustainable investments and financial growth |

Which is better?

Carbon accounting advisory specializes in measuring and managing an organization's greenhouse gas emissions to ensure regulatory compliance and improve sustainability reporting accuracy. Green finance advisory focuses on investment strategies that support environmentally sustainable projects, enabling businesses to access green bonds, loans, and funding aligned with climate goals. Choosing between them depends on whether the priority is operational carbon footprint management or securing financing for green initiatives.

Connection

Carbon accounting advisory and green finance advisory intersect by providing companies with accurate emissions data crucial for securing sustainable investment. Carbon accounting quantifies greenhouse gas emissions, enabling green finance advisors to structure funding aligned with environmental goals and regulatory standards. This synergy drives transparent reporting and supports businesses in accessing green bonds, sustainability-linked loans, and impact investing opportunities.

Key Terms

Green finance advisory:

Green finance advisory specializes in guiding businesses and investors to integrate environmental, social, and governance (ESG) factors into financial decisions, promoting sustainable investments and access to green bonds or loans. This advisory service focuses on structuring green financing strategies that align with regulatory frameworks like the EU Taxonomy and supports climate risk disclosures under standards such as the Task Force on Climate-related Financial Disclosures (TCFD). Explore how green finance advisory can accelerate your sustainable growth and compliance initiatives.

Sustainable investment strategies

Green finance advisory specializes in guiding sustainable investment strategies by integrating environmental, social, and governance (ESG) criteria to support low-carbon and climate-resilient projects. Carbon accounting advisory focuses on accurately measuring, reporting, and verifying carbon emissions to enable organizations to reduce their carbon footprint and comply with regulatory requirements. Explore how these advisory services empower businesses to achieve robust sustainability goals and enhance long-term financial performance.

ESG (Environmental, Social, Governance) integration

Green finance advisory emphasizes sustainable investment strategies that align financial goals with environmental impact reduction, promoting ESG integration through clean energy projects and climate risk assessment. Carbon accounting advisory specializes in measuring, reporting, and verifying carbon footprints to enhance transparency and compliance with international environmental standards. Explore further to understand how these advisory services drive corporate sustainability and regulatory adherence.

Source and External Links

Sustainable Investment and ESG Advisory - Position Green - Position Green offers green finance advisory including expert guidance on green and sustainability-linked bonds and loans, second party opinions, and building ESG investment strategies to reduce risks and create value in private market investing.

Delivering green advisory services - Green Investment Group - Green Investment Group provides industry-leading green impact assessment and advisory services that help investors verify green credentials and avoid greenwashing, contributing to sustainable finance standardization and certification for green bonds and loans.

Sustainable Finance Advisory Program - The World Bank Treasury - The World Bank's Sustainable Finance Advisory team helps developing countries issue green bonds by offering pre- and post-issuance technical assistance, including framework development, second opinions, impact reporting, and meeting global standards.

dowidth.com

dowidth.com