Organizational design sprints focus on rapidly aligning company structures and teams to boost agility and performance, while mergers and acquisitions integration centers on combining distinct entities to realize synergies and streamline operations. Both approaches require strategic planning and effective change management to achieve sustainable growth. Explore how tailored consulting strategies optimize these processes for maximum business value.

Why it is important

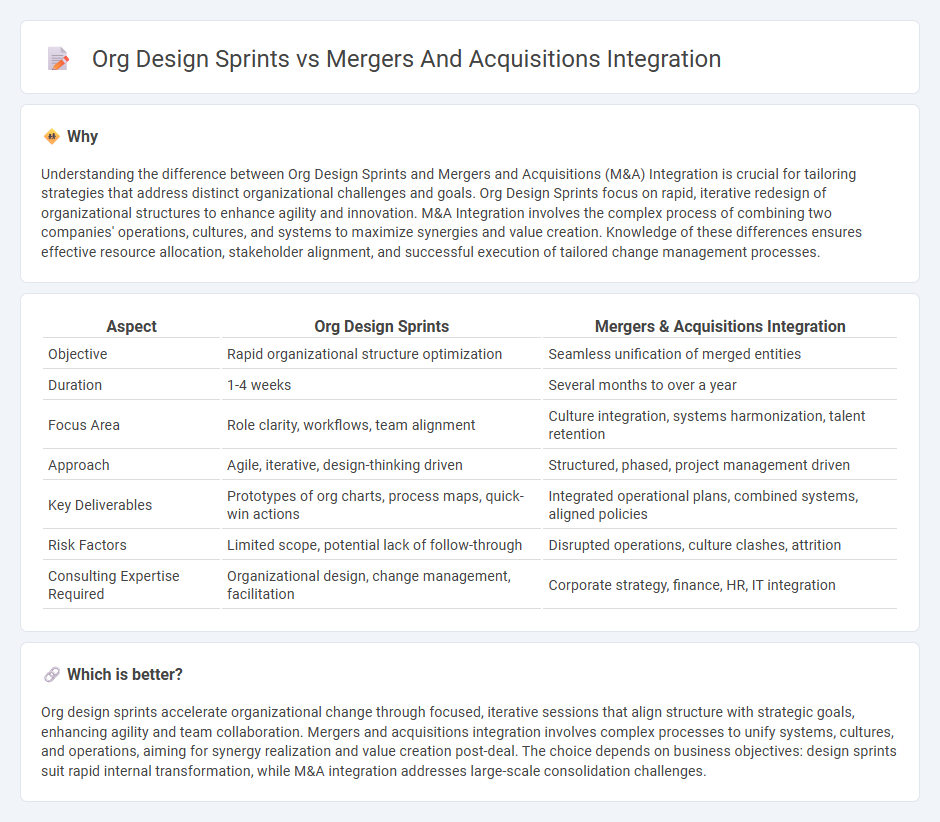

Understanding the difference between Org Design Sprints and Mergers and Acquisitions (M&A) Integration is crucial for tailoring strategies that address distinct organizational challenges and goals. Org Design Sprints focus on rapid, iterative redesign of organizational structures to enhance agility and innovation. M&A Integration involves the complex process of combining two companies' operations, cultures, and systems to maximize synergies and value creation. Knowledge of these differences ensures effective resource allocation, stakeholder alignment, and successful execution of tailored change management processes.

Comparison Table

| Aspect | Org Design Sprints | Mergers & Acquisitions Integration |

|---|---|---|

| Objective | Rapid organizational structure optimization | Seamless unification of merged entities |

| Duration | 1-4 weeks | Several months to over a year |

| Focus Area | Role clarity, workflows, team alignment | Culture integration, systems harmonization, talent retention |

| Approach | Agile, iterative, design-thinking driven | Structured, phased, project management driven |

| Key Deliverables | Prototypes of org charts, process maps, quick-win actions | Integrated operational plans, combined systems, aligned policies |

| Risk Factors | Limited scope, potential lack of follow-through | Disrupted operations, culture clashes, attrition |

| Consulting Expertise Required | Organizational design, change management, facilitation | Corporate strategy, finance, HR, IT integration |

Which is better?

Org design sprints accelerate organizational change through focused, iterative sessions that align structure with strategic goals, enhancing agility and team collaboration. Mergers and acquisitions integration involves complex processes to unify systems, cultures, and operations, aiming for synergy realization and value creation post-deal. The choice depends on business objectives: design sprints suit rapid internal transformation, while M&A integration addresses large-scale consolidation challenges.

Connection

Org design sprints accelerate the alignment of organizational structures and roles essential for post-merger efficiency. Mergers and acquisitions integration relies on rapid, iterative design cycles to address cultural integration, workflow harmonization, and leadership alignment. Combining these approaches ensures smooth transitions and maximizes value realization in M&A processes.

Key Terms

Synergy realization

Mergers and acquisitions integration prioritizes aligning systems, processes, and cultures to achieve operational synergies and maximize shareholder value, often requiring extensive due diligence and post-merger restructuring. Org design sprints focus on rapid, iterative redesign of organizational structures to enhance agility, collaboration, and innovation, driving synergy realization through targeted team realignment and workflow optimization. Explore strategies to blend M&A integration with org design sprints for accelerated synergy realization and sustained competitive advantage.

Target operating model

Mergers and acquisitions integration centers on aligning and streamlining processes, systems, and cultures to achieve a cohesive target operating model that maximizes value and operational efficiency. Organizational design sprints focus on rapidly prototyping and validating the optimal target operating model through iterative, cross-functional collaboration, emphasizing agility and innovation. Explore more to understand how these approaches can strategically transform your organization's operating model for sustained success.

Cross-functional collaboration

Mergers and acquisitions integration demands meticulous cross-functional collaboration to align diverse organizational cultures, streamline processes, and consolidate systems for seamless synergy realization. Org design sprints accelerate this alignment through focused, iterative workshops that engage multidisciplinary teams in co-creating adaptive structures, roles, and workflows to drive agility and innovation. Explore how integrating these approaches enhances collaboration and transformation success in your enterprise.

Source and External Links

What is Integration in M&A - M&A Science - M&A integration or Post-merger integration (PMI) is the process of connecting two or more companies to operate together, with integration strategies like targeted (light-touch), full (absorption), and functional integration to capture synergies based on the acquirer's goals.

Nine steps to setting up an M&A integration program | EY - US - EY outlines a nine-phase timeline for M&A integration, starting with defining vision and value drivers with leadership to align integration strategy and achieve deal value realization.

The 10 Steps to Successful M&A Integration | Bain & Company - Bain emphasizes starting integration planning during diligence and leveraging digital tools and AI to accelerate planning, synergy tracking, and decision-making for effective M&A integration execution.

dowidth.com

dowidth.com