Loss prevention analytics focuses on identifying and mitigating risks related to theft, inventory shrinkage, and operational inefficiencies within retail environments. Return fraud analysis specifically targets fraudulent return activities by examining patterns, customer behavior, and transaction anomalies to reduce financial losses. Explore detailed strategies and technologies to enhance security and profitability in retail operations.

Why it is important

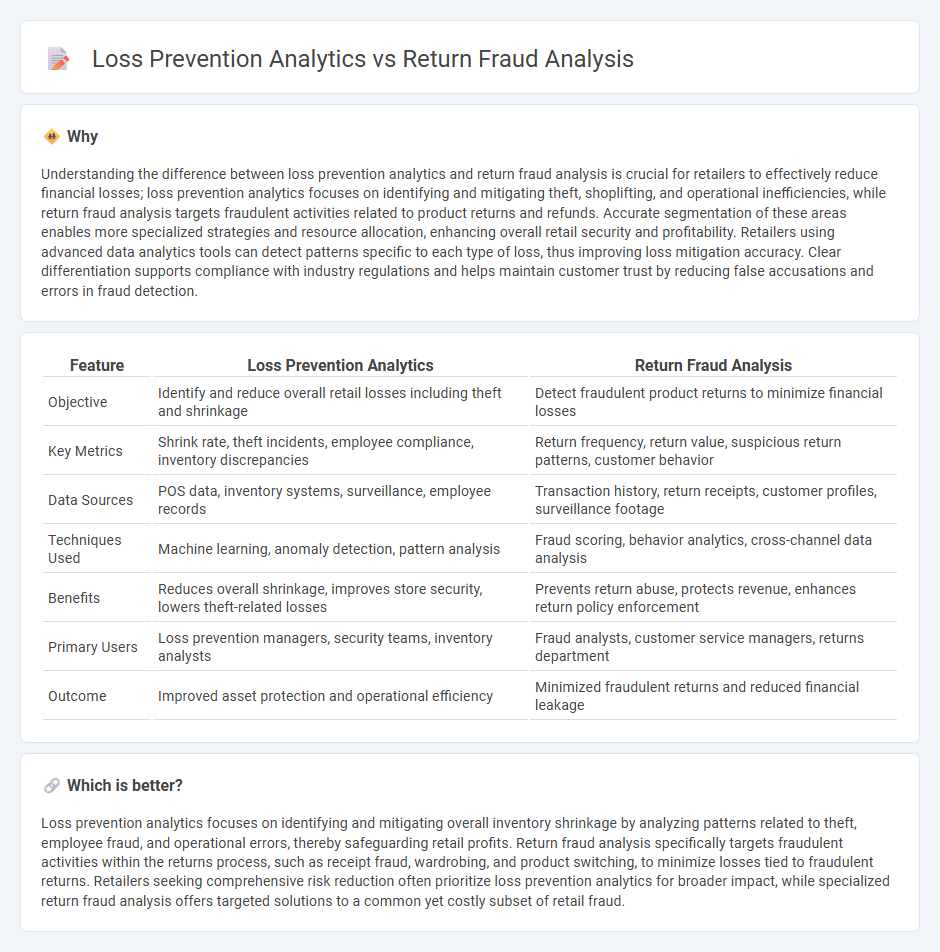

Understanding the difference between loss prevention analytics and return fraud analysis is crucial for retailers to effectively reduce financial losses; loss prevention analytics focuses on identifying and mitigating theft, shoplifting, and operational inefficiencies, while return fraud analysis targets fraudulent activities related to product returns and refunds. Accurate segmentation of these areas enables more specialized strategies and resource allocation, enhancing overall retail security and profitability. Retailers using advanced data analytics tools can detect patterns specific to each type of loss, thus improving loss mitigation accuracy. Clear differentiation supports compliance with industry regulations and helps maintain customer trust by reducing false accusations and errors in fraud detection.

Comparison Table

| Feature | Loss Prevention Analytics | Return Fraud Analysis |

|---|---|---|

| Objective | Identify and reduce overall retail losses including theft and shrinkage | Detect fraudulent product returns to minimize financial losses |

| Key Metrics | Shrink rate, theft incidents, employee compliance, inventory discrepancies | Return frequency, return value, suspicious return patterns, customer behavior |

| Data Sources | POS data, inventory systems, surveillance, employee records | Transaction history, return receipts, customer profiles, surveillance footage |

| Techniques Used | Machine learning, anomaly detection, pattern analysis | Fraud scoring, behavior analytics, cross-channel data analysis |

| Benefits | Reduces overall shrinkage, improves store security, lowers theft-related losses | Prevents return abuse, protects revenue, enhances return policy enforcement |

| Primary Users | Loss prevention managers, security teams, inventory analysts | Fraud analysts, customer service managers, returns department |

| Outcome | Improved asset protection and operational efficiency | Minimized fraudulent returns and reduced financial leakage |

Which is better?

Loss prevention analytics focuses on identifying and mitigating overall inventory shrinkage by analyzing patterns related to theft, employee fraud, and operational errors, thereby safeguarding retail profits. Return fraud analysis specifically targets fraudulent activities within the returns process, such as receipt fraud, wardrobing, and product switching, to minimize losses tied to fraudulent returns. Retailers seeking comprehensive risk reduction often prioritize loss prevention analytics for broader impact, while specialized return fraud analysis offers targeted solutions to a common yet costly subset of retail fraud.

Connection

Loss prevention analytics and return fraud analysis are interconnected through their focus on reducing financial losses in retail by identifying patterns of fraudulent behavior. Both use advanced data mining techniques and machine learning algorithms to detect anomalies in transaction data and return activities. Implementing these analyses together enhances the accuracy of fraud detection systems, leading to improved inventory control and increased profitability for retail businesses.

Key Terms

**Return Fraud Analysis:**

Return fraud analysis identifies patterns and behaviors associated with fraudulent product returns, employing advanced machine learning algorithms and transaction data to detect anomalies and reduce financial losses. It emphasizes real-time monitoring of return transactions, customer history, and product categories to prevent abuse and enhance accuracy in pinpointing suspicious returns. Explore more to understand how return fraud analysis can safeguard your retail operations effectively.

Receipt Falsification

Return fraud analysis targets identifying patterns of receipt falsification by examining transaction inconsistencies and anomaly detection algorithms to flag suspicious returns. Loss prevention analytics integrates surveillance data, employee behavior metrics, and real-time point-of-sale monitoring to mitigate receipt fraud and reduce financial losses. Discover comprehensive strategies to enhance security measures and optimize fraud detection systems.

Wardrobing

Return fraud analysis targets identifying deceptive behaviors like wardrobing, where customers use products temporarily and return them to exploit return policies. Loss prevention analytics employs predictive models and data patterns to minimize overall financial loss from various fraudulent activities, including return fraud. Discover how advanced analytics transform retail strategies by effectively combating wardrobing and protecting revenue.

Source and External Links

What is Return Fraud? Types, Impact, Prevention Tactics - FOCAL - Return fraud involves deception to get refunds or credits by exploiting return policies, with 11 common types such as returning stolen items, receipt fraud, employee fraud, and price switching among others.

Return fraud: The $100 billion problem facing retailers - Ekata - Return fraud is detected by patterns like excessive or unusual returns, altered receipts, damaged or switched merchandise, and frequent returns without original payment methods, posing a major loss for retailers.

Common Examples of Retail Return Fraud - Pindrop Security - Examples of return fraud include schemes such as the electronics resale racket where original products are replaced with items of similar weight to fraudulently obtain full refunds, and fraudulent gift card exchanges using false receipts.

dowidth.com

dowidth.com