Single family rental portfolios offer diversified properties across various neighborhoods, providing steady cash flow and appreciation potential, while mobile home park portfolios focus on owning land with multiple leased lots, often yielding higher cap rates and lower tenant turnover. Investors prefer single family rentals for their ease of financing and broader market appeal, whereas mobile home parks attract those seeking niche markets with less competition and recession-resistant demand. Explore the benefits and challenges of each portfolio type to determine the best fit for your real estate investment strategy.

Why it is important

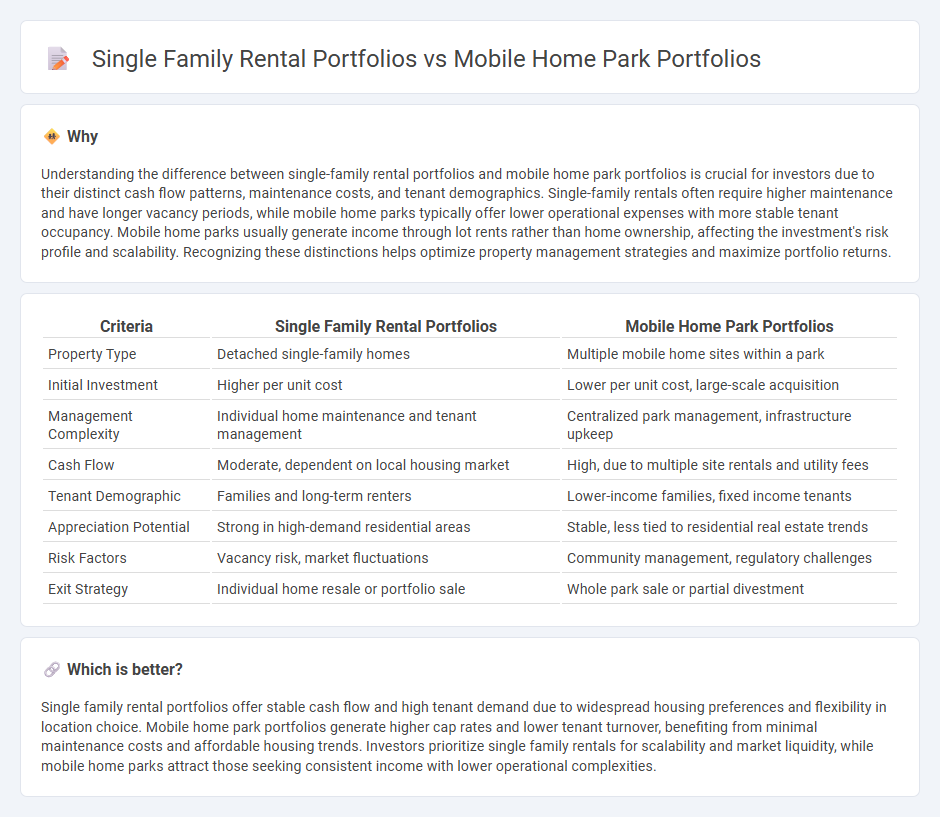

Understanding the difference between single-family rental portfolios and mobile home park portfolios is crucial for investors due to their distinct cash flow patterns, maintenance costs, and tenant demographics. Single-family rentals often require higher maintenance and have longer vacancy periods, while mobile home parks typically offer lower operational expenses with more stable tenant occupancy. Mobile home parks usually generate income through lot rents rather than home ownership, affecting the investment's risk profile and scalability. Recognizing these distinctions helps optimize property management strategies and maximize portfolio returns.

Comparison Table

| Criteria | Single Family Rental Portfolios | Mobile Home Park Portfolios |

|---|---|---|

| Property Type | Detached single-family homes | Multiple mobile home sites within a park |

| Initial Investment | Higher per unit cost | Lower per unit cost, large-scale acquisition |

| Management Complexity | Individual home maintenance and tenant management | Centralized park management, infrastructure upkeep |

| Cash Flow | Moderate, dependent on local housing market | High, due to multiple site rentals and utility fees |

| Tenant Demographic | Families and long-term renters | Lower-income families, fixed income tenants |

| Appreciation Potential | Strong in high-demand residential areas | Stable, less tied to residential real estate trends |

| Risk Factors | Vacancy risk, market fluctuations | Community management, regulatory challenges |

| Exit Strategy | Individual home resale or portfolio sale | Whole park sale or partial divestment |

Which is better?

Single family rental portfolios offer stable cash flow and high tenant demand due to widespread housing preferences and flexibility in location choice. Mobile home park portfolios generate higher cap rates and lower tenant turnover, benefiting from minimal maintenance costs and affordable housing trends. Investors prioritize single family rentals for scalability and market liquidity, while mobile home parks attract those seeking consistent income with lower operational complexities.

Connection

Single family rental portfolios and mobile home park portfolios are connected through their shared focus on providing affordable, community-oriented housing options that generate stable cash flow and long-term appreciation. Both asset classes appeal to investors seeking diversification within residential real estate sectors that benefit from high demand in suburban and rural markets. Performance metrics such as occupancy rates, tenant retention, and maintenance costs are critical for evaluating the profitability of these portfolio types.

Key Terms

Scalability

Mobile home park portfolios offer superior scalability compared to single family rental portfolios due to lower acquisition costs and higher cash flow per unit, enabling investors to expand rapidly. These communities typically require less maintenance and management complexity, which further enhances operational efficiency at scale. Explore detailed comparisons to understand how scalability impacts your investment strategy.

Tenant Demographics

Mobile home park portfolios typically attract tenants from lower-income brackets, often comprising retirees, blue-collar workers, and individuals seeking affordable housing options with long-term stability. Single family rental portfolios feature a more diverse tenant base, including families, young professionals, and middle-income earners looking for flexible living conditions and community amenities. Explore detailed demographic insights and investment implications to better understand tenant preferences and portfolio performance.

Maintenance Complexity

Mobile home park portfolios present unique maintenance challenges due to infrastructure upkeep, common area management, and the need for specialized repairs on both homes and park utilities. In contrast, single-family rental portfolios typically involve more standardized maintenance tasks, such as individual unit repairs and yard work, with less emphasis on shared facilities. Explore deeper insights into maintenance complexities and management strategies for these property types to optimize operational efficiency.

Source and External Links

Marcus & Millichap Arranges Sale of 4-Park Mobile Home Park Portfolio - Marcus & Millichap announced the sale of a four-park mobile home portfolio in the Spartanburg, South Carolina MSA, showcasing a successful transaction despite market challenges.

Manufactured Home Community Owners - Provides a list of manufactured home community owners, including entities like Equity LifeStyle Properties and YES Communities, highlighting diverse portfolios across the U.S.

How Mobile Home Park Investing Became a Billionaire Investment Strategy - Explains how mobile home parks have attracted billionaires like Sam Zell and private equity firms due to their high demand and strong cash flow potential.

dowidth.com

dowidth.com