Opportunity zones offer tax incentives to spur investment in designated economically distressed areas, driving real estate development and job creation. Brownfield redevelopment focuses on transforming previously contaminated or underutilized industrial sites into productive properties, enhancing urban renewal and environmental health. Explore the key differences and benefits of these strategies for impactful real estate investment.

Why it is important

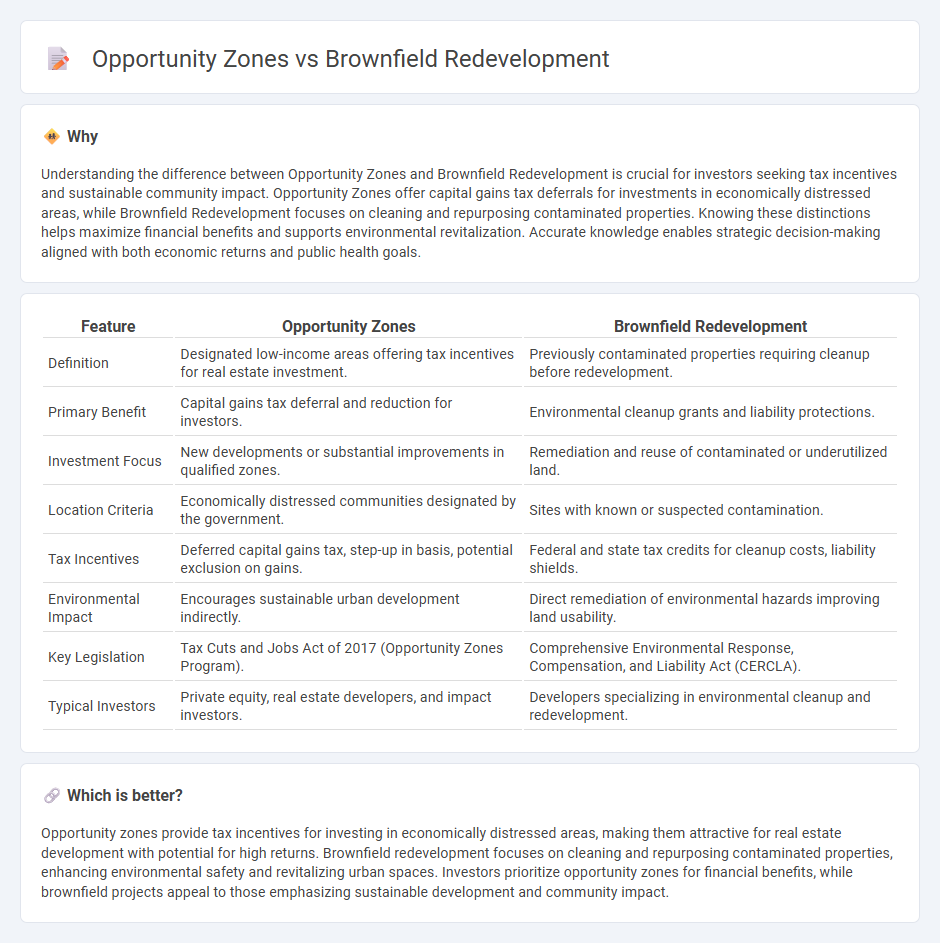

Understanding the difference between Opportunity Zones and Brownfield Redevelopment is crucial for investors seeking tax incentives and sustainable community impact. Opportunity Zones offer capital gains tax deferrals for investments in economically distressed areas, while Brownfield Redevelopment focuses on cleaning and repurposing contaminated properties. Knowing these distinctions helps maximize financial benefits and supports environmental revitalization. Accurate knowledge enables strategic decision-making aligned with both economic returns and public health goals.

Comparison Table

| Feature | Opportunity Zones | Brownfield Redevelopment |

|---|---|---|

| Definition | Designated low-income areas offering tax incentives for real estate investment. | Previously contaminated properties requiring cleanup before redevelopment. |

| Primary Benefit | Capital gains tax deferral and reduction for investors. | Environmental cleanup grants and liability protections. |

| Investment Focus | New developments or substantial improvements in qualified zones. | Remediation and reuse of contaminated or underutilized land. |

| Location Criteria | Economically distressed communities designated by the government. | Sites with known or suspected contamination. |

| Tax Incentives | Deferred capital gains tax, step-up in basis, potential exclusion on gains. | Federal and state tax credits for cleanup costs, liability shields. |

| Environmental Impact | Encourages sustainable urban development indirectly. | Direct remediation of environmental hazards improving land usability. |

| Key Legislation | Tax Cuts and Jobs Act of 2017 (Opportunity Zones Program). | Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA). |

| Typical Investors | Private equity, real estate developers, and impact investors. | Developers specializing in environmental cleanup and redevelopment. |

Which is better?

Opportunity zones provide tax incentives for investing in economically distressed areas, making them attractive for real estate development with potential for high returns. Brownfield redevelopment focuses on cleaning and repurposing contaminated properties, enhancing environmental safety and revitalizing urban spaces. Investors prioritize opportunity zones for financial benefits, while brownfield projects appeal to those emphasizing sustainable development and community impact.

Connection

Opportunity zones and brownfield redevelopment are interconnected through their shared focus on revitalizing underutilized or contaminated properties to stimulate economic growth. By leveraging tax incentives within opportunity zones, investors are encouraged to fund cleanup and redevelopment projects on brownfield sites, transforming them into viable real estate assets. This synergy promotes sustainable urban development, increases property values, and attracts new businesses and residents to previously neglected areas.

Key Terms

Environmental Remediation

Brownfield redevelopment centers on transforming contaminated properties into usable land through comprehensive environmental remediation, including soil decontamination and groundwater treatment. Opportunity zones offer tax incentives to spur investment in economically distressed areas, but environmental cleanup often remains a prerequisite to fully leverage these benefits. Explore how strategic environmental remediation enhances both brownfield projects and opportunity zone investments for sustainable development.

Tax Incentives

Brownfield redevelopment offers federal and state tax incentives such as the Brownfields Tax Credit, which provides up to 25% credit on cleanup costs to encourage the revitalization of contaminated properties. Opportunity Zones deliver capital gains tax deferrals and potential exclusions for investments held over specific periods, promoting economic growth in designated low-income communities. Explore detailed comparisons and benefits of these tax incentives to maximize your investment strategy.

Community Revitalization

Brownfield redevelopment transforms contaminated or underutilized properties into vibrant community assets, enhancing local economic growth and environmental health. Opportunity Zones offer tax incentives for investments in economically distressed areas, stimulating job creation and affordable housing development. Explore the distinctions and benefits to understand how each strategy fosters community revitalization effectively.

Source and External Links

What is Brownfield Redevelopment? A Guide for Developers - Brownfield redevelopment transforms abandoned properties into productive spaces, fostering economic growth and community revitalization.

Smart Growth and Infill Brownfields Redevelopment | US EPA - This approach emphasizes redeveloping brownfields to create community and economic assets, leveraging existing infrastructure for sustainable growth.

Brownfields Redevelopment Incentive Program - The program offers tax credits to encourage environmental remediation and redevelopment of brownfield sites for commercial or mixed-use projects.

dowidth.com

dowidth.com