Escrow crowdfunding allows multiple investors to pool resources into specific real estate projects with funds held securely until project milestones are met, offering targeted investment opportunities. Real estate mutual funds invest in a diversified portfolio of property-related assets, providing liquidity and professional management with lower individual capital requirements. Explore the differences between these investment methods to determine the best fit for your real estate portfolio.

Why it is important

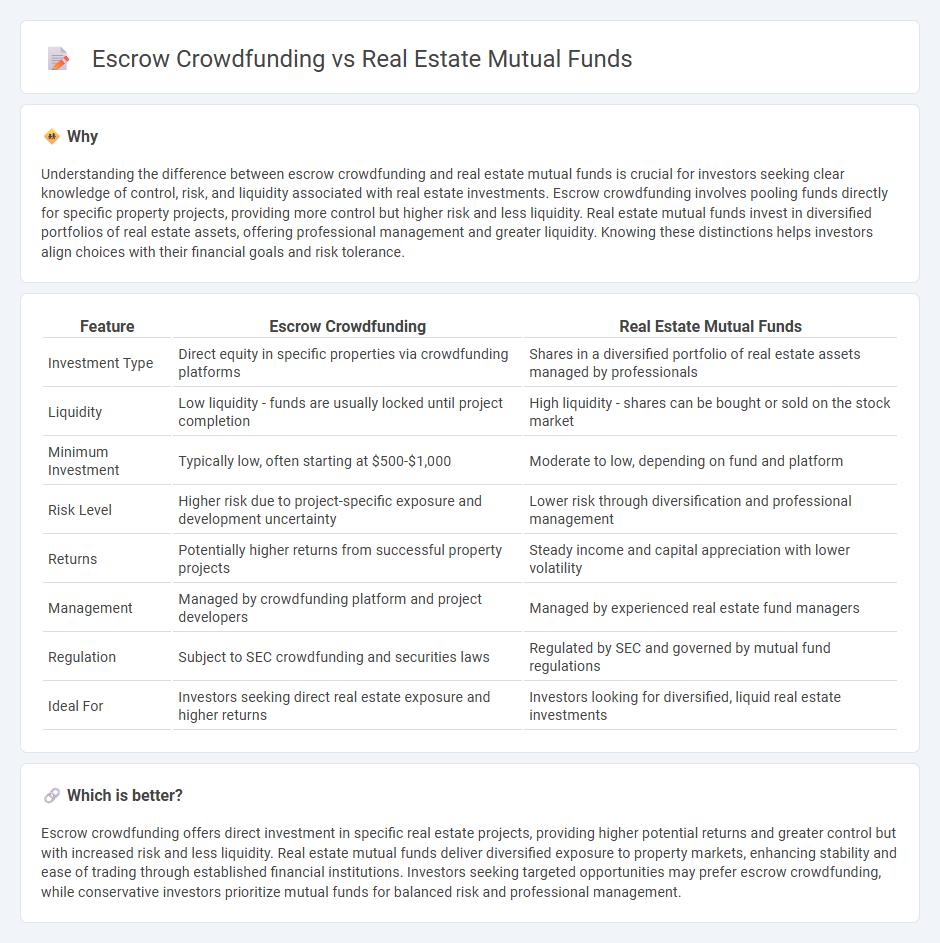

Understanding the difference between escrow crowdfunding and real estate mutual funds is crucial for investors seeking clear knowledge of control, risk, and liquidity associated with real estate investments. Escrow crowdfunding involves pooling funds directly for specific property projects, providing more control but higher risk and less liquidity. Real estate mutual funds invest in diversified portfolios of real estate assets, offering professional management and greater liquidity. Knowing these distinctions helps investors align choices with their financial goals and risk tolerance.

Comparison Table

| Feature | Escrow Crowdfunding | Real Estate Mutual Funds |

|---|---|---|

| Investment Type | Direct equity in specific properties via crowdfunding platforms | Shares in a diversified portfolio of real estate assets managed by professionals |

| Liquidity | Low liquidity - funds are usually locked until project completion | High liquidity - shares can be bought or sold on the stock market |

| Minimum Investment | Typically low, often starting at $500-$1,000 | Moderate to low, depending on fund and platform |

| Risk Level | Higher risk due to project-specific exposure and development uncertainty | Lower risk through diversification and professional management |

| Returns | Potentially higher returns from successful property projects | Steady income and capital appreciation with lower volatility |

| Management | Managed by crowdfunding platform and project developers | Managed by experienced real estate fund managers |

| Regulation | Subject to SEC crowdfunding and securities laws | Regulated by SEC and governed by mutual fund regulations |

| Ideal For | Investors seeking direct real estate exposure and higher returns | Investors looking for diversified, liquid real estate investments |

Which is better?

Escrow crowdfunding offers direct investment in specific real estate projects, providing higher potential returns and greater control but with increased risk and less liquidity. Real estate mutual funds deliver diversified exposure to property markets, enhancing stability and ease of trading through established financial institutions. Investors seeking targeted opportunities may prefer escrow crowdfunding, while conservative investors prioritize mutual funds for balanced risk and professional management.

Connection

Escrow crowdfunding and real estate mutual funds intersect through collective investment structures that pool capital for property acquisition and development. Escrow crowdfunding secures investor funds in a neutral account until project milestones are met, ensuring transactional transparency and reducing risk. Real estate mutual funds aggregate investor money to purchase diversified property portfolios, leveraging escrow mechanisms for fund management and regulatory compliance.

Key Terms

Liquidity

Real estate mutual funds offer higher liquidity by allowing investors to buy and sell shares on the market with relative ease, whereas escrow crowdfunding typically involves longer lock-in periods until the project reaches completion or sale. Mutual funds benefit from professional management and diversified portfolios, enhancing the ability to liquidate positions quickly compared to individual crowdfunding projects tied to specific property timelines. Explore the nuances of liquidity between these real estate investment options to make an informed financial decision.

Ownership structure

Real estate mutual funds pool investor capital to purchase diversified property portfolios, offering fractional ownership without direct asset control, while escrow crowdfunding enables individual investors to hold specific property stakes via managed escrow accounts, ensuring transparency and security. Mutual funds provide liquidity through tradable shares, whereas escrow crowdfunding involves fixed investment terms tied to property transactions. Explore the nuances of ownership structures to determine the best fit for your real estate investment goals.

Risk management

Real estate mutual funds diversify investments across multiple properties and markets, reducing individual asset risk through professional management and regulatory oversight. Escrow crowdfunding involves directly pooling investor capital for specific developments, exposing participants to project-specific risks and variable returns without guaranteed oversight. Explore detailed comparisons to better understand which approach aligns with your risk tolerance and investment goals.

Source and External Links

Understanding REITs and Mutual Funds: Differences, Similarities - This article highlights the differences between REITs and real estate mutual funds in terms of investment strategies and benefits.

Real Estate - Fidelity Investments - Fidelity offers a variety of real estate sector mutual funds and ETFs, providing investors with diverse options for exposure to the real estate market.

PGIM US Real Estate Fund - This fund focuses on domestic real estate securities to provide both capital appreciation and income for investors.

dowidth.com

dowidth.com