Dynamic pricing in real estate adjusts property prices in real time based on demand, market trends, and competitor analysis, optimizing revenue during high-traffic periods. Value-based pricing sets property prices according to the perceived value to buyers, focusing on factors like location, amenities, and emotional appeal rather than solely on market fluctuations. Explore how these pricing strategies impact investment returns and sales efficiency in the real estate market.

Why it is important

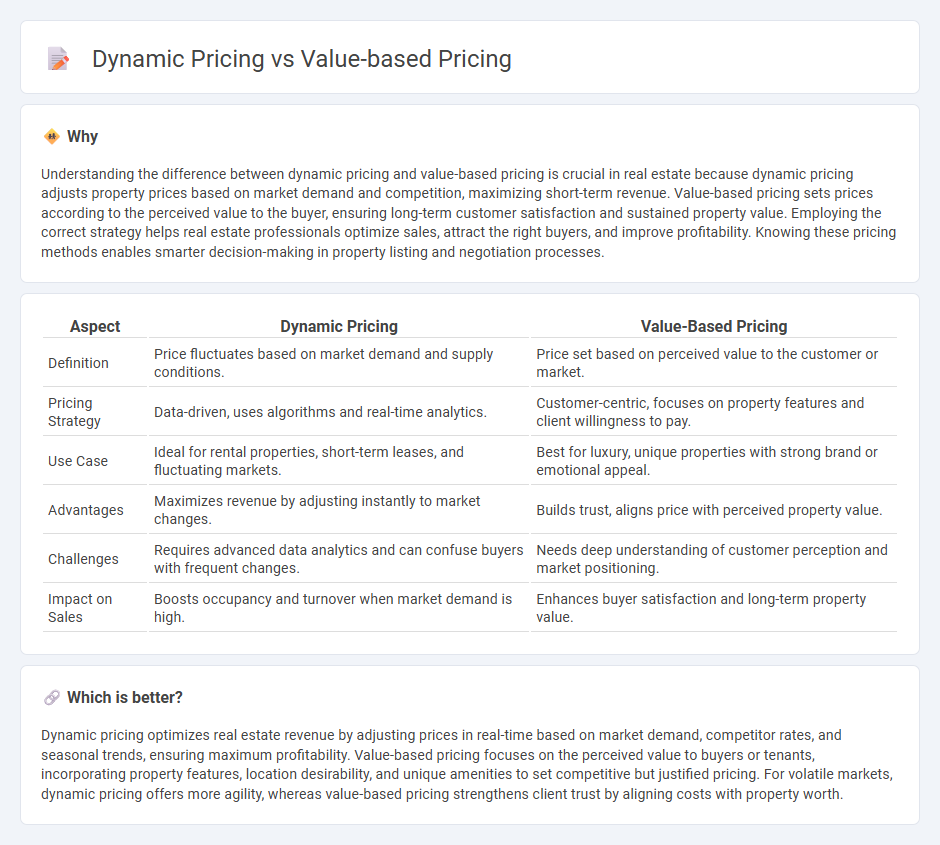

Understanding the difference between dynamic pricing and value-based pricing is crucial in real estate because dynamic pricing adjusts property prices based on market demand and competition, maximizing short-term revenue. Value-based pricing sets prices according to the perceived value to the buyer, ensuring long-term customer satisfaction and sustained property value. Employing the correct strategy helps real estate professionals optimize sales, attract the right buyers, and improve profitability. Knowing these pricing methods enables smarter decision-making in property listing and negotiation processes.

Comparison Table

| Aspect | Dynamic Pricing | Value-Based Pricing |

|---|---|---|

| Definition | Price fluctuates based on market demand and supply conditions. | Price set based on perceived value to the customer or market. |

| Pricing Strategy | Data-driven, uses algorithms and real-time analytics. | Customer-centric, focuses on property features and client willingness to pay. |

| Use Case | Ideal for rental properties, short-term leases, and fluctuating markets. | Best for luxury, unique properties with strong brand or emotional appeal. |

| Advantages | Maximizes revenue by adjusting instantly to market changes. | Builds trust, aligns price with perceived property value. |

| Challenges | Requires advanced data analytics and can confuse buyers with frequent changes. | Needs deep understanding of customer perception and market positioning. |

| Impact on Sales | Boosts occupancy and turnover when market demand is high. | Enhances buyer satisfaction and long-term property value. |

Which is better?

Dynamic pricing optimizes real estate revenue by adjusting prices in real-time based on market demand, competitor rates, and seasonal trends, ensuring maximum profitability. Value-based pricing focuses on the perceived value to buyers or tenants, incorporating property features, location desirability, and unique amenities to set competitive but justified pricing. For volatile markets, dynamic pricing offers more agility, whereas value-based pricing strengthens client trust by aligning costs with property worth.

Connection

Dynamic pricing in real estate adjusts property values based on real-time market demand, while value-based pricing sets prices according to the perceived worth of the property to buyers. Both strategies rely on accurately assessing market conditions and customer preferences to optimize pricing. Integrating dynamic and value-based pricing enhances profit margins by aligning listing prices with fluctuating demand and buyer valuation.

Key Terms

Market Demand

Value-based pricing centers on setting prices according to perceived customer value and willingness to pay, leveraging detailed market demand analysis to maximize profitability. Dynamic pricing constantly adjusts prices in real-time based on fluctuating market demand, competitor pricing, and inventory levels to optimize sales and revenue. Explore how these pricing strategies can transform your market approach by understanding demand sensitivity and pricing dynamics further.

Property Valuation

Value-based pricing in property valuation relies on assessing the intrinsic worth of real estate based on factors such as location, market demand, and potential income streams. Dynamic pricing adjusts property values in real-time, factoring in changing market conditions, competitor pricing, and buyer interest levels to optimize sale prices. Explore further to understand how each pricing strategy impacts property valuation accuracy and profitability.

Real-time Analytics

Value-based pricing leverages customer perceived value and willingness to pay, setting prices that maximize profit margins by aligning costs with customer demand insights. Dynamic pricing uses real-time analytics to adjust prices instantaneously based on market conditions, competitor actions, and inventory levels, optimizing revenue through data-driven responsiveness. Explore how integrating real-time analytics amplifies pricing strategies for enhanced market competitiveness and profitability.

Source and External Links

The Value-Based Pricing Guide - This guide explains how value-based pricing is a strategy that sets prices based on the perceived value of goods or services to customers, allowing businesses to charge a premium for their offerings.

Value-Based Pricing - Definition, Example, Use - Value-based pricing is a strategy that adjusts prices according to the perceived value of a product or service, often used for high-value or prestige products.

Value-Based Pricing: A Complete Overview & Guide - This overview provides insights into how value-based pricing focuses on the benefits and outcomes a product offers to customers, enhancing customer loyalty and differentiating businesses.

dowidth.com

dowidth.com