Leaseback programs allow property owners to sell their real estate and lease it back, providing immediate capital while retaining operational control. Gross leases involve one rent payment that covers all property expenses, simplifying budgeting for tenants. Explore the advantages and applications of leaseback programs versus gross leases to determine the best strategy for your real estate investment.

Why it is important

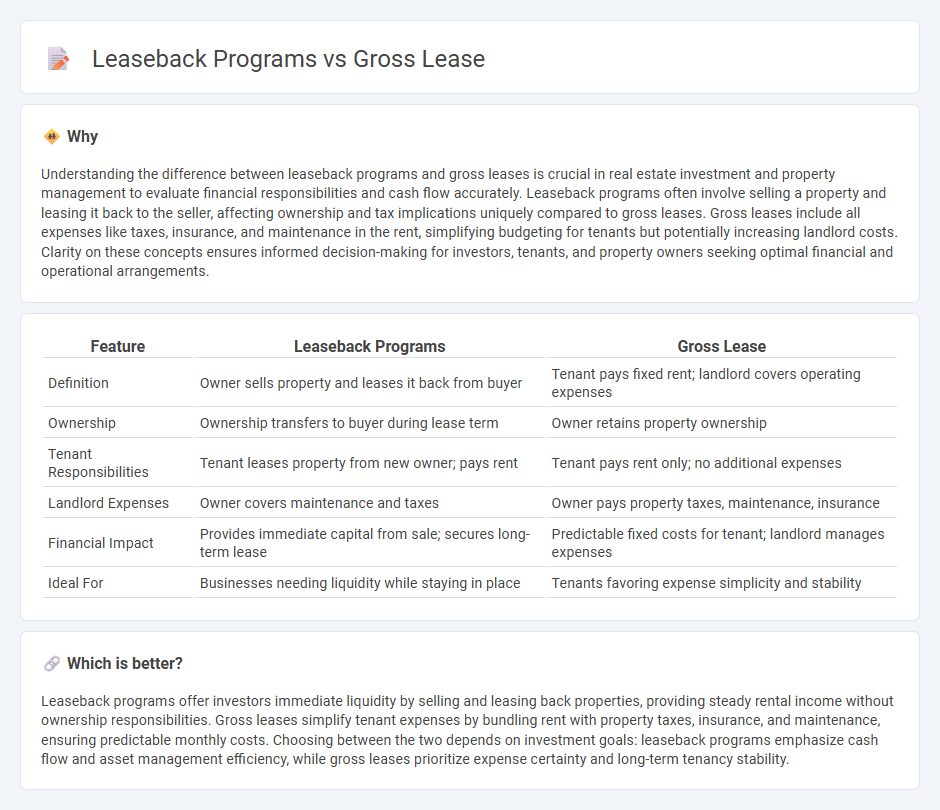

Understanding the difference between leaseback programs and gross leases is crucial in real estate investment and property management to evaluate financial responsibilities and cash flow accurately. Leaseback programs often involve selling a property and leasing it back to the seller, affecting ownership and tax implications uniquely compared to gross leases. Gross leases include all expenses like taxes, insurance, and maintenance in the rent, simplifying budgeting for tenants but potentially increasing landlord costs. Clarity on these concepts ensures informed decision-making for investors, tenants, and property owners seeking optimal financial and operational arrangements.

Comparison Table

| Feature | Leaseback Programs | Gross Lease |

|---|---|---|

| Definition | Owner sells property and leases it back from buyer | Tenant pays fixed rent; landlord covers operating expenses |

| Ownership | Ownership transfers to buyer during lease term | Owner retains property ownership |

| Tenant Responsibilities | Tenant leases property from new owner; pays rent | Tenant pays rent only; no additional expenses |

| Landlord Expenses | Owner covers maintenance and taxes | Owner pays property taxes, maintenance, insurance |

| Financial Impact | Provides immediate capital from sale; secures long-term lease | Predictable fixed costs for tenant; landlord manages expenses |

| Ideal For | Businesses needing liquidity while staying in place | Tenants favoring expense simplicity and stability |

Which is better?

Leaseback programs offer investors immediate liquidity by selling and leasing back properties, providing steady rental income without ownership responsibilities. Gross leases simplify tenant expenses by bundling rent with property taxes, insurance, and maintenance, ensuring predictable monthly costs. Choosing between the two depends on investment goals: leaseback programs emphasize cash flow and asset management efficiency, while gross leases prioritize expense certainty and long-term tenancy stability.

Connection

Leaseback programs involve a property owner selling real estate and then leasing it back, creating a long-term tenant-landlord relationship often structured as a gross lease. In a gross lease, the tenant pays a fixed rental amount while the landlord covers property expenses such as taxes, insurance, and maintenance, simplifying financial management for the tenant in leaseback agreements. This connection allows businesses to unlock capital from real estate assets while maintaining operational control and predictable occupancy costs.

Key Terms

Rent Structure

Gross lease structures simplify rent payments by bundling base rent, property taxes, insurance, and maintenance fees into a single, predictable amount, reducing tenant financial variability. Leaseback programs enable property owners to sell their asset and lease it back, often with customized rent structures that balance operational control with capital flexibility. Explore more to understand how these rent structures impact long-term financial planning and property management strategies.

Ownership Transfer

Gross lease agreements typically involve the tenant paying a fixed rent amount, while the landlord covers property expenses, limiting ownership transfer implications. Leaseback programs facilitate ownership transfer by allowing sellers to lease back the property after sale, providing liquidity and continued use without ownership burdens. Explore more to understand how these models impact financial and operational control in real estate.

Operational Control

Gross leases involve tenants paying a fixed rent while the landlord manages operational expenses such as maintenance, property taxes, and insurance, resulting in limited tenant control. Leaseback programs allow property owners to sell assets and lease them back, maintaining operational control over the property and benefiting from increased capital liquidity. Explore in-depth comparisons of gross lease and leaseback strategies to optimize your real estate operational control.

Source and External Links

Gross lease - Wikipedia - In a gross lease, the tenant pays a flat rental amount and the landlord covers all operating expenses, including taxes, utilities, and maintenance.

What is a Gross Lease? - TurboTenant - A gross lease is most common in commercial properties, where the tenant pays a fixed rent and the landlord is responsible for all property-related operating costs, providing simplicity and predictability for the tenant.

Understanding Gross, Double Net, and Triple Net Leases - Gross leases are the simplest commercial lease type, with the landlord paying all expenses, but rents are typically higher to compensate for these additional costs.

dowidth.com

dowidth.com