Micro flipping focuses on rapidly buying and reselling properties for quick profit, leveraging small-scale real estate transactions and minimal renovation costs. Tax lien investing involves purchasing liens on properties with delinquent taxes, generating income through interest or potential property acquisition if liens remain unpaid. Explore the advantages and risks of micro flipping and tax lien investing to determine the best real estate strategy for your financial goals.

Why it is important

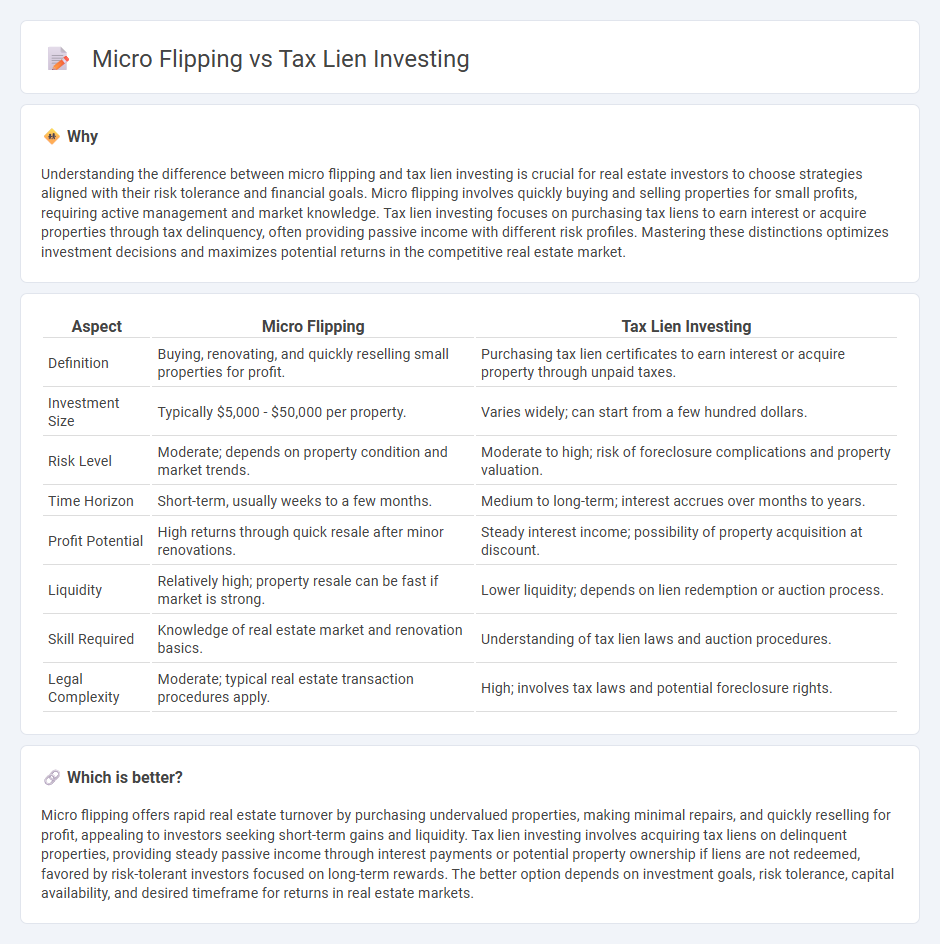

Understanding the difference between micro flipping and tax lien investing is crucial for real estate investors to choose strategies aligned with their risk tolerance and financial goals. Micro flipping involves quickly buying and selling properties for small profits, requiring active management and market knowledge. Tax lien investing focuses on purchasing tax liens to earn interest or acquire properties through tax delinquency, often providing passive income with different risk profiles. Mastering these distinctions optimizes investment decisions and maximizes potential returns in the competitive real estate market.

Comparison Table

| Aspect | Micro Flipping | Tax Lien Investing |

|---|---|---|

| Definition | Buying, renovating, and quickly reselling small properties for profit. | Purchasing tax lien certificates to earn interest or acquire property through unpaid taxes. |

| Investment Size | Typically $5,000 - $50,000 per property. | Varies widely; can start from a few hundred dollars. |

| Risk Level | Moderate; depends on property condition and market trends. | Moderate to high; risk of foreclosure complications and property valuation. |

| Time Horizon | Short-term, usually weeks to a few months. | Medium to long-term; interest accrues over months to years. |

| Profit Potential | High returns through quick resale after minor renovations. | Steady interest income; possibility of property acquisition at discount. |

| Liquidity | Relatively high; property resale can be fast if market is strong. | Lower liquidity; depends on lien redemption or auction process. |

| Skill Required | Knowledge of real estate market and renovation basics. | Understanding of tax lien laws and auction procedures. |

| Legal Complexity | Moderate; typical real estate transaction procedures apply. | High; involves tax laws and potential foreclosure rights. |

Which is better?

Micro flipping offers rapid real estate turnover by purchasing undervalued properties, making minimal repairs, and quickly reselling for profit, appealing to investors seeking short-term gains and liquidity. Tax lien investing involves acquiring tax liens on delinquent properties, providing steady passive income through interest payments or potential property ownership if liens are not redeemed, favored by risk-tolerant investors focused on long-term rewards. The better option depends on investment goals, risk tolerance, capital availability, and desired timeframe for returns in real estate markets.

Connection

Micro flipping and tax lien investing both serve as strategic real estate investment methods focused on short-term profit through property acquisition and quick turnover. Micro flipping capitalizes on rapidly buying and selling distressed or undervalued properties without significant renovation, while tax lien investing involves purchasing liens on properties with delinquent taxes, potentially leading to property ownership or interest earnings. Both techniques require understanding market trends, legal frameworks, and property valuation to maximize returns in real estate investing.

Key Terms

**Tax Lien Investing:**

Tax lien investing involves purchasing delinquent property tax claims to earn interest or acquire property upon lien maturity, offering a potentially high return on investment with comparatively low initial capital. This strategy requires thorough research of local tax laws, property values, and lien auction procedures to minimize risks and maximize profits. Discover detailed tactics and benefits of tax lien investing to enhance your real estate portfolio growth.

Tax Lien Certificate

Tax lien certificate investing involves purchasing liens placed by municipalities on properties with unpaid taxes, granting the investor the right to collect the debt plus interest or potentially acquire the property through foreclosure. Unlike micro flipping, which focuses on quickly reselling properties for small profits, tax lien certificates provide a passive income stream backed by real estate assets and government authority. Explore detailed strategies and benefits of tax lien certificate investing to maximize your real estate portfolio returns.

Redemption Period

Tax lien investing involves purchasing a property's tax debt, earning returns through interest during the redemption period when the owner can repay to reclaim the property. Micro flipping focuses on quickly buying and selling properties with minimal improvements, bypassing lengthy redemption periods. Discover how these strategies differ and which suits your investment goals best.

Source and External Links

Tax lien investing: What you need to know - Tax lien investing involves buying tax lien certificates at auctions, giving investors the legal right to collect unpaid property taxes plus interest and penalties, but it is only allowed in some states and requires enforcing within a specific timeframe.

What is Tax Lien Investing? - TurboTax Tax Tips & Videos - Intuit - Tax lien investing allows individuals to diversify their portfolios by purchasing certificates from public auctions, potentially earning interest payments as property owners repay their tax debts, though it carries risks such as property owner bankruptcy.

Tax Lien Investing: Learn About The Risks And Benefits - Investing in tax liens offers exposure to real estate without owning property directly, but the process is complex and risky, involving legal claims placed by municipalities on properties with unpaid taxes and requiring knowledge to avoid losses.

dowidth.com

dowidth.com