Micro flipping involves quickly reselling properties for short-term profit by making minimal improvements, capitalizing on market dynamics and flexible investment strategies. Buy and hold focuses on acquiring properties to generate consistent rental income and long-term appreciation, emphasizing stability and wealth accumulation. Discover which real estate investment strategy aligns with your financial goals and risk tolerance.

Why it is important

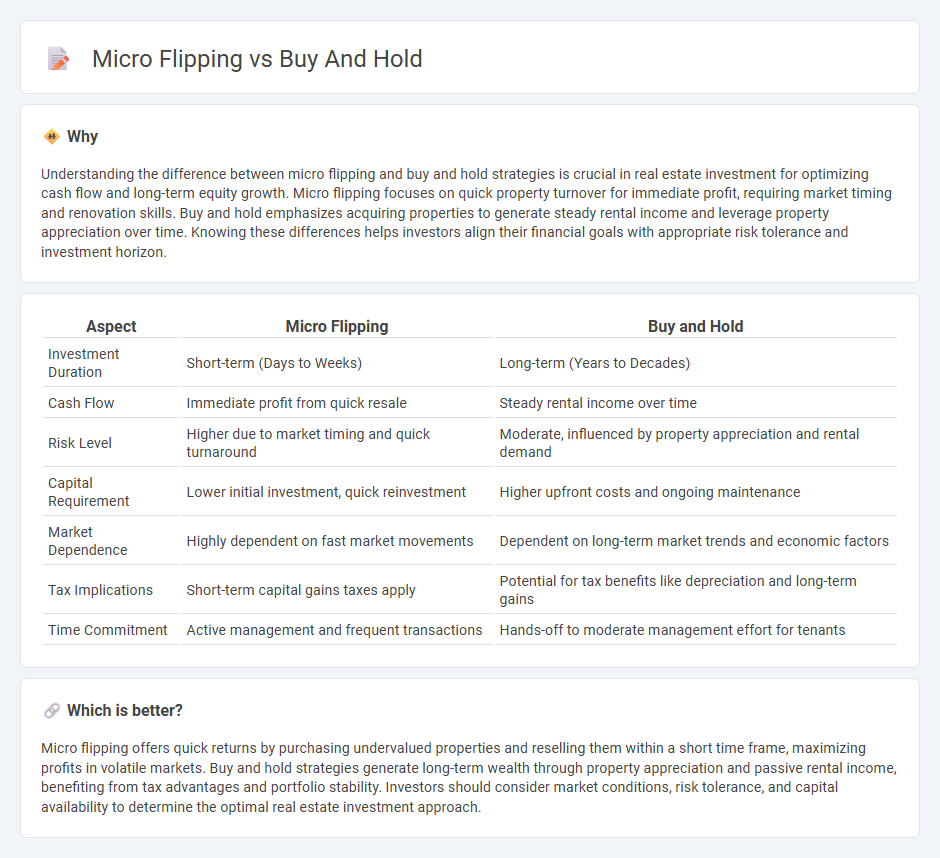

Understanding the difference between micro flipping and buy and hold strategies is crucial in real estate investment for optimizing cash flow and long-term equity growth. Micro flipping focuses on quick property turnover for immediate profit, requiring market timing and renovation skills. Buy and hold emphasizes acquiring properties to generate steady rental income and leverage property appreciation over time. Knowing these differences helps investors align their financial goals with appropriate risk tolerance and investment horizon.

Comparison Table

| Aspect | Micro Flipping | Buy and Hold |

|---|---|---|

| Investment Duration | Short-term (Days to Weeks) | Long-term (Years to Decades) |

| Cash Flow | Immediate profit from quick resale | Steady rental income over time |

| Risk Level | Higher due to market timing and quick turnaround | Moderate, influenced by property appreciation and rental demand |

| Capital Requirement | Lower initial investment, quick reinvestment | Higher upfront costs and ongoing maintenance |

| Market Dependence | Highly dependent on fast market movements | Dependent on long-term market trends and economic factors |

| Tax Implications | Short-term capital gains taxes apply | Potential for tax benefits like depreciation and long-term gains |

| Time Commitment | Active management and frequent transactions | Hands-off to moderate management effort for tenants |

Which is better?

Micro flipping offers quick returns by purchasing undervalued properties and reselling them within a short time frame, maximizing profits in volatile markets. Buy and hold strategies generate long-term wealth through property appreciation and passive rental income, benefiting from tax advantages and portfolio stability. Investors should consider market conditions, risk tolerance, and capital availability to determine the optimal real estate investment approach.

Connection

Micro flipping and buy and hold strategies intersect through their focus on residential properties aimed at maximizing long-term returns. Micro flipping involves acquiring undervalued homes and making minor improvements to quickly resell for profit, often serving as a short-term entry point for investors. This approach complements buy and hold by generating capital that can be reinvested into rental properties, enhancing portfolio growth and cash flow stability in real estate investment.

Key Terms

Cash Flow

Cash flow is a critical metric differentiating buy and hold strategies from micro flipping in real estate investing, with buy and hold focusing on consistent monthly rental income versus micro flipping's quick profit margin from rapid sales. Buy and hold investors benefit from long-term asset appreciation and steady cash flow, while micro flippers rely on short-term market timing and renovation to create value. Discover key cash flow considerations to optimize your real estate investment strategy.

Appreciation

Buy and hold strategies capitalize on long-term property appreciation by accumulating value over years through market growth and property enhancements. Micro flipping targets rapid, short-term gains by quickly acquiring, renovating, and reselling properties to leverage immediate market demand. Explore detailed comparisons to determine which appreciation-focused approach aligns best with your investment goals.

Exit Strategy

Comparing buy and hold versus micro flipping highlights distinct exit strategies where buy and hold relies on long-term appreciation and steady rental income, while micro flipping focuses on rapid renovation and resale for quick profits. Real estate investors must evaluate market conditions, holding costs, and risk tolerance when choosing an approach to maximize ROI. Discover more about crafting effective exit strategies tailored to your investment goals.

Source and External Links

Buy and hold - Wikipedia - Buy and hold is an investment strategy where an investor purchases assets to hold over the long term, avoiding selling during market drops or timing the market, based on the belief that asset value will appreciate over time and aligned with passive management principles endorsed by investors like Warren Buffett.

Buy-and-Hold Investing: Is It the Right Investment Strategy? - This passive strategy involves buying and holding stocks or other assets to benefit from long-term capital appreciation while ignoring short-term price volatility, potentially offering a more stable investment approach with fewer transaction costs.

8-05 Buy and Hold - PersonalFinanceLab - The buy and hold approach focuses on purchasing stocks of solid, well-managed companies expected to deliver long-term profits and holding them for decades to ride out market fluctuations, reducing stress from short-term trading activities.

dowidth.com

dowidth.com