Opportunity Zones offer significant tax incentives by allowing investors to defer and potentially reduce capital gains taxes when investing in designated low-income areas. Tax Abatement Programs provide property tax reductions for a set period, encouraging improvements and new developments in targeted regions. Explore these strategies further to maximize your real estate investment benefits.

Why it is important

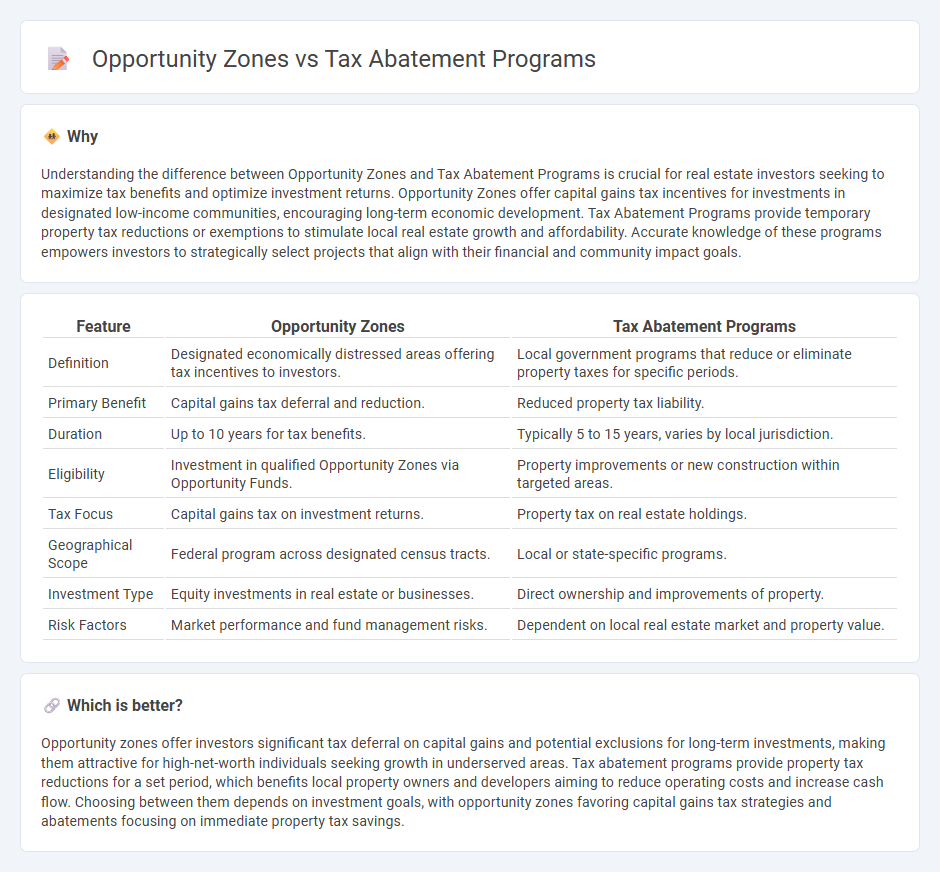

Understanding the difference between Opportunity Zones and Tax Abatement Programs is crucial for real estate investors seeking to maximize tax benefits and optimize investment returns. Opportunity Zones offer capital gains tax incentives for investments in designated low-income communities, encouraging long-term economic development. Tax Abatement Programs provide temporary property tax reductions or exemptions to stimulate local real estate growth and affordability. Accurate knowledge of these programs empowers investors to strategically select projects that align with their financial and community impact goals.

Comparison Table

| Feature | Opportunity Zones | Tax Abatement Programs |

|---|---|---|

| Definition | Designated economically distressed areas offering tax incentives to investors. | Local government programs that reduce or eliminate property taxes for specific periods. |

| Primary Benefit | Capital gains tax deferral and reduction. | Reduced property tax liability. |

| Duration | Up to 10 years for tax benefits. | Typically 5 to 15 years, varies by local jurisdiction. |

| Eligibility | Investment in qualified Opportunity Zones via Opportunity Funds. | Property improvements or new construction within targeted areas. |

| Tax Focus | Capital gains tax on investment returns. | Property tax on real estate holdings. |

| Geographical Scope | Federal program across designated census tracts. | Local or state-specific programs. |

| Investment Type | Equity investments in real estate or businesses. | Direct ownership and improvements of property. |

| Risk Factors | Market performance and fund management risks. | Dependent on local real estate market and property value. |

Which is better?

Opportunity zones offer investors significant tax deferral on capital gains and potential exclusions for long-term investments, making them attractive for high-net-worth individuals seeking growth in underserved areas. Tax abatement programs provide property tax reductions for a set period, which benefits local property owners and developers aiming to reduce operating costs and increase cash flow. Choosing between them depends on investment goals, with opportunity zones favoring capital gains tax strategies and abatements focusing on immediate property tax savings.

Connection

Opportunity zones and tax abatement programs are connected through their shared goal of incentivizing real estate investment in economically distressed areas. Opportunity zones offer capital gains tax deferrals and exclusions for investments held long-term, while tax abatement programs reduce or eliminate property taxes for new developments or improvements. Together, they enhance financial viability for developers and encourage revitalization of underdeveloped urban and rural communities.

Key Terms

Property Tax Reduction

Tax abatement programs offer property tax reductions by temporarily lowering or eliminating taxes to incentivize development or rehabilitation in specific areas, while opportunity zones provide long-term capital gains tax incentives for investments but do not directly reduce property taxes. Property tax abatement is often more targeted to encourage immediate local real estate improvements, whereas opportunity zones focus on broader economic growth through investment. Discover how these strategies can optimize your tax savings on property investments.

Capital Gains Deferral

Tax abatement programs reduce or eliminate property taxes for a set period, directly lowering carrying costs without impacting capital gains taxation. Opportunity Zones incentivize investments by allowing deferral and possible reduction of capital gains taxes when gains are reinvested in designated low-income areas. Explore detailed strategies and benefits of both to maximize capital gains deferral and optimize your investment portfolio.

Economic Development

Tax abatement programs offer targeted property tax reductions designed to stimulate local economic growth by encouraging business investment and job creation within specific jurisdictions. Opportunity Zones provide tax incentives on capital gains to attract long-term investments in economically distressed communities, promoting sustainable development and revitalization. Explore how these strategic economic development tools can transform regions and drive investment opportunities.

Source and External Links

Tax Abatement - This webpage explains tax abatements as financial incentives offered by local governments to stimulate development and economic growth through temporary tax reductions.

Tax Abatements or Exemptions - This article discusses how tax abatements or exemptions are used in the housing sector to provide financial incentives for particular types of developments, such as affordable housing.

Tax Abatement - This document from the EPA highlights tax abatement programs for environmental cleanups, home rehabilitation, and new construction, often with significant tax reductions based on project specifics.

dowidth.com

dowidth.com