Fractional ownership platforms allow multiple investors to purchase shares in high-value real estate, enabling diversified portfolios and lower individual capital requirements compared to traditional property ownership. Property management companies focus on the operational aspects of maintaining rental properties, handling tenant relations, maintenance, and rent collection to optimize property performance. Explore how fractional ownership contrasts with property management services to find investment strategies suited to your goals.

Why it is important

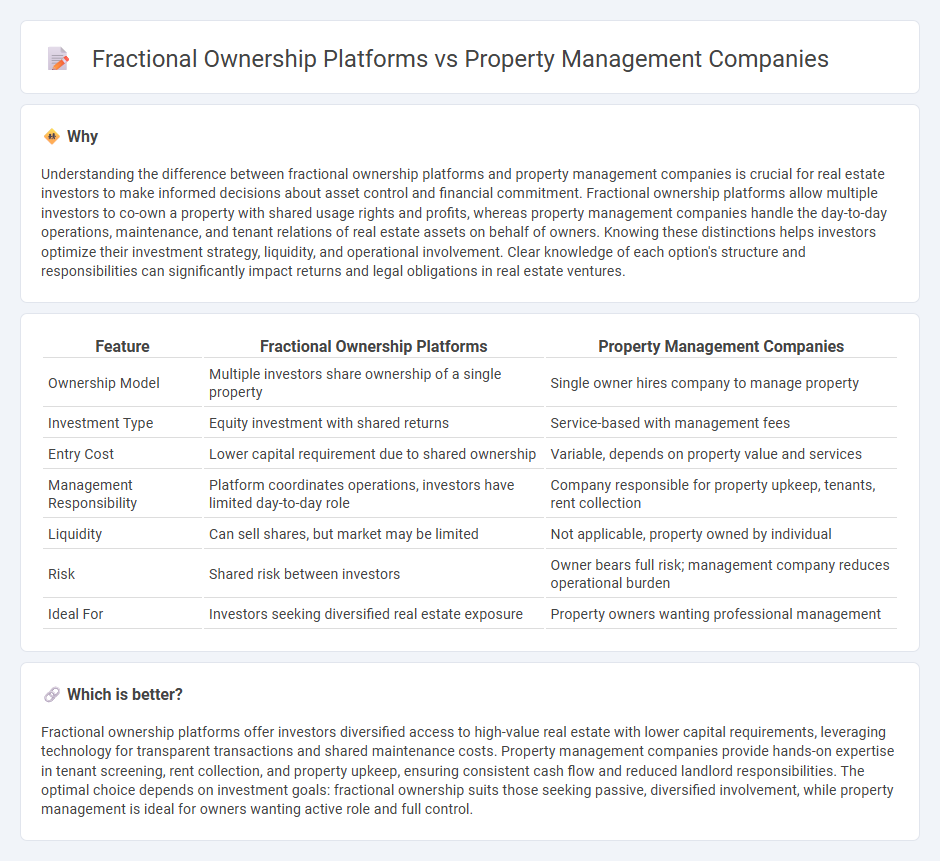

Understanding the difference between fractional ownership platforms and property management companies is crucial for real estate investors to make informed decisions about asset control and financial commitment. Fractional ownership platforms allow multiple investors to co-own a property with shared usage rights and profits, whereas property management companies handle the day-to-day operations, maintenance, and tenant relations of real estate assets on behalf of owners. Knowing these distinctions helps investors optimize their investment strategy, liquidity, and operational involvement. Clear knowledge of each option's structure and responsibilities can significantly impact returns and legal obligations in real estate ventures.

Comparison Table

| Feature | Fractional Ownership Platforms | Property Management Companies |

|---|---|---|

| Ownership Model | Multiple investors share ownership of a single property | Single owner hires company to manage property |

| Investment Type | Equity investment with shared returns | Service-based with management fees |

| Entry Cost | Lower capital requirement due to shared ownership | Variable, depends on property value and services |

| Management Responsibility | Platform coordinates operations, investors have limited day-to-day role | Company responsible for property upkeep, tenants, rent collection |

| Liquidity | Can sell shares, but market may be limited | Not applicable, property owned by individual |

| Risk | Shared risk between investors | Owner bears full risk; management company reduces operational burden |

| Ideal For | Investors seeking diversified real estate exposure | Property owners wanting professional management |

Which is better?

Fractional ownership platforms offer investors diversified access to high-value real estate with lower capital requirements, leveraging technology for transparent transactions and shared maintenance costs. Property management companies provide hands-on expertise in tenant screening, rent collection, and property upkeep, ensuring consistent cash flow and reduced landlord responsibilities. The optimal choice depends on investment goals: fractional ownership suits those seeking passive, diversified involvement, while property management is ideal for owners wanting active role and full control.

Connection

Fractional ownership platforms and property management companies collaborate closely to streamline investment in real estate by dividing properties into shares for multiple investors while ensuring professional upkeep and tenant management. Property management companies handle maintenance, leasing, and tenant communications, adding value and stability to fractional ownership investments. This partnership enhances liquidity and accessibility in real estate markets, attracting diverse investors seeking low-entry-cost opportunities with managed risks.

Key Terms

Lease Administration

Property management companies specialize in comprehensive lease administration by handling tenant screening, rent collection, and maintenance coordination to ensure smooth property operations. Fractional ownership platforms focus on shared equity models, where lease administration is often automated and centered around managing ownership schedules and usage rights. Explore the differences further to determine which approach suits your real estate investment strategy.

Maintenance Services

Property management companies offer comprehensive maintenance services, including regular inspections, repairs, and emergency response, ensuring properties remain in optimal condition for long-term value retention. Fractional ownership platforms often rely on third-party contractors for maintenance, which can lead to varied service quality and response times depending on the provider network. Discover how each model impacts property upkeep and owner satisfaction by exploring detailed comparisons and expert insights.

Shared Equity

Property management companies offer full-service solutions for managing rental properties, handling tenant relations, maintenance, and rent collection, which suits traditional real estate investors. Fractional ownership platforms enable multiple investors to co-own a property, reducing individual investment risk while sharing expenses and usage rights, emphasizing shared equity benefits. Explore how shared equity models through fractional ownership can maximize your real estate investment strategy.

Source and External Links

9 Best Property Management Companies in Tampa, FL - Mynd - Provides a list of top property management companies in Tampa, including their fees and services.

7 Best Property Management Companies in Tampa, FL - Blog - Highlights seven leading property management companies in Tampa, focusing on their strengths and offerings.

Tampa Property Management Company | Maximize ROI - Eaton Realty - Offers full-service property management with a focus on maximizing property ROI and streamlining rental processes.

dowidth.com

dowidth.com