Ghost kitchens in retail spaces maximize urban real estate by transforming underutilized areas into high-efficiency food preparation hubs, capitalizing on delivery-driven market trends. Self-storage facilities offer steady cash flow through modular space leasing, appealing to investors seeking consistent returns amid fluctuating retail demands. Explore the evolving real estate opportunities by understanding the strategic benefits of these adaptive uses.

Why it is important

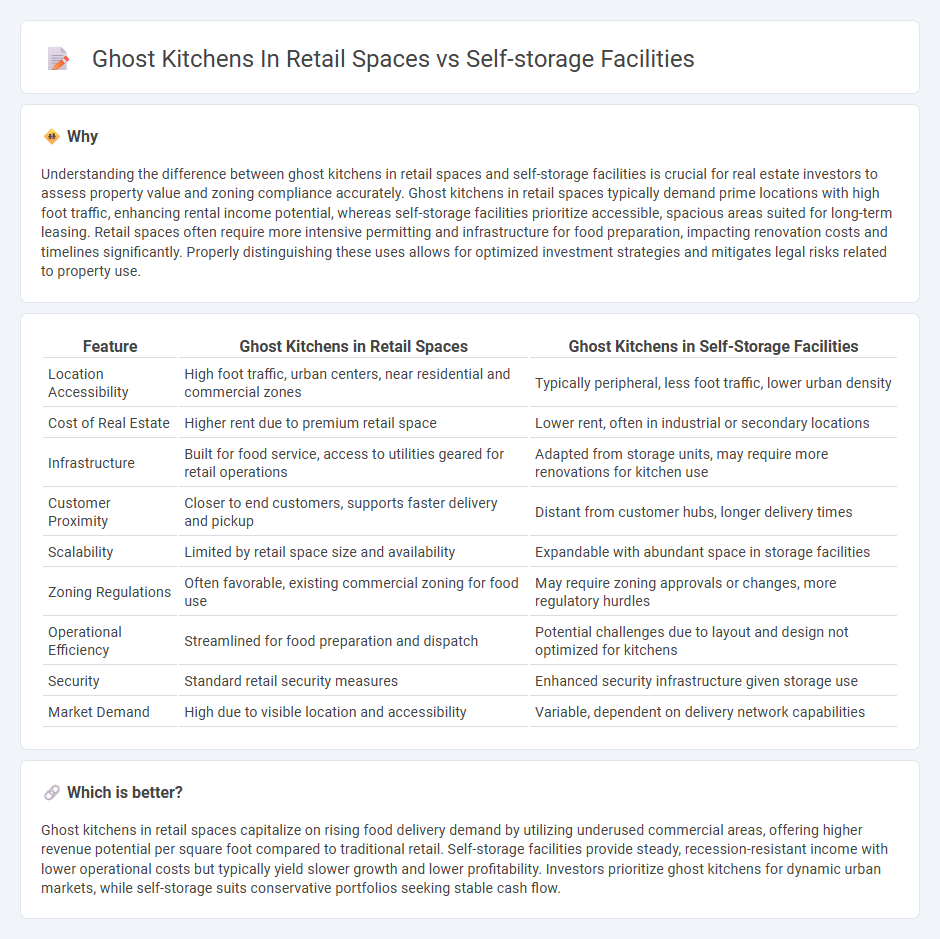

Understanding the difference between ghost kitchens in retail spaces and self-storage facilities is crucial for real estate investors to assess property value and zoning compliance accurately. Ghost kitchens in retail spaces typically demand prime locations with high foot traffic, enhancing rental income potential, whereas self-storage facilities prioritize accessible, spacious areas suited for long-term leasing. Retail spaces often require more intensive permitting and infrastructure for food preparation, impacting renovation costs and timelines significantly. Properly distinguishing these uses allows for optimized investment strategies and mitigates legal risks related to property use.

