Roll-up acquisitions combine multiple smaller companies within the same industry to create a larger, more efficient entity, enhancing market share and operational synergies. Mergers involve the consolidation of two or more companies, often similar in size, to form a new organization with shared resources and strategic goals. Explore the key differences and benefits of roll-up acquisitions versus mergers to maximize your entrepreneurial growth strategy.

Why it is important

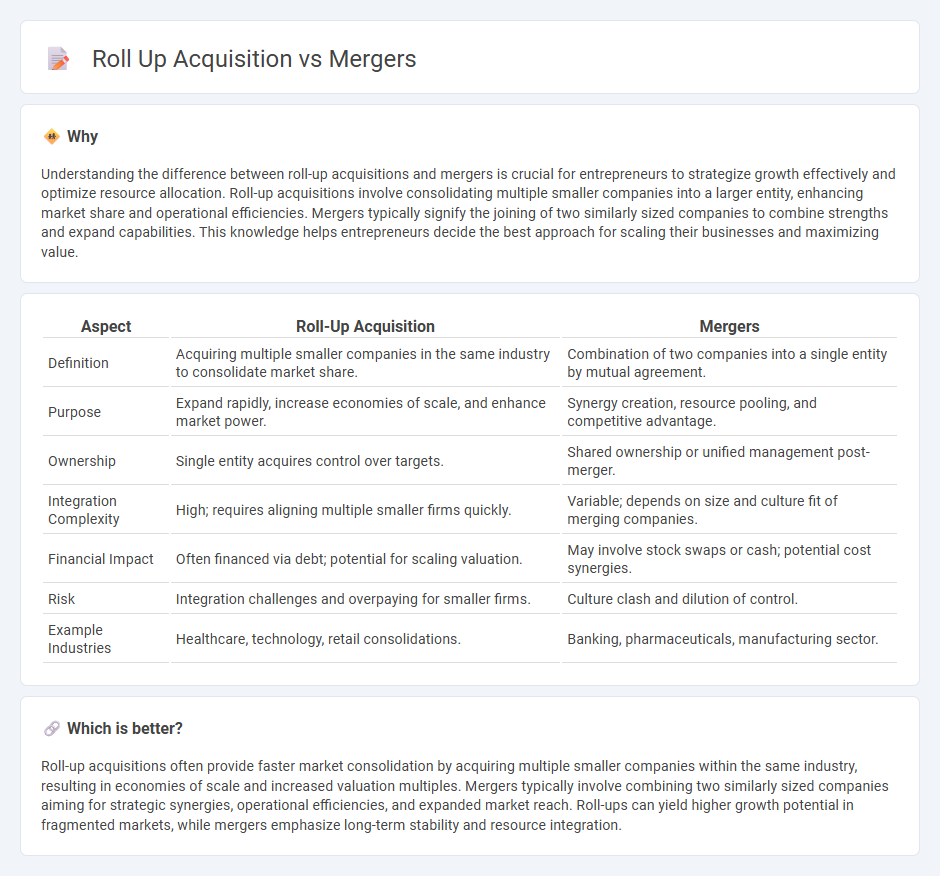

Understanding the difference between roll-up acquisitions and mergers is crucial for entrepreneurs to strategize growth effectively and optimize resource allocation. Roll-up acquisitions involve consolidating multiple smaller companies into a larger entity, enhancing market share and operational efficiencies. Mergers typically signify the joining of two similarly sized companies to combine strengths and expand capabilities. This knowledge helps entrepreneurs decide the best approach for scaling their businesses and maximizing value.

Comparison Table

| Aspect | Roll-Up Acquisition | Mergers |

|---|---|---|

| Definition | Acquiring multiple smaller companies in the same industry to consolidate market share. | Combination of two companies into a single entity by mutual agreement. |

| Purpose | Expand rapidly, increase economies of scale, and enhance market power. | Synergy creation, resource pooling, and competitive advantage. |

| Ownership | Single entity acquires control over targets. | Shared ownership or unified management post-merger. |

| Integration Complexity | High; requires aligning multiple smaller firms quickly. | Variable; depends on size and culture fit of merging companies. |

| Financial Impact | Often financed via debt; potential for scaling valuation. | May involve stock swaps or cash; potential cost synergies. |

| Risk | Integration challenges and overpaying for smaller firms. | Culture clash and dilution of control. |

| Example Industries | Healthcare, technology, retail consolidations. | Banking, pharmaceuticals, manufacturing sector. |

Which is better?

Roll-up acquisitions often provide faster market consolidation by acquiring multiple smaller companies within the same industry, resulting in economies of scale and increased valuation multiples. Mergers typically involve combining two similarly sized companies aiming for strategic synergies, operational efficiencies, and expanded market reach. Roll-ups can yield higher growth potential in fragmented markets, while mergers emphasize long-term stability and resource integration.

Connection

Roll-up acquisitions consolidate multiple smaller companies within the same industry to create a larger entity, enhancing market share and operational efficiency. Mergers involve the combination of two or more companies to achieve synergies, streamline costs, and expand product offerings. Both strategies drive entrepreneurial growth by enabling faster scale, competitive advantage, and increased valuation in evolving markets.

Key Terms

Synergy

Mergers often create synergy by combining complementary strengths and resources from two companies, leading to increased operational efficiency and market reach. Roll-up acquisitions focus on consolidating smaller companies within an industry to achieve economies of scale, reduce costs, and standardize processes. Explore the key differences between these strategies to optimize your business growth and synergy potential.

Consolidation

Mergers consolidate two companies into a single, unified entity to enhance market share and streamline operations, while roll-up acquisitions involve acquiring multiple smaller firms to form a larger, more competitive organization. Mergers often focus on combining complementary strengths, whereas roll-ups aim to achieve economies of scale and reduce competition within fragmented markets. Explore the nuanced strategies behind consolidation to optimize business growth.

Valuation

Valuation in mergers often depends on the combined market capitalization and projected synergies, whereas roll-up acquisitions focus on aggregating smaller companies to increase overall valuation through economies of scale and enhanced EBITDA multiples. Mergers generally involve negotiating premiums based on strategic fit and long-term growth potential, while roll-ups emphasize cost savings and unified financial metrics for improved investor appeal. Explore detailed valuation strategies in mergers and roll-up acquisitions to optimize investment outcomes.

Source and External Links

Merger - Overview, Types, Advantages and Disadvantages - A merger is a corporate strategy where two companies combine and operate as a single legal entity, typically to access a larger customer base, increase market share, or gain efficiencies through various types such as horizontal, vertical, and conglomerate mergers.

Mergers and acquisitions - Mergers and acquisitions are transactions that combine companies via various forms including horizontal, vertical, and conglomerate mergers, with specific legal and tax structures often used like forward or reverse triangular mergers.

What is a Merger? Definition, Types, and Examples - A merger forms a new singular legal entity from two companies, facilitated by investment bankers and lawyers, and includes types like horizontal (competitors merging), market extension, and vertical mergers that integrate supply chains.

dowidth.com

dowidth.com