Tokenized real estate transforms property ownership into digital tokens on a blockchain, enabling fractional investments with increased liquidity and transparency. Real estate crowdfunding pools capital from multiple investors to fund projects, often with lower entry barriers but less tradability. Discover how these innovative investment methods can reshape your portfolio and market access.

Why it is important

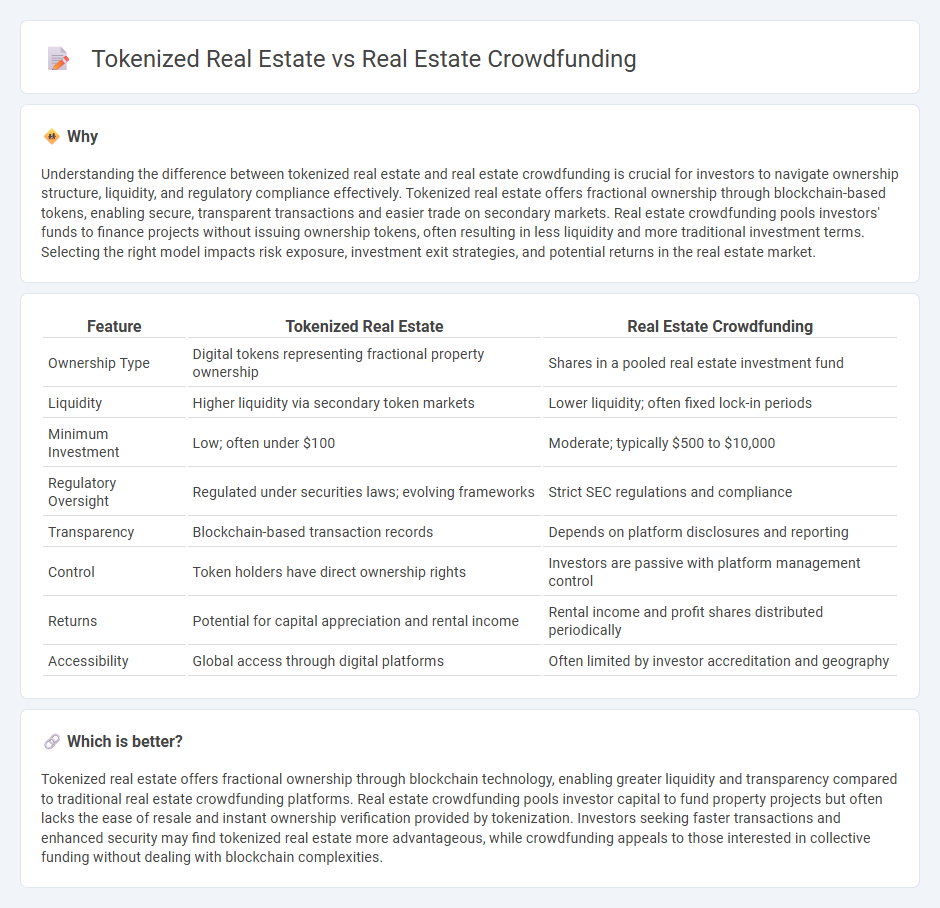

Understanding the difference between tokenized real estate and real estate crowdfunding is crucial for investors to navigate ownership structure, liquidity, and regulatory compliance effectively. Tokenized real estate offers fractional ownership through blockchain-based tokens, enabling secure, transparent transactions and easier trade on secondary markets. Real estate crowdfunding pools investors' funds to finance projects without issuing ownership tokens, often resulting in less liquidity and more traditional investment terms. Selecting the right model impacts risk exposure, investment exit strategies, and potential returns in the real estate market.

Comparison Table

| Feature | Tokenized Real Estate | Real Estate Crowdfunding |

|---|---|---|

| Ownership Type | Digital tokens representing fractional property ownership | Shares in a pooled real estate investment fund |

| Liquidity | Higher liquidity via secondary token markets | Lower liquidity; often fixed lock-in periods |

| Minimum Investment | Low; often under $100 | Moderate; typically $500 to $10,000 |

| Regulatory Oversight | Regulated under securities laws; evolving frameworks | Strict SEC regulations and compliance |

| Transparency | Blockchain-based transaction records | Depends on platform disclosures and reporting |

| Control | Token holders have direct ownership rights | Investors are passive with platform management control |

| Returns | Potential for capital appreciation and rental income | Rental income and profit shares distributed periodically |

| Accessibility | Global access through digital platforms | Often limited by investor accreditation and geography |

Which is better?

Tokenized real estate offers fractional ownership through blockchain technology, enabling greater liquidity and transparency compared to traditional real estate crowdfunding platforms. Real estate crowdfunding pools investor capital to fund property projects but often lacks the ease of resale and instant ownership verification provided by tokenization. Investors seeking faster transactions and enhanced security may find tokenized real estate more advantageous, while crowdfunding appeals to those interested in collective funding without dealing with blockchain complexities.

Connection

Tokenized real estate and real estate crowdfunding both leverage blockchain and digital platforms to democratize property investment by allowing multiple investors to pool funds for fractional ownership. Tokenized real estate converts physical properties into digital tokens, facilitating liquidity and easier transferability, while real estate crowdfunding gathers collective capital via online platforms to finance property projects. Together, these innovations expand access to real estate markets, reduce entry barriers, and enhance investment transparency through smart contracts and secure transactions.

Key Terms

Fractional Ownership

Fractional ownership in real estate crowdfunding allows multiple investors to pool funds and share equity in a property, typically managed by a centralized platform. Tokenized real estate leverages blockchain technology to create digital tokens representing ownership shares, enabling faster transactions, increased liquidity, and enhanced transparency. Explore how these innovative models are transforming real estate investment through fractional ownership.

Blockchain

Blockchain technology revolutionizes real estate crowdfunding by enabling fractional ownership through tokenized real estate assets, enhancing liquidity and transparency in property investments. Tokenized real estate leverages smart contracts on blockchain to automate transactions, reduce intermediaries, and increase security, surpassing traditional crowdfunding methods. Explore the future of property investment by learning more about blockchain-powered tokenized real estate platforms.

Liquidity

Real estate crowdfunding typically offers limited liquidity, as investors often must wait until the project reaches completion or undergoes a sale to access their funds. Tokenized real estate enhances liquidity by allowing fractional ownership to be traded on digital exchanges, providing more flexibility and faster access to capital. Explore the benefits and differences of these investment methods to optimize your real estate portfolio.

Source and External Links

Crowdfunding real estate: What to know - Real estate crowdfunding allows investors to pool money online to buy property shares collectively, providing access to high-value residential and commercial real estate investments with reduced effort compared to traditional methods.

Arrived - Arrived is a platform where investors can buy shares in rental homes starting from $100, earning passive income from dividends and property appreciation without managing the property themselves.

Crowd Street - Crowd Street connects accredited investors with curated commercial real estate opportunities, offering detailed deal information and direct access to vetted, private market investments for portfolio diversification.

dowidth.com

dowidth.com