Build-to-rent developments offer purpose-built rental properties designed for long-term tenancy, contrasting with condominium developments where individual units are sold to homeowners. Investors often prefer build-to-rent for steady income streams and professional management, while condominiums attract buyers seeking property ownership and equity growth. Explore the key differences to determine which real estate strategy aligns with your investment goals.

Why it is important

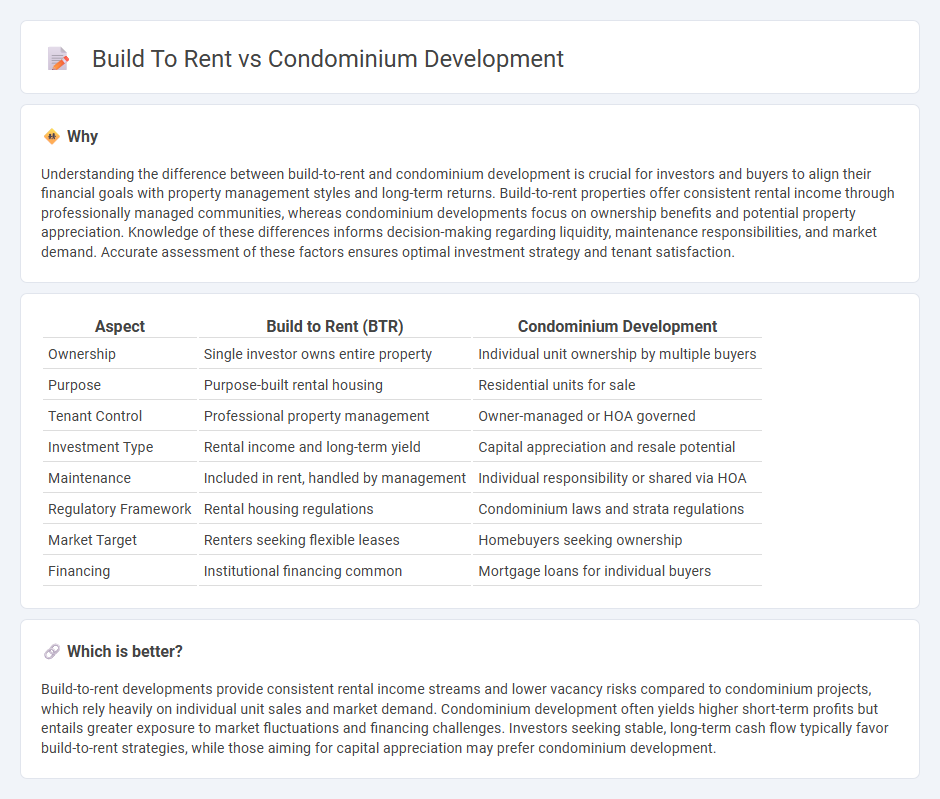

Understanding the difference between build-to-rent and condominium development is crucial for investors and buyers to align their financial goals with property management styles and long-term returns. Build-to-rent properties offer consistent rental income through professionally managed communities, whereas condominium developments focus on ownership benefits and potential property appreciation. Knowledge of these differences informs decision-making regarding liquidity, maintenance responsibilities, and market demand. Accurate assessment of these factors ensures optimal investment strategy and tenant satisfaction.

Comparison Table

| Aspect | Build to Rent (BTR) | Condominium Development |

|---|---|---|

| Ownership | Single investor owns entire property | Individual unit ownership by multiple buyers |

| Purpose | Purpose-built rental housing | Residential units for sale |

| Tenant Control | Professional property management | Owner-managed or HOA governed |

| Investment Type | Rental income and long-term yield | Capital appreciation and resale potential |

| Maintenance | Included in rent, handled by management | Individual responsibility or shared via HOA |

| Regulatory Framework | Rental housing regulations | Condominium laws and strata regulations |

| Market Target | Renters seeking flexible leases | Homebuyers seeking ownership |

| Financing | Institutional financing common | Mortgage loans for individual buyers |

Which is better?

Build-to-rent developments provide consistent rental income streams and lower vacancy risks compared to condominium projects, which rely heavily on individual unit sales and market demand. Condominium development often yields higher short-term profits but entails greater exposure to market fluctuations and financing challenges. Investors seeking stable, long-term cash flow typically favor build-to-rent strategies, while those aiming for capital appreciation may prefer condominium development.

Connection

Build-to-rent projects and condominium developments are interconnected through their focus on residential real estate investment and urban housing solutions. Both models utilize strategic land use and market analysis to maximize asset value and meet diverse housing demands, with build-to-rent targeting long-term rental income and condominiums offering individual ownership units. Real estate developers leverage these approaches to optimize return on investment, balancing tenant occupancy rates with property appreciation within evolving housing markets.

Key Terms

Ownership Structure

Condominium development offers individual ownership of units with shared common areas, enabling residents to build equity and customize their living spaces, while build-to-rent projects involve single ownership of the entire property with units leased to tenants, focusing on consistent rental income and professional management. Ownership structure in condominiums involves a homeowners association governing shared responsibilities, in contrast to build-to-rent properties where a single entity maintains control over maintenance and operations. Explore more about how ownership models impact investment strategies and resident experiences.

Revenue Model

Condominium developments generate revenue primarily through one-time unit sales, yielding immediate capital recovery, whereas build-to-rent projects rely on recurring rental income that provides long-term cash flow stability. The condominium model benefits from quicker exit strategies but faces market volatility risks, while build-to-rent fosters steady appreciation and tenant retention advantages. Explore detailed financial comparisons and strategic implications to determine the best revenue model for your property investment.

Property Management

Condominium developments require property management teams to focus on individual unit maintenance, resident relations, and adherence to homeowners' association rules. Build-to-rent communities prioritize large-scale property upkeep, tenant retention strategies, and streamlined service delivery to ensure consistent rental income. Explore detailed property management approaches in both sectors to understand their operational efficiencies.

Source and External Links

Checklist for Condominium Development - A detailed checklist outlining essential information and considerations required during the planning stages of a new condominium project, including developer details and project specifics.

Understanding Condominium and PUD Ownership - Explains the differences between condominiums and planned unit developments (PUDs), emphasizing these are types of land ownership rather than architectural styles, with details on ownership rights and common interest developments.

Condominiums Defined - Davis-Stirling.com - Describes typical condominium forms such as townhouse, stacked lowrise, midrise, and highrise, including governance structures and ownership of units and common areas.

dowidth.com

dowidth.com