Comparison Table

| Feature | Ghost Kitchens in Retail Spaces | Ghost Kitchens in Self-Storage Facilities |

|---|---|---|

| Location Accessibility | High foot traffic, urban centers, near residential and commercial zones | Typically peripheral, less foot traffic, lower urban density |

| Cost of Real Estate | Higher rent due to premium retail space | Lower rent, often in industrial or secondary locations |

| Infrastructure | Built for food service, access to utilities geared for retail operations | Adapted from storage units, may require more renovations for kitchen use |

| Customer Proximity | Closer to end customers, supports faster delivery and pickup | Distant from customer hubs, longer delivery times |

| Scalability | Limited by retail space size and availability | Expandable with abundant space in storage facilities |

| Zoning Regulations | Often favorable, existing commercial zoning for food use | May require zoning approvals or changes, more regulatory hurdles |

| Operational Efficiency | Streamlined for food preparation and dispatch | Potential challenges due to layout and design not optimized for kitchens |

| Security | Standard retail security measures | Enhanced security infrastructure given storage use |

| Market Demand | High due to visible location and accessibility | Variable, dependent on delivery network capabilities |

Which is better?

Ghost kitchens in retail spaces capitalize on rising food delivery demand by utilizing underused commercial areas, offering higher revenue potential per square foot compared to traditional retail. Self-storage facilities provide steady, recession-resistant income with lower operational costs but typically yield slower growth and lower profitability. Investors prioritize ghost kitchens for dynamic urban markets, while self-storage suits conservative portfolios seeking stable cash flow.

Connection

Ghost kitchens in retail spaces and self-storage facilities share a strategic link by optimizing underused real estate to generate additional revenue streams. Retail locations repurposed for ghost kitchens capitalize on high foot traffic zones without the need for traditional dine-in infrastructure, while self-storage facilities utilize vacant units for food preparation, enhancing space efficiency. This convergence reflects a growing trend in real estate where flexible, multi-use properties meet evolving consumer demands in the food and storage sectors.

Key Terms

Occupancy Rate

Self-storage facilities typically maintain higher occupancy rates in retail spaces due to consistent demand for secure, accessible storage, averaging around 85-90%, while ghost kitchens see more variable occupancy depending on market saturation and local food delivery trends, often ranging from 60-75%. The steady need for convenient storage solutions versus the competitive, fluctuating nature of food service directly impacts space utilization in retail environments. Explore deeper insights into how occupancy rates influence profitability and strategic location choices for both business models.

Triple Net Lease (NNN)

Self-storage facilities in retail spaces commonly utilize Triple Net Leases (NNN), requiring tenants to cover property taxes, insurance, and maintenance, resulting in stable, long-term income for landlords. Ghost kitchens also adopt NNN leases, benefiting from lower operational costs and flexible space usage, attracting food delivery businesses in high-demand urban areas. Explore how NNN lease structures optimize profitability and risk management in both self-storage and ghost kitchen retail spaces.

Zoning Regulations

Self-storage facilities often face stricter zoning regulations compared to ghost kitchens due to their classification as commercial storage, which may require special permits in retail zones. Ghost kitchens typically operate under food service or light industrial zoning, allowing more flexibility within mixed-use retail developments. Explore zoning implications and compliance strategies to optimize your retail space utilization effectively.

Source and External Links

Rent Storage Units at 4601 N Market St, Wilmington, DE - Store Space - This self-storage facility in Wilmington, DE offers fenced and gated access with 24/7 video surveillance, indoor and drive-up climate-controlled units, truck-accessible loading, and amenities catering to college students nearby.

Self Storage Units in North Wilmington, DE - Sentinel Self Storage - Sentinel Self Storage provides gated entry, heavy-duty fencing, 24/7 security cameras, indoor and climate-controlled units, as well as warehouse and drive-up storage units designed for both residential and commercial customers.

Storage Units in Wilmington, DE at 3420 Kirkwood Hwy - Extra Space Storage - Offers multiple storage unit sizes including climate-controlled and drive-up units, indoor vehicle storage, advanced security features, 24/7 access options, elevators, covered loading bays, and wide aisles for trucks.

dowidth.com

dowidth.com