Lease to own models offer renters the opportunity to build equity while living in the property, combining elements of renting and future ownership with fixed monthly payments and a portion credited toward purchase. Option to purchase agreements provide the right, but not the obligation, to buy the property within a specified timeframe, usually requiring an upfront option fee and negotiated purchase terms. Explore the nuances and benefits of both lease to own and option to purchase to determine the best fit for your real estate goals.

Why it is important

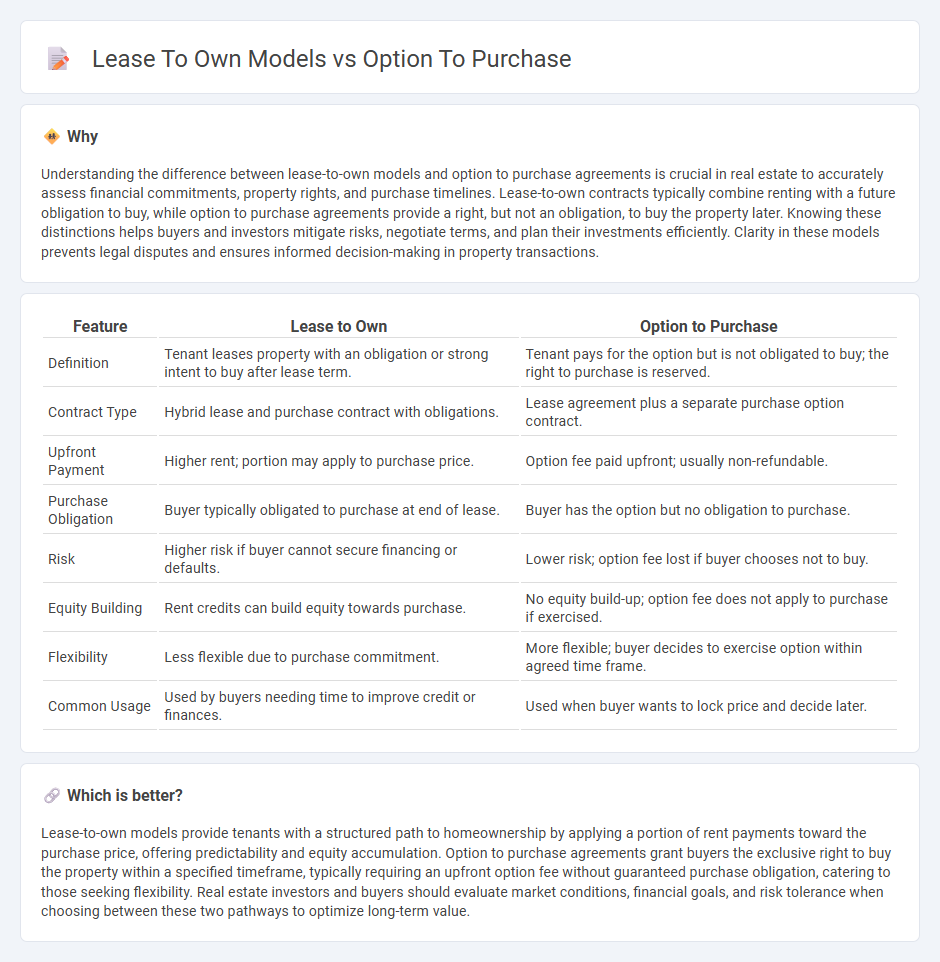

Understanding the difference between lease-to-own models and option to purchase agreements is crucial in real estate to accurately assess financial commitments, property rights, and purchase timelines. Lease-to-own contracts typically combine renting with a future obligation to buy, while option to purchase agreements provide a right, but not an obligation, to buy the property later. Knowing these distinctions helps buyers and investors mitigate risks, negotiate terms, and plan their investments efficiently. Clarity in these models prevents legal disputes and ensures informed decision-making in property transactions.

Comparison Table

| Feature | Lease to Own | Option to Purchase |

|---|---|---|

| Definition | Tenant leases property with an obligation or strong intent to buy after lease term. | Tenant pays for the option but is not obligated to buy; the right to purchase is reserved. |

| Contract Type | Hybrid lease and purchase contract with obligations. | Lease agreement plus a separate purchase option contract. |

| Upfront Payment | Higher rent; portion may apply to purchase price. | Option fee paid upfront; usually non-refundable. |

| Purchase Obligation | Buyer typically obligated to purchase at end of lease. | Buyer has the option but no obligation to purchase. |

| Risk | Higher risk if buyer cannot secure financing or defaults. | Lower risk; option fee lost if buyer chooses not to buy. |

| Equity Building | Rent credits can build equity towards purchase. | No equity build-up; option fee does not apply to purchase if exercised. |

| Flexibility | Less flexible due to purchase commitment. | More flexible; buyer decides to exercise option within agreed time frame. |

| Common Usage | Used by buyers needing time to improve credit or finances. | Used when buyer wants to lock price and decide later. |

Which is better?

Lease-to-own models provide tenants with a structured path to homeownership by applying a portion of rent payments toward the purchase price, offering predictability and equity accumulation. Option to purchase agreements grant buyers the exclusive right to buy the property within a specified timeframe, typically requiring an upfront option fee without guaranteed purchase obligation, catering to those seeking flexibility. Real estate investors and buyers should evaluate market conditions, financial goals, and risk tolerance when choosing between these two pathways to optimize long-term value.

Connection

Lease-to-own models and option to purchase agreements are interconnected as both provide tenants a pathway to homeownership by allowing them to rent a property with the opportunity to buy it later. In lease-to-own contracts, a portion of the monthly rent is typically credited toward the purchase price, while option to purchase grants tenants the exclusive right to buy the property within a specified timeframe without obligation. These arrangements benefit both buyers and sellers by offering flexibility in financing and time to secure mortgage approval or improve credit scores.

Key Terms

Purchase Price

Purchase price in option to purchase models typically represents a fixed amount agreed upon upfront, providing clarity and potential savings compared to fluctuating market rates. Lease to own models often incorporate purchase price into cumulative lease payments, potentially leading to higher overall costs despite gradual ownership. Discover more about how purchase price structures impact long-term financial benefits.

Option Fee

Option fee in purchase agreements is a non-refundable amount that secures the buyer's right to purchase the property within a specified period, often credited toward the purchase price. Lease-to-own models typically include an option fee that grants tenants the right to buy the home after renting, with part of the rent sometimes applied to the eventual purchase. Explore detailed comparisons and financial implications of option fees to determine the best fit for your homeownership goals.

Lease Premium

Lease premium models offer lessees a fixed upfront payment to secure the option to purchase the leased asset at the end of the lease term, providing greater financial predictability compared to traditional lease-to-own agreements. This approach reduces uncertainty in total ownership costs by clearly defining the purchase price and lease payments, benefiting both lessors and lessees in asset management and budgeting. Explore detailed comparisons of lease premium versus lease-to-own models to optimize your acquisition strategy.

Source and External Links

Option To Purchase & Right Of First Refusal - An option to purchase agreement grants a buyer the exclusive right to buy a property within a set time and price, preventing the seller from selling to others during that period, with variations like straight options, letter of credit options, and interest options available.

Purchase Options - WeConservePA Library - A purchase option is a right to buy or lease property within a specific time and price without obligation, ensuring the property won't be sold or developed during that time and giving the buyer flexibility to decide whether to complete the purchase.

Option to Purchase in Real Estate Law | LawInfo - Commonly linked with lease agreements, options to purchase allow a tenant to rent with the right to buy before the option expires, providing financial flexibility and certainty for both parties.

dowidth.com

dowidth.com